Cryptocurrency Mastercard or Visa Cards: How to Use Them and Not Face KYC Sanctions

Updated: Apr 26, 2021 at 12:57

Cryptocurrency cards are the modern way to spend bitcoins for purchases even if the vendor doesn’t accept cryptocurrency directly. However, users worldwide face multiple issues while using these crypto cards, including the inability to pay everywhere, bad customer service, bad exchange rates, high fees, and even closed or frozen accounts with money lost.

Coinidol.com Blockchain and cryptocurrency news outlet collected the most common complaints from cryptocurrency cards users and recommendations on how to use them with the least problems possible.

Easy to get, harder to use

Today, cryptocurrency users in most countries worldwide can already order and use cryptocurrency debit or prepaid cards to make fast crypto to fiat currency conversions and buy goods and services both online and at the POS (point of sale), or even withdraw money from ATMs.

That sounds convenient and easy. However, cryptocurrency cards, whether they are Visa or MasterCard, require all their users to pass the whole Know Your Customer (KYC) verification process and follow the user’s agreement with the cryptocurrency card issuing company.

Basic KYC verification consists of:

-

(Almost always) Identity verification, including providing a full name, birthdate, passport/ID copy;

-

(Often) Address verification, which sometimes requires users to upload one or several utility bills, bank statements, or rental agreements;

-

(Sometimes) Money flow statements and risks involved with maintaining a business relationship, which requires users to provide information on their monthly/yearly income and the source of that income.

Providing all the required documents and then waiting for their verification may take time, especially if that person has just moved to a new address, or changed his job, or is requesting a card from another country with documents written in another language.

Moreover, in the time of COVID pandemic and its restrictions, users face more difficulties in collecting all the required documents, especially if their issuance requires their physical presence which is impossible during the lockdown.

The history of KYC restrictions for cryptocurrency cards

Several companies started to provide bitcoin prepaid and virtual cards issued by Wave Crest Holding and operated by VISA back in 2017 and became quite popular in Europe.

But on January 5, 2018, the company announced the closure of all cryptocurrency cards due to a change in operating permissions. VISA immediately terminated the license agreement with Wave Crest Holding explaining it was due to continuous non-compliance with the company rules.

Users of such bitcoin and cryptocurrency payment service providers such as BitPay, Cryptopay.me, Coinsbank, TenX, Wirex, and AdvCash lost their ability to use cryptocurrency cards.

It took months before companies started to issue and work with new cryptocurrency cards again. But, keeping in mind the mistake of the pioneer cryptocurrency cards issuer, these companies were forced to follow VISA rules and specifically KYC verification to all users.

Basically, despite dealing with the cryptocurrency field - which was originally an alternative to traditional banking - users were again dragged into the same verification process as they have in any official state bank. As a result, this caused some unpleasant situations for cryptocurrency customers.

Most common customers complaints

Here we will try to give examples of some of the most common problems and complaints cryptocurrency card users have to deal with. We will also provide real statements from users expressing their experiences, but we won’t mention their names in respect of their identity.

The complaints about the companies mentioned below can be found freely online and double-checked. All the companies mentioned do or did offer crypto cards to their users. We believe that each of the companies mentioned is working to improve its services, but we will show some of the most common problems that users complain about as of the time of writing.

We must also note that all these examples are primarily written to help users to understand what actions may be accidentally misinterpreted by cryptocurrency companies and thus lead to sanctions that prevent users from using their cryptocurrency cards. Understanding these actions may help both users and companies avoid the same mistakes in future.

Users of this country are not accepted

The regulation of cryptocurrency varies greatly in different countries. That includes tax policy and the amount of cryptocurrency that person may be allowed to convert in fiat.

While storing and trading can be done easily in cryptocurrency, when the customer wants to trade it to fiat and then withdraw it in fiat (what is basically done when you use a crypto card in an ATM or POS) all the transactions are made via a traditional banking provider.

Cryptocurrency companies offering crypto cards must have an agreement with the local bank that will operate fiat transactions. So, users of cryptocurrency cards usually get two (or more) accounts: one operated by a cryptocurrency company and dealing with crypto assets, and one more at the local bank for storing and sending fiat. And the line between both operators is very strict - cryptocurrency or fiat. Very often users first have to trade their cryptocurrencies into USD, EUR or another national currency before they can simply buy something in a shop using cryptocurrency cards. They must first send assets from cryptocurrency to linked bank accounts.

This is why many cryptocurrency companies offering crypto cards can not provide services to users in different countries - they simply have no agreement with the bank operating or authorities in the region of the customer.

Users must first check if the card can be used in their country and only then start the process of signing up for an account and ordering a crypto card. Unfortunately, most of the companies do not list this on the first page, so be patient and find it in the FAQ or users reviews.

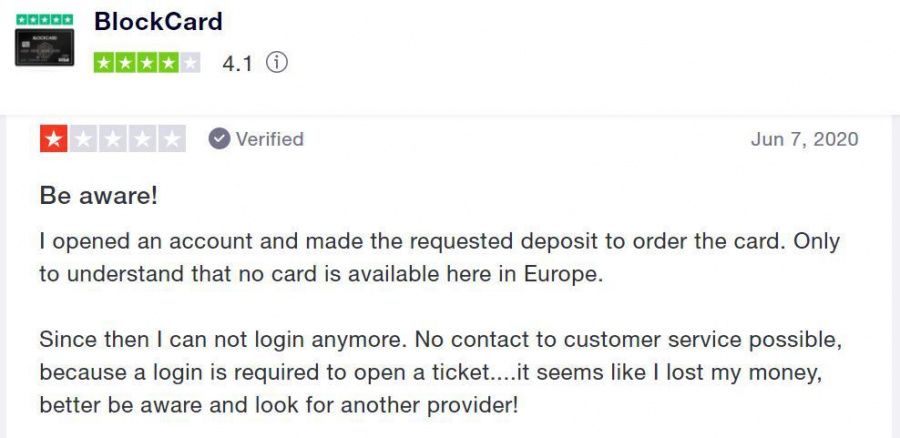

For example, some people who were planning to use VISA crypto cards issued by BlockCard, a crypto fintech platform powered by Ternio, found out that as of 2020 the card is available ONLY to users from the US. One of the reviews states:

Verification difficulties

To start using crypto cards and all their features, users must pass all the KYC procedures and verifications. Failure to do this sometimes cost a penny.

