Cryptocurrency Mining on the African Continent: Challenges and Opportunities

It is more than 10 years since the first cryptocurrency appeared on earth. The emergence of crypto attracted varied reactions from the different countries of the world. Africa, the second-largest continent is especially lagging in crypto trading and mining. What challenges and opportunities lie on the way of crypto mining growth in Africa?

Crypto mining is widespread globally

When it comes to crypto mining, there are both big and small players in the game. China, for instance, is the leading crypto-mining country in the world, and perhaps, the world’s richest in terms of crypto asset holdings. It doesn’t come as a surprise as China is the global manufacturing hub for not only general electronics but crypto mining hardware. Crypto mining in China is sometimes backed by the government and seen as a boost to the economy. But there are also dangerous substitutes in the game: Sweden, Georgia, Latvia, Canada, Estonia, Finland, Switzerland are all popular crypto mining hotspots.

Africa lags in crypto mining

Although the continent is the second-largest in terms of size, and with 55 countries, its crypto mining hashrate does not exceed 10%. Crypto is, of course, growing on the continent but that is still nothing compared to the growth in the aforementioned crypto strongholds. China alone, for example, claims more than 65% of the total crypto mining hashrate.

South Africa remains Africa’s crypto mining hub although the first crypto mining in Africa was first spotted in Ghana eight years after bitcoin launched. Other important crypto mining fields are found in Kenya, Egypt, Uganda, and Ghana.

Why Africa’s crypto mining is still underdeveloped

The primary reason for the low development of crypto mining in Africa is the widespread unemployment and poverty. Sub-Saharan Africa, especially, is a case in point. Of the 28 world’s poorest nations, 27 are found in sub-Saharan Africa. Average poverty rate apparently stands at 41 per cent. On the other hand, mining rigs are extremely expensive, sometimes costing at least USD 5,000. Besides, electricity is mostly unaffordable and yet crypto mining survives on abundant electricity supply. In Uganda, for instance, only 28% of the population have access to electricity.

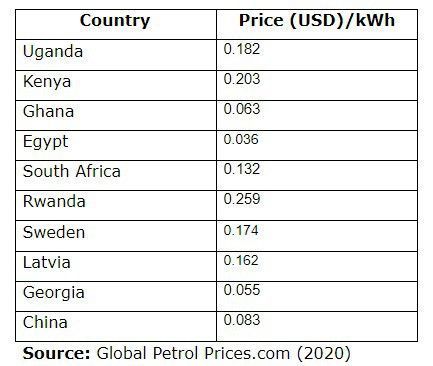

Domestic electricity prices in selected African and elsewhere as of March 2020

While electricity prices in some African countries could be seen to be even lower than in some of the top mining territories elsewhere, the question of income per capita comes into play. At least 21% of Ugandans live below the poverty line, while up to 36% of Kenyans are still buried below the same line. Food, shelter, medical and other basic necessities come first on the list of what to spend on, hence, affecting the takeoff of the mining industry in the region.

Finally, most African governments are negative about cryptocurrency and mark its mining and trading illegal. South Africa remains one of the few countries on the continent with a conducive environment for crypto activities, hence, the fast-paced crypto growth in the country.

The future is bright for Africa

While the crypto growth and development has been relatively lower on the African continent compared to the rest of the world, a crypto revolution is inevitable. The continent has witnessed a charged crypto atmosphere over the past few years. Akoin (AKN), Akon’s flagship cryptocurrency just launched on the continent on November 11.

Besides, CoinIdol, a world blockchain news outlet, reported that the famous rapper is making significant efforts to help his motherland grow, including the establishment of a high tech Akon City.

Secondly, most African governments are seeking alternative electricity sources and solar, wind, and other clean energy developments have been taking shape on the continent.

In Uganda, the country is about to commission the Karuma Hydro Power Station that would supply additional 600MW of electricity that is hoped to cut power costs down. Presently, Ugandan households pay 0.182 USD per kWh of electricity, while businesses pay 0.155 USD for the same amount of power. This could provide a somewhat conducive atmosphere for Ugandan miners.

In short, Africa, though rich in human and mineral resources, does not lead in crypto mining and generally crypto activities. The continent’s crypto mining industry is faced with numerous challenges ranging from political to social and economic. However, the continent is witnessing some developments which might be to the advantage of the mining industry.

Price

Price

Price

Price

News

(0 comments)