To Become a Millionaire: 5 Ways to Make Money from Investments

Updated: May 11, 2020 at 19:48

With the spread of smartphone-based apps and commission-free independent trading platforms, investing becomes accessible as never before. Now, in the times of Covid-19, many traders and brokers have a rare opportunity to play on market setbacks and turn them into a positive return.

There are a plethora of financial instruments on the current financial market, with a varying degree of risk and returns. But eventually, they all share one common trait – a careful research and background check has to be the first starting point.

If treated properly, in the long run investing can even become a road to financial independence. Either way, it is always worth being mindful that investing has its own pitfalls and requires solid knowledge of instruments, financial intuition and years of experience to become successful.

For a start, let’s look into different asset classes the current market has on offer.

Stocks

This asset class exceeds all others in terms of popularity and market value, which is all together compounds to $90 trillion. On a stock market, the US and Asia keep the most solid presence: two largest stock exchanges in the world by market cap are New York Stock Exchange (NYSE) and Nasdaq, then followed Tokyo Stock Exchange (TSE/TYO) and Shanghai Stock Exchange (SSE). The trade time of the US stock market typically occurs between 9:30 a.m. and 4 p.m. (EDT) and trading hours of Asian markets may vary.

High regulatory oversight gives investors a high degree of confidence in the stock market, which makes it the most reliable option and suits best for beginners. It is still, however, least shielded from the broader economic risk, what the situation with Covid-19 proved once again.

Bonds

This class is more hardly accessible compared to stocks since the trades of bonds typically happen over-the-counter (OTC). In the majority of cases, asset managers perform this duty for the individual client. Depending on the type, bonds differ from one another on the basis of timeline (maturity), price and the associated level of risk. To provide a roadmap for investors, major rating agencies such as Moody’s and Standard & Poor’s (S&P) are rating bonds from AAA to C or D, going down from the highest proof of returns to the lowest.

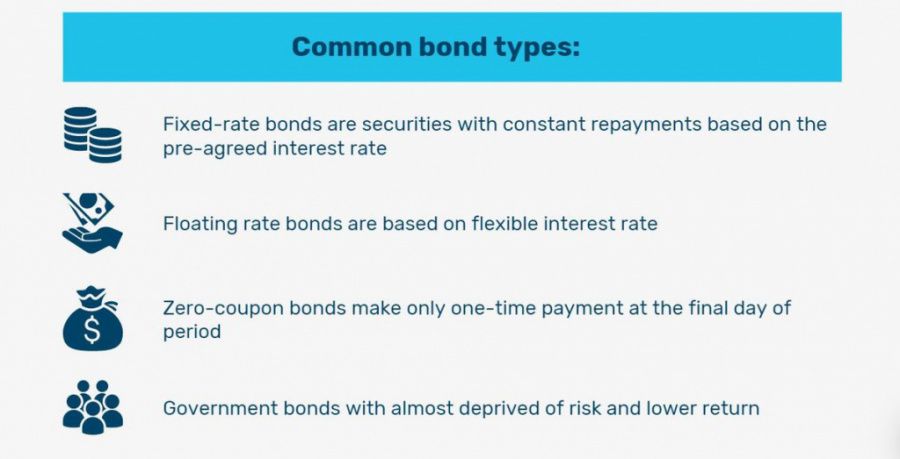

Some of the most common bond types include fixed-rate bonds – securities with constant repayments based on the pre-agreed interest rate. They go in opposition with floating rate bonds (floating rate notes) based on flexible interest rate, or to zero-coupon bonds that make only one-time payment at the final day of period (maturity date). Apart from that, there are government bonds (e.g. US Treasury securities) that are almost deprived of risk – which, however, also results in lower returns. Corporate bonds may be a viable alternative to stocks where the returns are guaranteed, and foreign bonds are listed in foreign currency that have more influence over bond’s benefits than interest rate.

Funds

There are the organizations that undertake larger investments from a collective pool of money from individual investors. They include exchange-traded funds (ETFs) which trade their shares on public stock exchanges - and mutual funds that are not listed anywhere, index funds that aim at higher performance than a particular index (e.g. S&P 500), and hedge funds that bring higher returns by employing risky strategies. Funds provide a hustle-free way for the ones who are not eager to track assets classes individually and make investment choices by themselves and instead prefer their funds to be managed by organization.

Contracts

These instruments allow more flexibility in investment choice. Forex traders commonly use futures contracts, which allow them to buy or sell a particular asset class for an agreed price at a certain moment in the future. While employing the leverage – share of money invested by the broker, it allows achieving higher returns only with a relatively small amount of the actual position (just 3-12%) covered by the investor.

A similar logic guides contracts for differences (CFDs) – they use leverage extensively and allow investors to have a stake in some asset class without the actual ownership. Contracts allow you to make a bet on the expected future price of the market, while also avoiding standard fees charged from gains on a stock market. The difference between futures and CFD contracts lies in a method of acquisition – futures contracts are sold on futures marketplaces, where commodities can also be purchased, while CFDs are primarily bought through private brokers.

Alternative investment forms - cryptocurrencies

This includes everything that falls outside the scope of traditional finance. This class is quite broad and mostly covers assets with low liquidity, such as real estate, elements of luxury and commodities. The most recent addition to the list is cryptocurrency, which already created around itself an ecosystem of exchanges, blockchain start-ups and even cryptocurrency funds.

Coinidol.com, a world blockchain news outlet, observed that cryptocurrency gradually consolidates in the world through regulations, taxation, empowerment and job creation. Up to this day, it remains the most controversial asset class, but the one that the current financial system needs most. There are already some high-scale projects involving stablecoins, which may popularize cryptocurrency and bring it into a public tender.

How the future will unfold for cryptocurrency, for now, remains to be seen. In the meantime, cryptocurrency investment also has its own tips and tricks, which have to be stored in mind before leveraging money into it.

With profusion of asset classes in the modern financial world, and due to the appearance of decentralized finance, it is as accessible as never before to make an investment decision according to an individual choice and preference.

News

News

Coin expert

(0 comments)