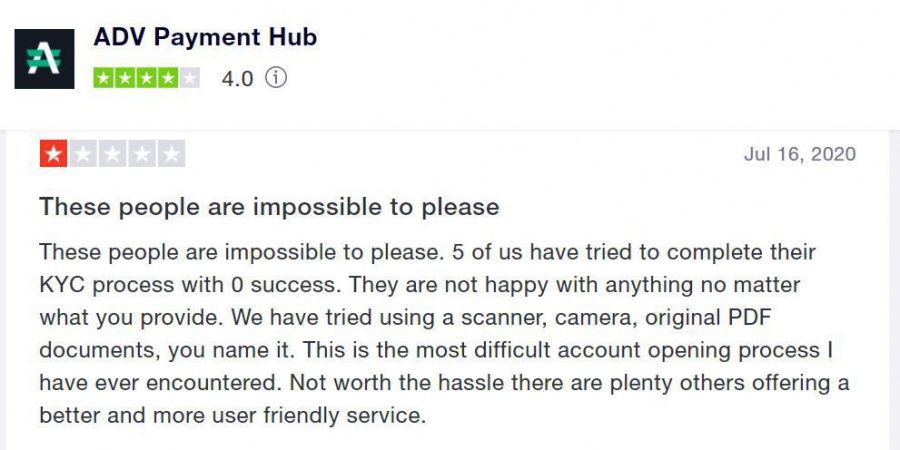

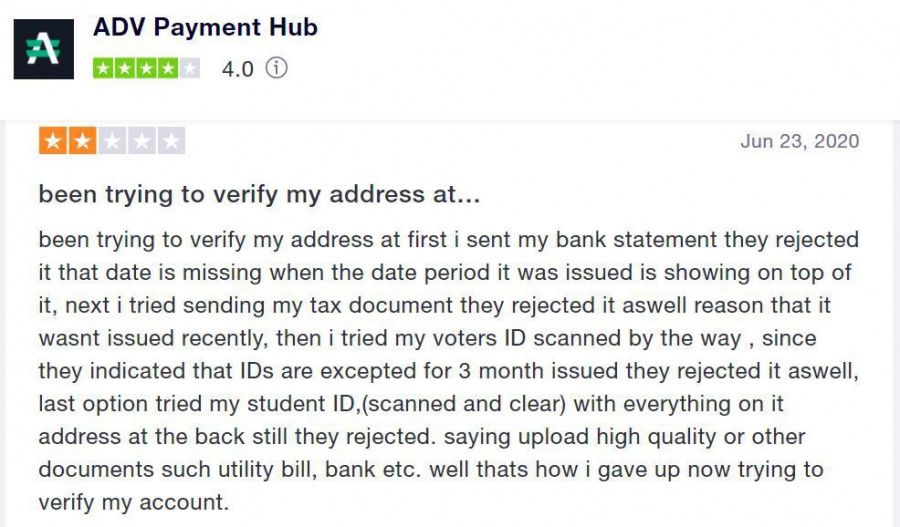

Adv Cash had been offering its first VISA crypto cards before the restrictions in 2018. Years later, the company announced plans to issue its crypto cards again. However, now it also requires all the users to meet KYC requirements, which include providing photos or scans of documents. Unfortunately, not all users can do that in the requested quality.

One of the complaints state:

Users must also remember that companies usually only accept recent documents (as a rule issued not longer than 3-6 months). The absence of newly issued documents may cause verification difficulties as well:

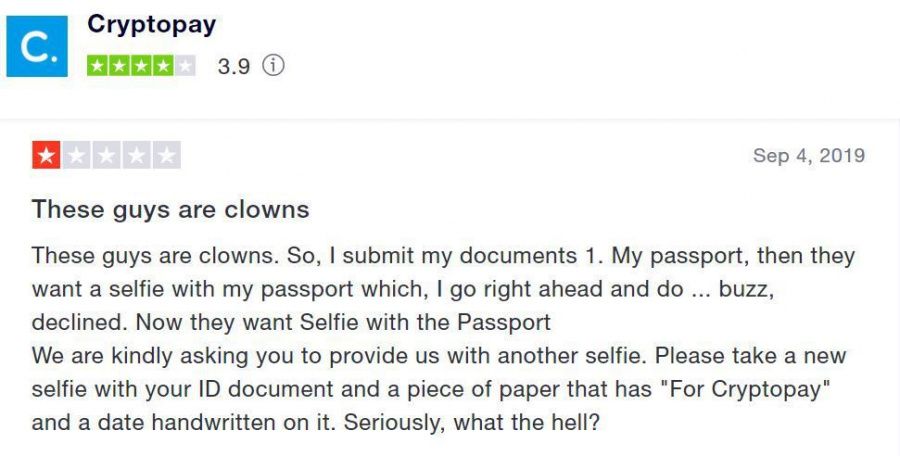

Some companies may even request the customer take a selfie with their passport and date written to complete their checks.

Platforms like Cryptopay.me, a cryptocurrency company offering cards to users in Europe and UK, confirm that that kind of sophisticated verification “happens rarely, but it happens”:

Language barrier

Some services request the verification of user addresses using utility bills, rent agreement, bank statement, etc.

However, users report that if the document is written in non-latin letters (used in English, Spanish, French, etc) it may be declined by some of the companies. Sometimes automatic systems that conduct verification can not read languages like Greek or Macedonian to verify the address in the document. These users can try to solve the problem by turning to the customer support service, or by requesting documents with their address in English from the bank or other institution that can be accepted.

The lack of fast customers support

Even if you are already using crypto cards, sometimes transactions on the cryptocurrency platforms may get delayed or frozen due to various reasons, including suspicious behaviour of the user, maintenance, high volume of transactions, or even hacks or simply glitches. For every user, the situation where his/her account doesn't operate the way he/she expects is definitely at least annoying.

The first thing that users do in that case - turn to customer support. But when it comes to cryptocurrency card providers, fast support is not what most of them are proud of.

