Can a 1.5 Billion Investment Push Ethereum to New Highs?

Updated: May 28, 2021 at 14:05

The CEO of SpaceX and Tesla, Elon Musk, invested $1.5 Billion in Bitcoin, and the price of crypto went sky-high. Now, billionaire Carl Icahn considers investing $1.5 Billion in Ethereum. Ironically, the amount of investment is the same in both cases. Can such investment trigger a bull run for Ethereum?

Each time a big capitalist invests huge amounts of money into a certain cryptocurrency, its price tends to increase dramatically. Many investors globally continue to become more optimistic that cryptocurrencies are here to stay in one form or another. More research into the blockchain and crypto sector is being done to see how best they can invest in this nascent industry to make supernormal profits, just like in any other traditional business.

BTC, ETH and other genuine cryptocurrencies represent stores of value

As the inflation rate in the United States continues to escalate - now at 4.2% - billionaires in the country are seeking other potential investment alternatives where they can store their wealth. Some of the alternatives include private equity, private debt, hedge funds, real estate, collectibles, structured products, and commodities like gold and cryptocurrency.

The benefits of alternative investments are that they give inordinate portfolio diversification and reduce overall risk with the latent for towering returns. As cryptocurrency becomes a bigger part of the investing panorama and easily accessible to various types of venture capitalists.

While clarifying why he is planning to invest about $1.5 billion into Ethereum and buying into other crypto assets such as Bitcoin, the former cryptocurrency skeptic Icahn revealed that crypto assets are a potential store of value.

The 85-year-old businessman chose to first invest in ETH over any other coins simply because of its unprecedented utility of the network. Ethereum can be used as a payment system as well as a store of value.

Will Ethereum also gain by over 80% as Bitcoin did?

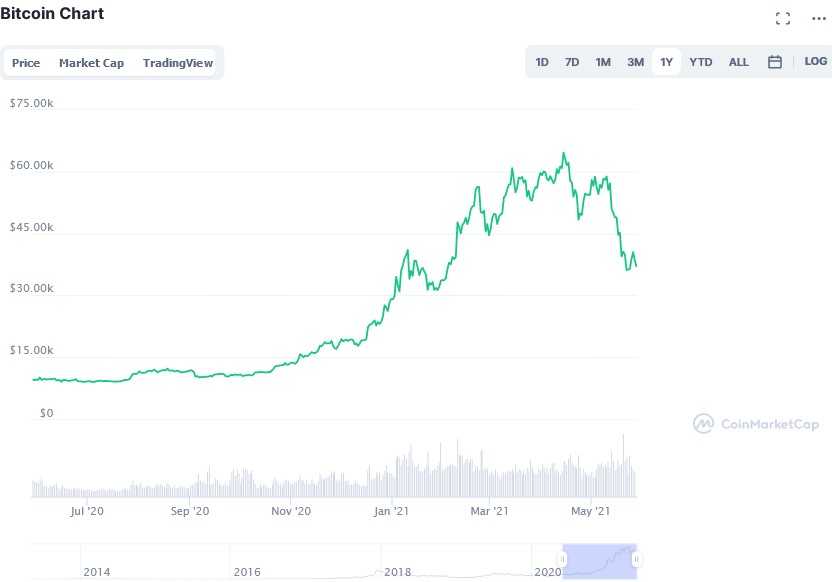

Musk invested heavily in Bitcoin, as CoinIdol, a world blockchain news outlet, has previously reported. He also declared to the US Securities and Exchange Commission (SEC) that he had invested nearly $1.5B in BTC in February this year, the price of BTC skyrocketed by over 18% to touch a new all-time high (ATH) of $47,132 at that time. At that time, Elon said that he was investing in Bitcoin because the fiat currency was facing bearish real interest rates.

Due to the excitement within the crypto community, Bitcoin’s price continued to soar and even hit an ATH of $64,863.10.

That means that from January when Musk made his huge investment in Bitcoin up to when BTC recorded its ATH, it gained by about 80%.

If the same gains are to happen when a similar investment is planted into Ethereum, it is estimated that its new price will increase and be about $4,600 (based on the current price) to $7,850 (based on its all-time high). About 16 days ago, ETH recorded its ATH of $4,362 (May 12). However, at press time, Ethereum is trading in red at $2,557.13, with a market cap of $297.524 billion and volume of $30.821 billion.

Most analysts are still bearish about cryptocurrencies, while some traders are buying coins while their prices are on the drop. But with crypto, there is always an element of surprise in the market. In fact, for the community to know for sure whether a $1.5 billion investment can push Ethereum to the levels of BTC, such investment should actually happen.

News

News

Coin expert

(0 comments)