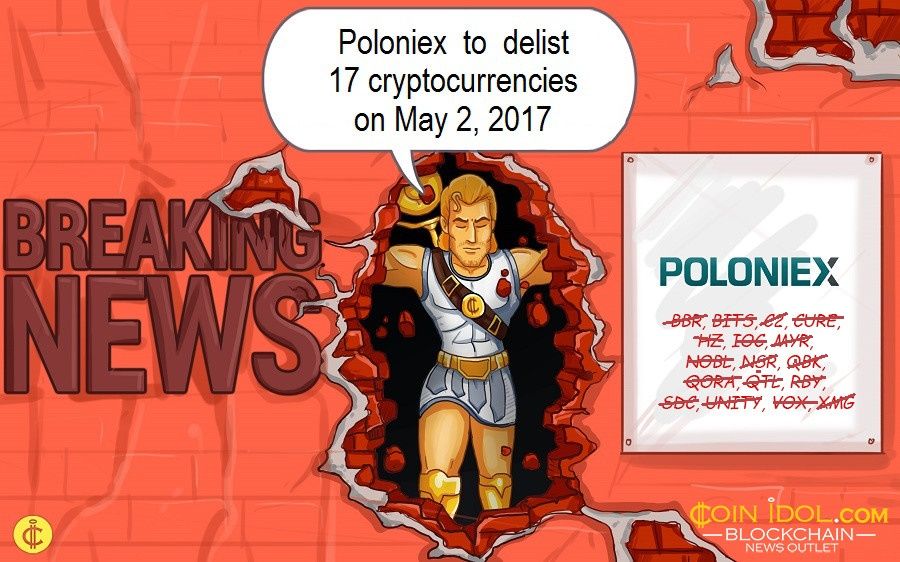

Poloniex Will Delist Seventeen Altcoins In One Day

Poloniex has recently announced its plans to delist 17 cryptocurrencies on May 2, 2017.

Update: "Hacked or Corrupted: Suspicion of Insider Trading At Poloniex" and "Altcoins Delisted From Poloniex are Not Dead and Kicking"

On May 2, 2017, the following will be delisted: BBR, BITS, C2, CURE, HZ, IOC, MYR, NOBL, NSR, QBK, QORA, QTL, RBY, SDC, UNITY, VOX, XMG

— Poloniex Exchange (@Poloniex) 19 April 2017

This decision was recently published on the cryptocurrency exchange’s Twitter page, and has no explanations of why the Boolberry (BBR), Bitstar (BITS), Coin 2.1 (C2), CureCoin (CURE), Horizon (HZ), I/O Coin (IOC), Myriad (MYR), NobleCoin (NOBL), NuShares (NSR), Qibuck (QBK), Qora (QORA), Quatloo (QTL), Rubycoin (RBY), ShadowCash(SDC), SuperNET (UNITY), Voxels (VOX) and Magi (XMG) altcoins are going to be delisted, surprising many altcoin traders.

It seems that some representatives of the altcoins that are going to be delisted were also not informed about this decision.

@Poloniex Hey @Poloniex , anything we can do to avoid delisting ?

— Boolberry (@BoolberryBBR) 19 April 2017

Prospects for these altcoins on other cryptocurrency exchanges

Most of these coins are far beyond the top-10 cryptocurrencies according to market cap and price, however, and according to reactions on Twitter, traders believe that some of these projects might have pretty good prospects.

Crypto community and altcoin traders can only guess why Poloniex decided to delist so many coins at once and whether other cryptocurrency exchanges will follow Poloniex. Being delisted from any of crypto exchanges would have a negative effect on the price of any of these altcoins.

"I think many of the coins deserve to be delisted. From an exchanges point of view, a lot of these coins don’t have the volume to justify the upkeep costs. Every time a wallet re-releases, they have to pay someone to actually update the wallets on exchange. If a coin is doing 0.25 BTC a day in volume and they make 0.25-0.35% of that, it takes a long time to even cover to cost to have someone update it. There are smaller, more suited exchanges for coins like those. If volume peaks again for some reason down the road, they can always add it back. Most exchanged will keep coins listed “just in case” they randomly pump one day,” commented John MacPherson, Compliance Manager for Wall of Coins, a P2P bitcoin and dash exchange by Genitrust, Inc, who also worked in AML/KYC and investigations at Cryptsy and Jaxx/Decentral.

He continued:

“Do I think that it would hurt the price if this happens? For sure. That is why the exchanges shouldn’t list, then delist, then list, then delist, because when they do, it will manipulate markets. People will panic with delisting and most will dump. Some brave souls or bag holders will try to pump to keep it listed. The coin will drop in price across the exchanges it is on and it will slowly die off again, only to be used within a small community with very little volume."

Mike Lorrey, the co-creator of the cryptocurrency Bitgold, the predecessor of Bitcoin, also commented to Coinidol.com:

"The coins’ volume was already dropping relative to BTC and ETH. This is normal market action weeding out bad business models. Yes, prices will drop."

Daniel Dabek, chief architect and founder of Safe Exchange, curator of AltCoin Trading Community:

"These are coins that have little development. Clearly Poloniex had added these coins at a time in the early stages, and since nearly each of these coins simply pumped and dumped, akin to playing dice with a trading instrument. So it makes sense that these coins are delisted from this perspecitive. It is my point of view that if a coin is listed to an exchange it should face specific criteria and that criteria be known and only apply to new coins.

Competing exchanges should keep these coins listed since the volumes will migrate.

Nearly each coin had seen -30% or more loss after these announcements."

Aaron Foster, CEO, Co-founder of the BitPoint P2P exchange and wallet, said:

"The ability to fund projects in a decentralised manner via ICOs is a tremendous innovation. Without commenting on the merits of any of the particular tokens in question, the de-listing of thinly traded and weakly capitalised coins it's a sign of the market maturing."

Bill Shihara, CEO of Bittrex exchange also commented to Coinidol.com:

"As the blockchain industry evolves, it's natural to see projects fall in and out of favor, and for market volume and price to reflect that. At Bittrex, we evaluate digital currencies delistings on a number of factors, including volume, stability of a blockchain, developer activity, and community engagement. Every exchange has different goals when it comes to delistings. Our goal is to support innovation in the blockchain space, and that means we only delist projects when there are clear indicators that growth and innovation aren't happening. We understand that delistings can cause price movement, so we're transparent about the factors that go into it so that no one is surprised when they occur."

Price

Price

News

Price

Price

(0 comments)