Compared to traditional banks operators, the support systems of cryptocurrency cards operators are not the easiest ones to reach. Most major banks worldwide have a hotline available 24/7 for customers willing to block their cards in case of loss or theft, for example, and physical offices in your country. But users of crypto cards, as a rule, can not just call a cryptocurrency company or visit their office for clarification or help.

Users of crypto cards in case of trouble can make fast actions only by themselves using a mobile app or by entering an account in the browser. Or finding solutions may be done in FAQ sections, but it usually has only limited answers.

For specific questions, users must create a ticket with the request to the support team. Sometimes (if available) via live chat on the platform. The time when this ticket is checked and replied by the support team may take days. And you may be happy if the first reply is not automatically created and answers at least partially to your request. Usually, users have to make several requests explaining their problem before they get a prompt solution.

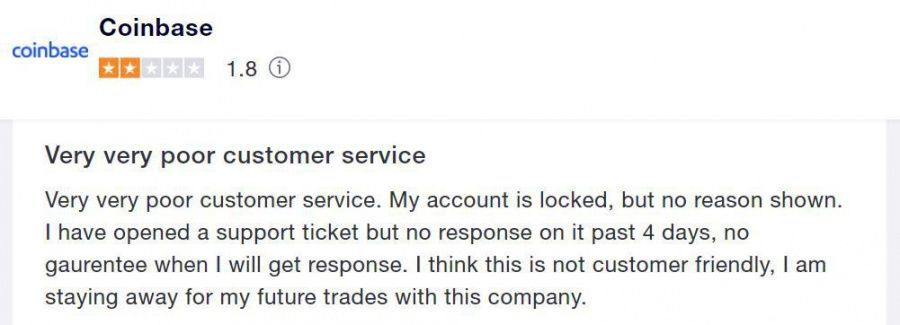

Coinbase digital currency exchange has proven to be among the most secure platforms offering a wide range of services, including crypto cards for US and European citizens. However, users are not always satisfied with the customer service they receive. Some of the complains state:

The same complaints are expressed by users of all other major crypto cards companies.

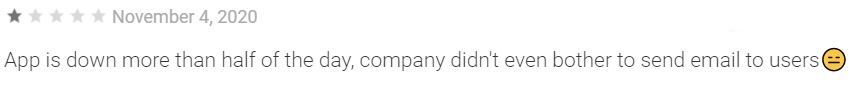

Mobile app may go down unexpectedly

This problem happens to all mobile apps from time to time. It may be extremely frustrating when the app with your funds is not loading when you need it and no notifications were received.

TRASTRA is a digital currency banking provider and VISA debit card issuer in Europe. Users get a debit card along with a personal IBAN for instant transactions.

One of the users of the TRASTRA app expressed his complaint:

Users must also remember to download updates for their app every time a new one is available.

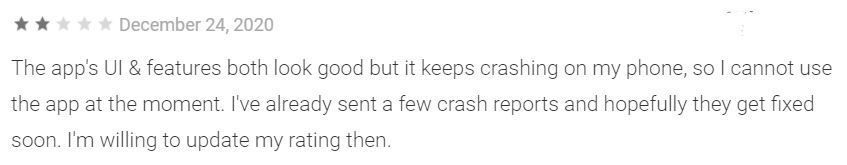

If the app doesn’t work well users find themselves unable to use it and their cryptocurrency card.

Monolith is represented as the first non-custodial Ethereum-based wallet offering DeFi tokens in the UK and Europe. Along with the Ethereum wallet, users get a Visa debit card. Users can trade tokens using their Monolith app on their smartphones.

However, while having a stylish design and concept for the project, users report that the company doesn't pay enough attention to the development of the app and call it “unbelievably laggy”.

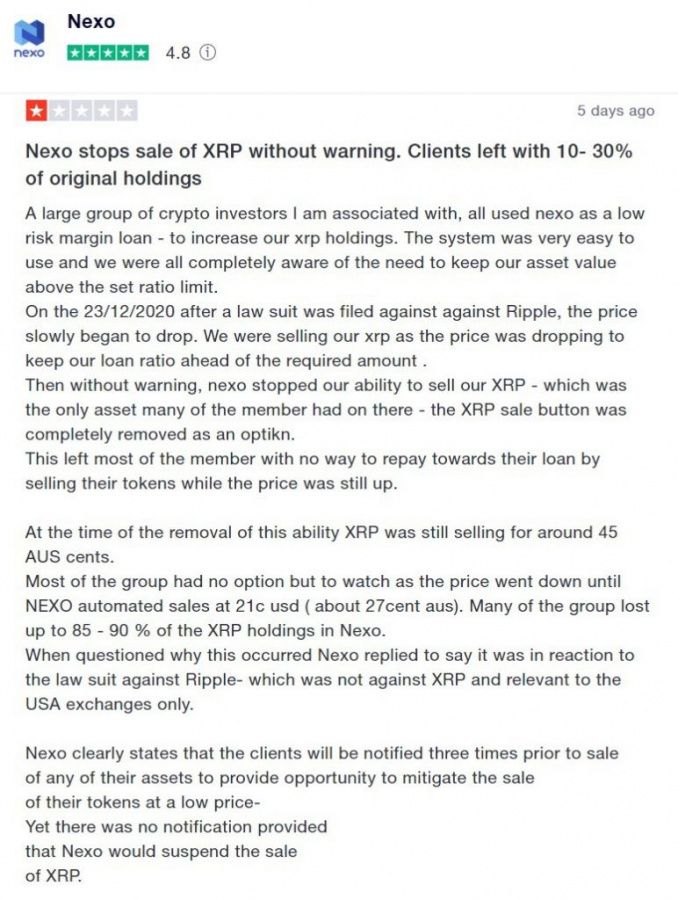

Unexpected changes

Most users expect that as they sign an agreement with a service provider nothing will change over time. But that happens rarely. The cryptocurrency market is still a new field, being more like the “wild west” than a stable market. Any new regulations or sanctions make changes to the cryptocurrency market and fluctuations sometimes force companies to take unpopular moves. While some companies try to do it as delicately as possible, others catch their users by surprise.

