Crypto Newbie: How to Tell Between Bitcoin, Altcoins and Tokens?

Updated: Oct 23, 2021 at 11:30

Although only lazybones haven’t heard of cryptocurrency yet, society generally still lacks awareness about this type of money. Nevertheless, the number of newcomers to the industry grows on a daily basis. But where to start before investing your money and risking to lose it all?

First of all, any beginner needs to understand what cryptocurrency is. Roughly speaking, one can get an idea about it after splitting the word itself in two. Cryptocurrency, meaning “cryptographic money” or something like that. Indeed, cryptocurrency represents digital encryption that can be used for payments or storing value. It is not backed by any physical value like any other form of money.

It is just a set of numbers recorded on the network called the blockchain. You can not see or touch it, however, this travesty does not prevent it to be used for actual payments. Probably, it’s because laws of mathematics are more reliable than any kind of physical background for a currency.

Decentralized money

On the plus side of any cryptocurrency is its decentralized nature. Despite the initial blockchain being developed and launched by an unknown person or a group of people under the code name Satoshi Nakamoto, no single person or entity can control the entire network. This peculiarity ensures anonymity and confidentiality of users, with the fact that Nakamoto has not been identified over the past 20 years being the best proof of that.

The second advantage of decentralization is that no single person or entity is able to manipulate cryptocurrency value according to one’s own interests. Surely, there are other ways of manipulating prices, but that is an entirely different story. Generally, cryptocurrency price depends on the news in the market and therefore is highly volatile. When the news is good, the price can go higher. When the news is bad, it can collapse.

However, the cryptocurrency market has its own temper, so it sometimes behaves quite the opposite of what was expected. And this fact makes it much more difficult to manipulate than any centralized market.

The King and his people

As mentioned above, a cryptocurrency is based on a blockchain, with each coin having its own one. Yes, there is more than one kind of cryptocurrency, with bitcoin being the first and the most popular one. It was launched back in 2009 by the above mentioned Mr Nakamoto.

In the course of time, its value increased many times, making people compare it with gold. At first sight, they really have something in common. Both assets can be used for storing value, both of them have limited supply and can be acquired through mining. Sure, the mining process itself differs, but still, the analogy is clear.

Later on, other developers picked up the idea, giving birth to other kinds of cryptocurrencies, such as Ethereum, Ripple, Litecoin, Monero etc. Each of these cryptocurrency has its own peculiarities. For instance, Ethereum has an increased transaction speed as well as the smart contract mechanism for automating transaction verification. Monero possesses enhanced anonymity features, which, on the other hand, makes it especially attractive for those engaged in illegal activity.

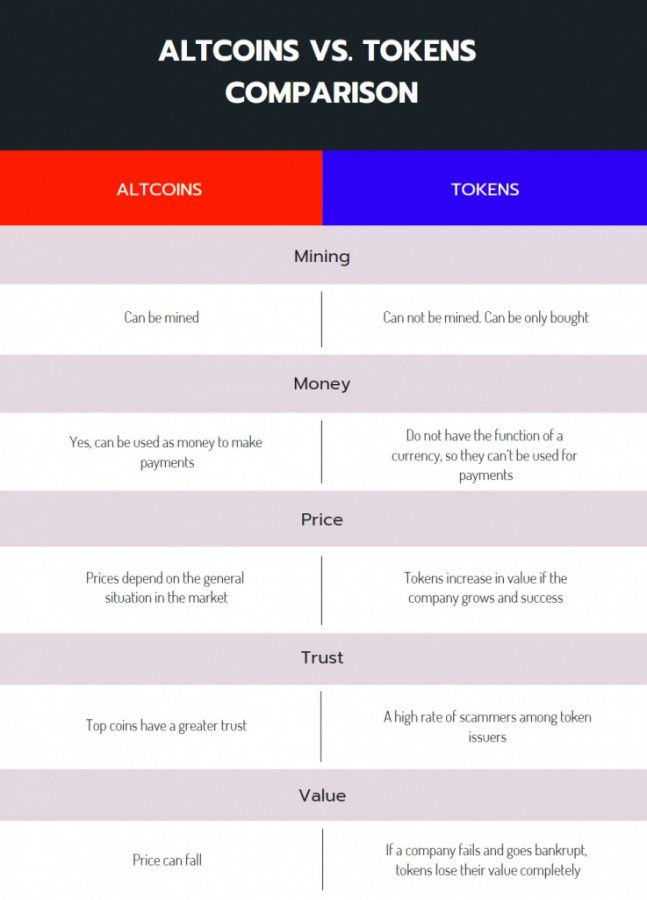

All cryptocurrency coins that are not Bitcoin are collectively called altcoins. Despite various peculiarities, all altcoins are based on the initial mechanisms of bitcoin. They can be mined, they are decentralized and they are based on blockchains. Their value is also related to that of Bitcoin. Thus, if BTC price increases, altcoins also grow to various extent. If it falls, altcoins most often follow the lead.

Altcoin prices depend on the general situation in the market, so investing in altcoins means investing in the market. As long as it grows, you will earn money. If it collapses, you will lose.

Coins vs. tokens

Besides the original Bitcoin and altcoins, there is another kind of crypto asset that is different from them. It is called a token. Tokens are also digital assets consisting of a digital code recorded on the blockchain. However, they are more like shares, while bitcoin and altcoins function as money.

Tokens are usually issued by certain companies and used to attract finance for the implementation of their project. They can not be mined, they can only be bought. That is why the value of tokens is tightly related to the success of the project. If a business grows, tokens increase in value. If a company fails and goes bankrupt, tokens lose their value completely.

This happens because tokens do not have the function of a currency, so they can’t be used for payments. They are generally used to confirm their holder’s right to a share of income of the emission, something like a debt warrant. The only way a holder can use them for payment is when one buys products or services from the emission. Some companies do offer such an option.

Among the common things between coins and tokens is that both can be used for investment. In this case, tokens can even bring higher returns than altcoins. However, there is a high rate of scammers among token issuers, so this kind of investment is associated with higher risks. Any investor needs to investigate the company thoroughly before trusting it with one’s money.

The right to live

In fact, any kind of cryptocurrency can be used for investment and making money depending on the users’ initial goals. If you wish to make a long-term investment with the ability to use your savings immediately when you need money, you’d better choose bitcoin or altcoins. If your main goal is to make as much money as possible, then you can explore the potential of tokens.

Be that as it may, any beginner wishing to try cryptocurrency investments must get an advance understanding of the market principles and peculiarities. Any kind of investment bears certain risks. Cryptocurrency investment is no exception. In fact, it might be even riskier. However, if you will gain enough knowledge to get the picture of the market and understand how everything works, both coins and tokens might be of a benefit to your wellbeing.

News

Price

News

Price

(0 comments)