☰ Menu

Albert Libenzon

Articles

Jul 06, 2016 at 10:05

Price

Bitcoin and Altcoin Price Analysis: July 6, 2016

Price

As we expected, this week the price of Bitcoin and altcoins remained stable. A sideways trend is typical for most cryptocurrencies at the moment.

Jul 05, 2016 at 12:43

Price

Bitcoin Price and Falling Markets

Price

Yesterday was relatively quiet for financial markets due to the US Independence Day celebration. Fears of serious repercussions of Brexit are gradually weakening, and the Bitcoin price briefly found peace in the range of $665 - $680.

Jul 04, 2016 at 15:37

Price

Bitcoin Price Fluctuation Dynamics after Brexit

Price

Two weeks have passed since the Brexit. World markets collapsed soon after the first results of the referendum were announced and today they continue to face the pressure.

Jun 29, 2016 at 15:42

Price

Review of the ETH Price this Week

Price

On June 23rd the British people voted to leave the EU. Before the Brexit we have seen the loss of value of fixed cryptocurrencies including PTS and ETH. The driver of the price reduction was the US Dollar, that pulled everything else behind as well.

Jun 22, 2016 at 14:16

Price

Bitcoin Price Rally Expecting Brexit

Price

Last week Bitcoin has shown a rapid growth to new highs: $738, £531, €673. Finally, bitcoiners see the growth of the Bitcoin price is coming true.

Jun 21, 2016 at 13:22

Price

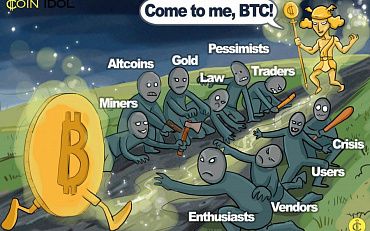

10 Reasons for Bitcoin Price Volatility

Price

Bitcoin has many positive benefits against other currencies. Some use Bitcoin just as a means of payment for goods or services, while others use it as a way to invest money, and some people decide to use Bitcoin to preserve their capital. In any way, the determining factor is the price of Bitcoin.

Jun 20, 2016 at 21:49

Price

Bitcoin Price Rises and Falls During The First 5 Months of 2016

Price

In the first week of the year 2016, Bitcoin price was at the level of $430. On January 7, 2016 the People's Bank of China devalued the Yuan, thus the Yuan price fell to 6.5446 for $1 US.

Jun 17, 2016 at 15:55

Price

The World’s Major Competitors to Bitcoin

Price

In May 2016 Bitcoin’s price showed an increase of more than 18% and reached the high level of $540. This growth confirms demand for Bitcoin on the global financial market, as well as among ordinary users.