The recent investigation by the SEC on Ripple made cryptocurrency exchanges freeze any XRP token trades. Some companies did it immediately and without any notification to their clients.

Nexo is represented as the world's leading regulated financial institution for digital assets. The company is now offering cryptocurrency cards to its users as well. The recent event with Ripple saw Nexo users caught by an unpleasant surprise. Among the complaints, one of the users stressed out that company suddenly removed the XRP sale button without any warning:

Card may not be working everywhere

Cryptocurrency cards are not the same as credit cards issued by major traditional banks. Sometimes users may find that his/her card is not accepted at some POS. Again, this is due to the card being operated by a local, most likely not major bank (like JPMorgan, Santander, HSBC, Bank of China, Citigroup, Barclays, etc) and they may not have an agreement with the bank carrying out the transactions on the POS terminal.

Customers having just one cryptocurrency card with no other cards or cash in their pocket may find that they can not make the payment in all cases.

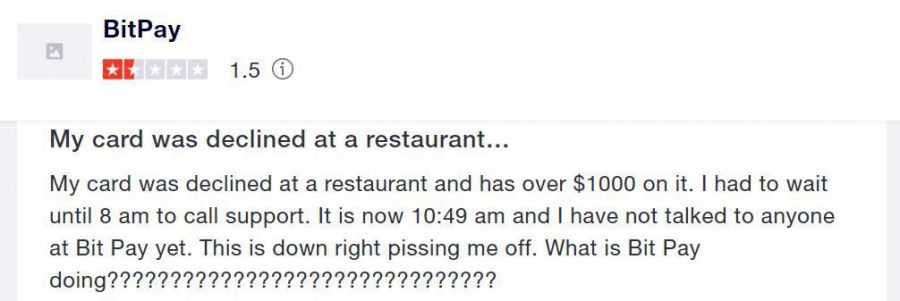

Unlike most other cryptocurrency companies, BitPay is one of a few that offers MasterCard crypto cards to its customers. One of the customers of BitPay Mastercard expressed his unpleasant situation:

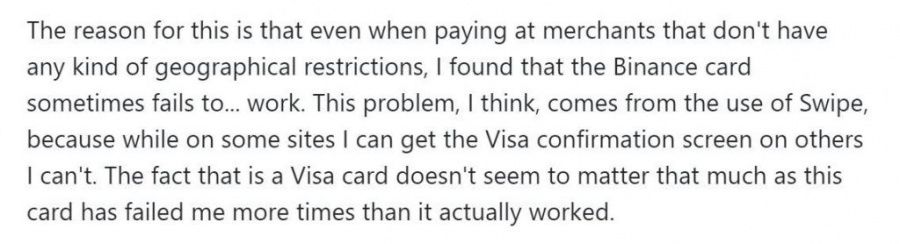

The same problem occurs sometimes for purchases online. One of the authors made his big review of Binance VISA crypto card.

Among his complaints is the problem that the card is not accepted by all merchants. He described his experience while trying to make payment for goods and services online - cards may simply be denied. Here is an abstract:

Whether you are using VISA or Mastercard, users should remember that sometimes the card might be declined even if it has a positive and sufficient balance.

Bad cryptocurrency exchange rate

Customers of cryptocurrency cards should be aware that the exchange rates may be less profitable than they expect. Companies providing crypto cards often get their revenue from crypto to fiat exchange fees and exchange rate differences. These kinds of complaints are stated by users of almost all the crypto cards.

Sometimes it becomes the major reason for a person to close his/her cryptocurrency account on the crypto card providers platform.

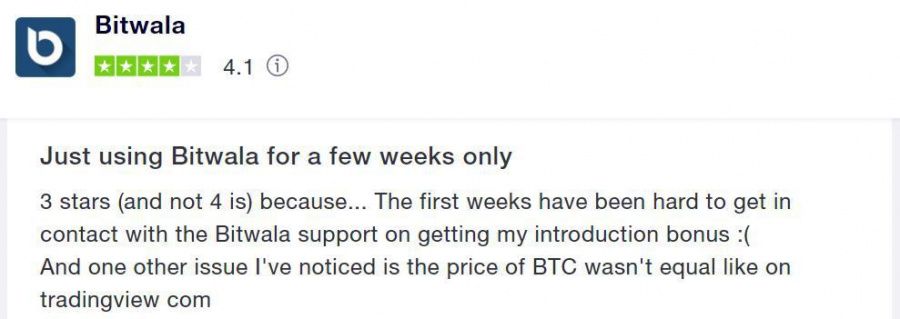

That kind of situation was described by the user of German blockchain banking service Bitwala crypto card:

High and unexpected fees

Despite all the promises of having no hidden fees and limits users, again and again, find that using cryptocurrency platforms for everyday use may cost some penny. And there are several ways that users are charged:

-

Unfair exchange rate. Companies that are offering cryptocurrency cards as their primary service usually have not the best exchange rates, instead of having some extra fees they may earn every time users exchange their money.

-

Monthly charge. Other companies just charge users monthly for using the card.

-

Fees per transaction. Most of the companies also take some small percentage or a fixed rate per transaction.

-

Other fees.

- High exchange fee

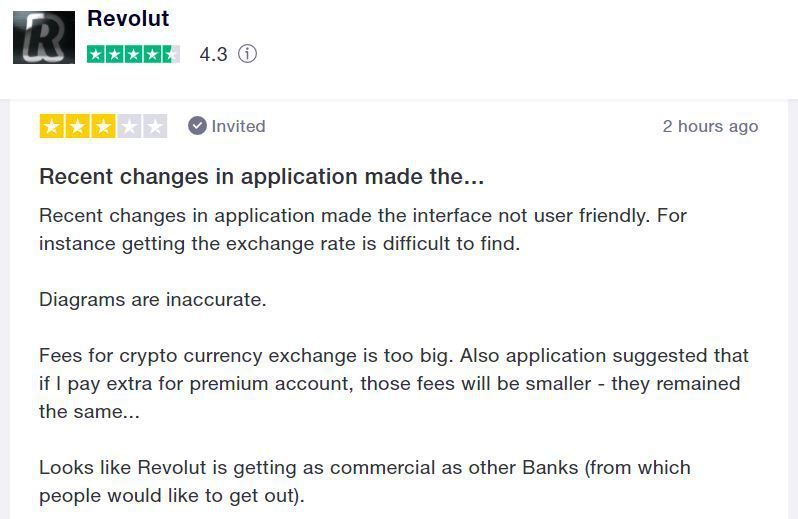

Revolut is a British financial technology company that offers various debit cards to its users in Europe. The card is traditional currency-based, but it also allows users to buy and send cryptocurrency between users.

However, an important note - it is impossible to send cryptocurrencies directly from an external crypto wallet; users must first send fiat from their bank account to their Revolut card and only then can the user buy cryptocurrencies and send cryptocurrencies to other Revolut users. To withdraw funds users must again sell cryptocurrencies to fiat.

Some Revolut users at first find it a great opportunity to invest in crypto but later stress out about the exchange fee:

- High transaction fee

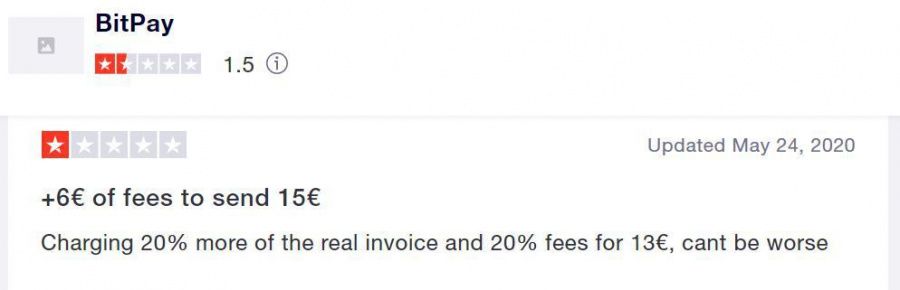

Another vivid example comes from a user of BitPay who complains that when making small transactions they often have to pay a big transaction fee:

- Monthly fee

Almost all companies offering cryptocurrency cards take a monthly fee for a card. As a rule, the basic monthly fee is around $2 USD or 1.5 EUR. However, companies may offer cards with different limits and users would be asked to pay more for cards with higher limits.

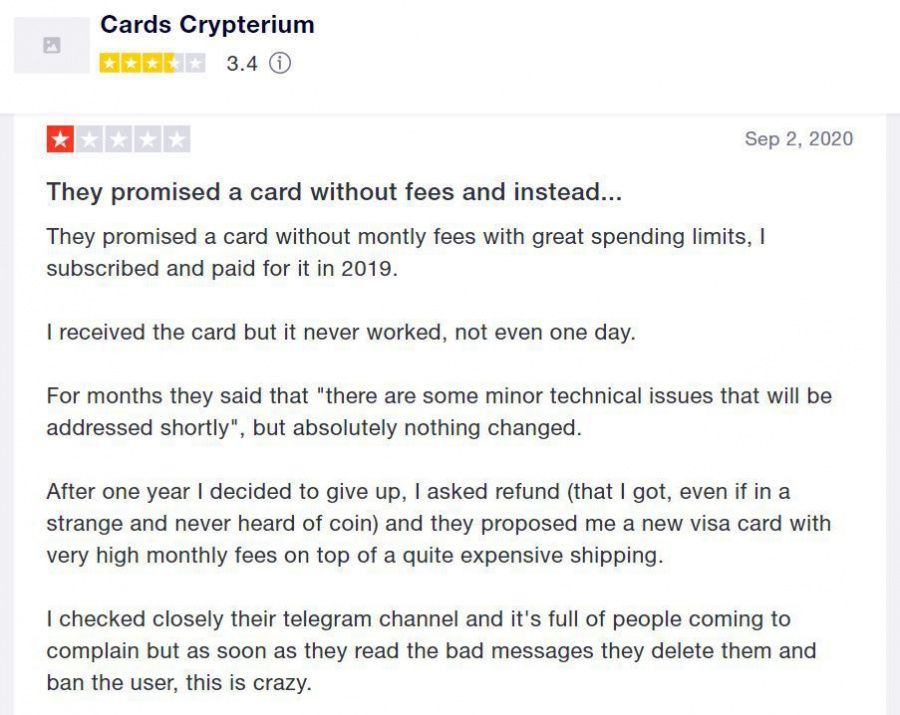

Crypterium offers both virtual and plastic Visa cards to its users. However, some users complain about the high monthly fee:

- Fee on refund

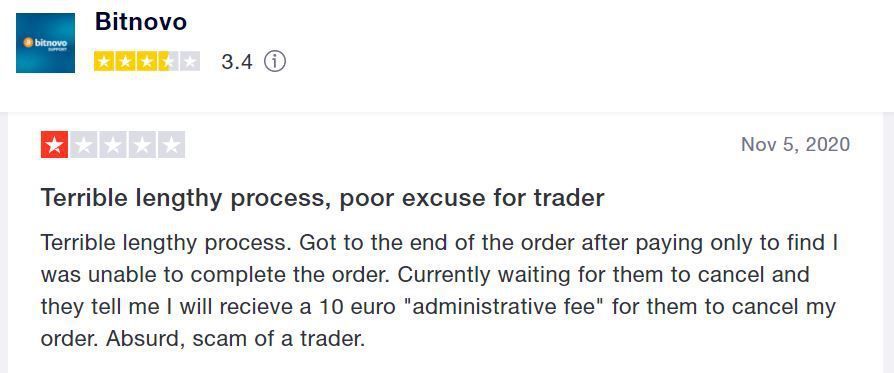

Users of some companies should be also ready to pay a fee in case they want to get a refund. Bitnovo offers two types of cryptocurrencies cards for residents of the European Union: Bitcard debit card and BITSA prepaid card.

While all the information on options, limits, and fees is described on companies homepage, some users warn on the fee for any refund or cancelation:

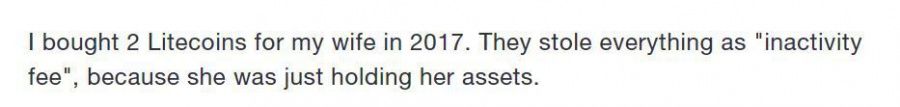

- Inactivity fee

Unfortunately, that kind of fees is more or less usual in all financial companies.

But some companies have gone even further by adding a special fee for “inactive accounts”.

Cryptocurrency companies prefer to take this fee in cryptocurrency, usually Bitcoin. Considering the volatility of Bitcoin the fee may reach unbelievably high amounts from time to time. For example, if 0.005 BTC was just $20 USD years ago when this measure was first represented, today by the end of 2020 0.005 BTC is almost $100 USD.

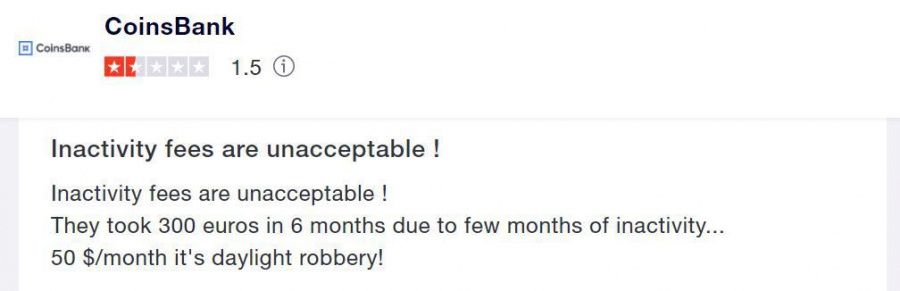

The Coinsbank cryptocurrency trading company, one of the first to present its Travel Bitcoin Debit Card, is often mentioned by users as having such a fee.

Users receive the information in the form of an email letter that if they don’t use their account for more than 12 months, the company will add a special fee each month of 49.95 EUR. That letter often gets lost in spam or forgotten.

Here are some examples of complaints people share on the internet:

Unfortunately, Coinsbank company was one of those whose first Bitcoin cards were frozen by Visa in 2018. At first, the company promised to offer its clients an option to withdraw funds using Western Union and also stated that it would create new crypto cards soon.

However, almost 3 years later, it still doesn’t offer new cards to its users. The withdrawal of funds from Coinsbank account to external cryptocurrency wallets can’t be called cheap either.

The old users of Coinsbank cards often leave their accounts unused for some time, expecting a better rate, new crypto card or another way to withdraw their money to be offered. These users are the first in line who are targeted to be the ones having a fee for inactive accounts. Old users, who are not engaged in cryptocurrency trading and do not want to pay a lot for transactions to external cryptocurrency wallets, are stuck.

Wirex is a digital payment platform offering cryptocurrency cards with multiple crypto and fiat currencies. In the terms and conditions of Wirex, a similar fee is also mentioned, but it is called a “storage fee” and may be applied to accounts that don’t transact using the Wirex Service for more than 9-18 months and is £/$/€ 5.00 per month for fiat balances. For unused, 18-month-old crypto balances, the storage fee is 0.003 BTC.

Similar fees are applied to users by several other cryptocurrency companies as well, and the number of platforms adopting it is growing.

Users of cryptocurrency platforms that offer crypto cards should keep in mind that these companies profit off every transaction that a user makes and are not that interested in operating as a long term depository. If you buy cryptocurrency now to wait till it’s value grows up in years - choose other platforms or cryptocurrency wallets.

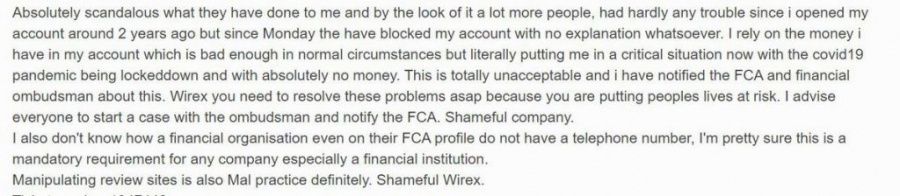

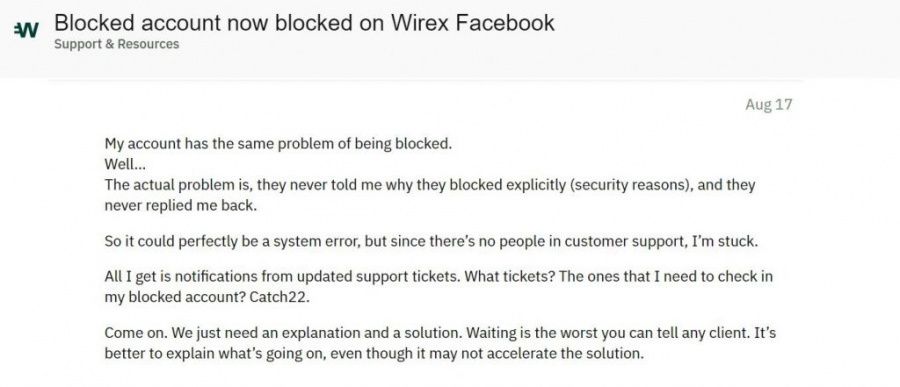

Company blocks accounts or cards without explanations

Several companies have been noticed blocking accounts with no explanation. People have been complaining about very bad customer support and the lack of explanation from the company team. When the account is blocked people turn to the service provider using any communication way they can find. Some answers may be shocking.

Ex-users of Wirex crypto cards reported that even after years of using crypto cards they may get a short letter stating that a person has 24 hours to withdraw all his funds before the account will be blocked.

An attempt to get an explanation and fix the situation is ignored. Users state that any questions to find out the reason get declined and end up with a simple explanation

“Due to applicable legislation and legal requirements we cannot disclose the reason for your account closure”.

Another user stated:

This means that any glitch in the system, any alerts of suspicious behavior (even if a person can fully explain it and provide the documents) may lead to the unexpected closure of one's account, and the person may not even know the reason to appeal it or prevent it the next time.

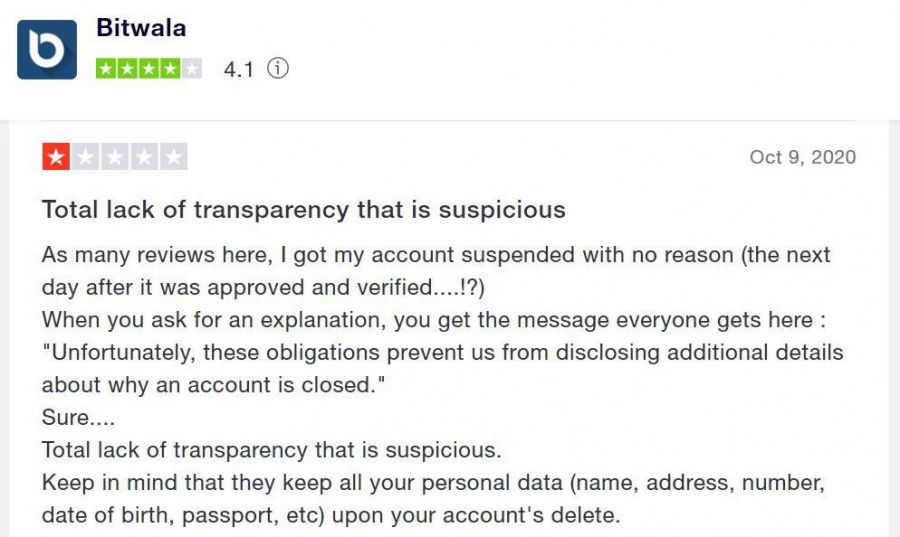

Customer of Bitwala reported the same problem:

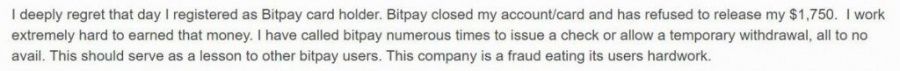

Account frozen and money taken

Following the situations described above, people sometimes find that they no longer have any ability to get their funds back. Accounts get frozen instantly with no time given to withdraw money or send it to the external wallet.

Users of several companies, including BitPay describe that kind of situation:

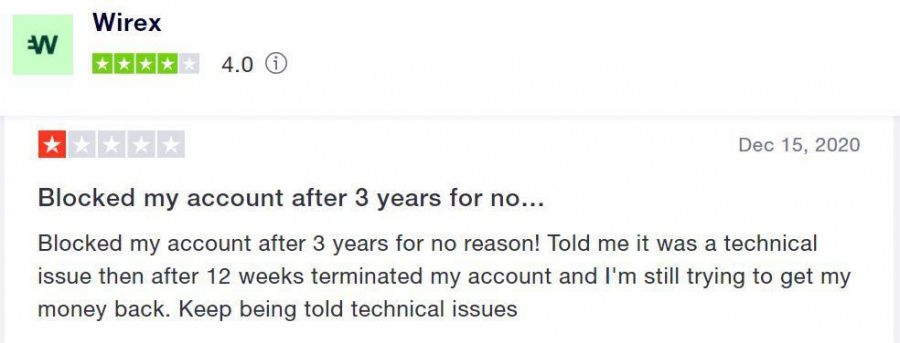

A user of Wirex shared some details of the similar situation he had:

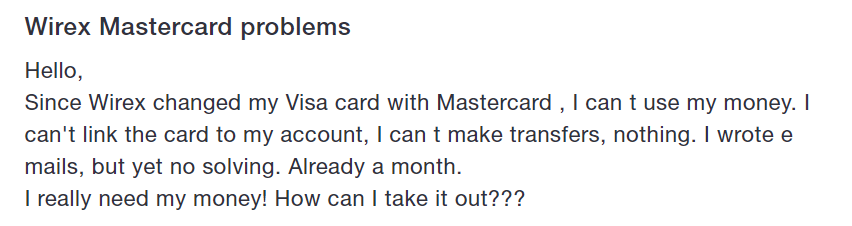

Furthermore in March 2021 Wirex frozen all VISA cards it issued before and moved to MasterCard. Various users stress out that it was an unexpected move. Moreover, users report having more problems to contact customers service:

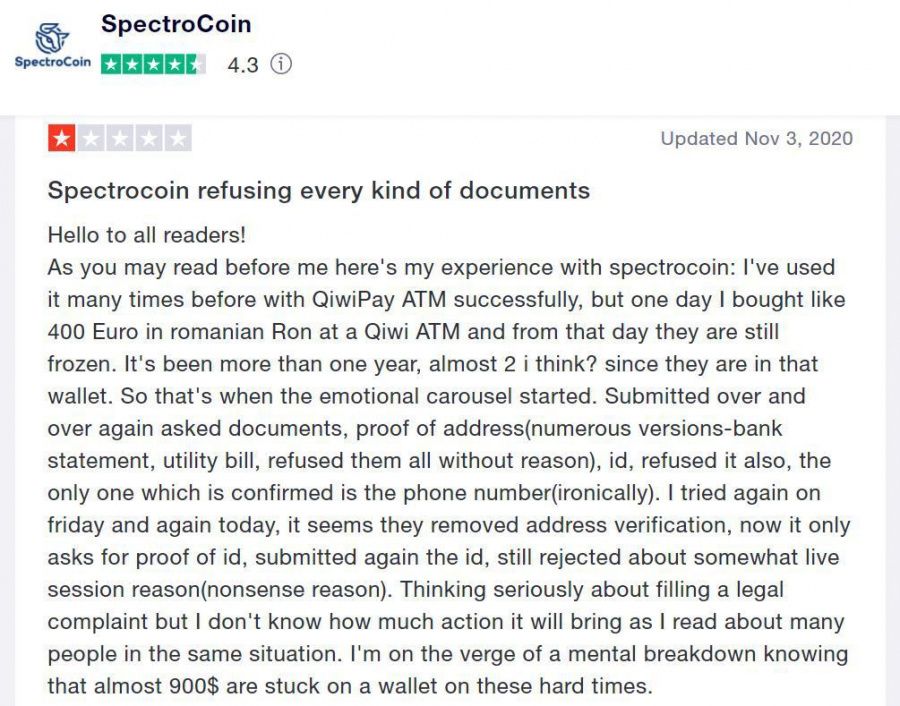

Spectrocoin cryptocurrency exchange is offering Bitcoin Visa prepaid cards in various countries worldwide.

However, some users face similar verification problems as well:

Promoting specific cryptocurrency, that might not end up well

Most cryptocurrency companies try to issue their own cryptocurrency tokens instead of just operating with the ones that are already on the market. When the token is issued they give away or sell it to their customers promising bonuses and profits. Basically, this is a tactic of asking users to invest in the company. Unfortunately, the history of the ICO boom in 2016 and its failure is a vivid example that not all the coins can grow and survive on the market.

So what happens if the investment or the demand for the token doesn’t reach the desired level? The token falls in its value and investors simply lose their money.

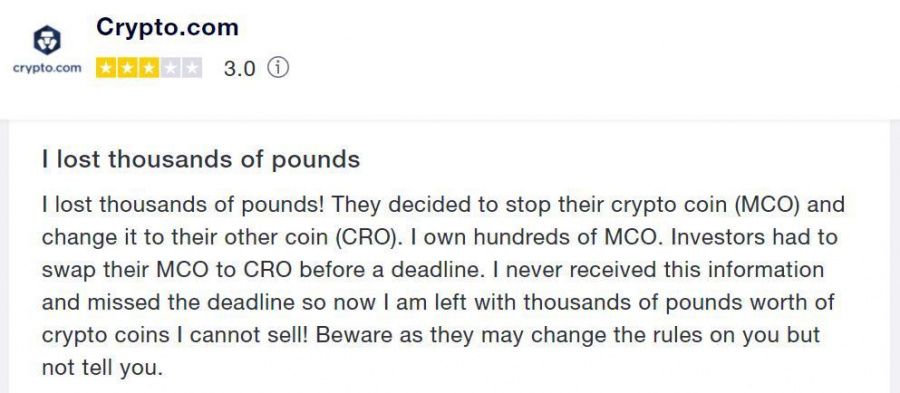

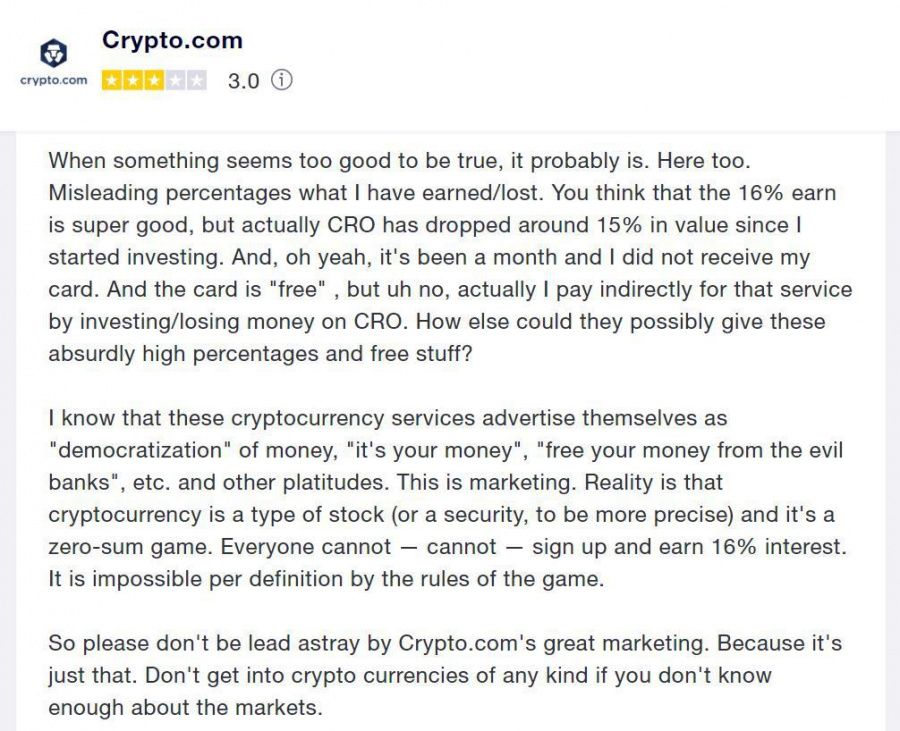

Crypto.com is a payment and cryptocurrency platform offering not just one but several different kinds of crypto cards. Each card has its own cashback and bonuses system awarded to its users in the in-platform token CRO. But this is not the first token that was used on crypto.com.

Before the rebranding Crypto.com was known as Monaco project having its own MCO coin launched in 2017. In 2018 the MCO coin price reached over $20 USD per coin but then the price went down. In 2020 MCO price was fluctuating between $1.3 and $6.12 USD. Users who invested in this coin in 2018 and didn’t manage to exchange it on time complained about losing their funds. Some of them state similar to this:

The investment expectations do not always fulfill, both on traditional and cryptocurrency markets, so users must always keep their eyes open to what is going on with their tool of investment on the market in order not to get in a similar situation.

One of the users explained it:

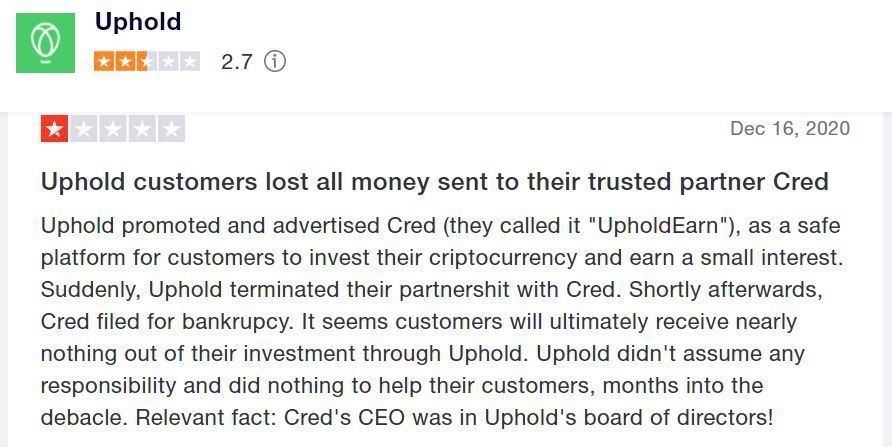

Another case describing the situation shows what might happen when cryptocurrency exchanges sign a partnership with small token developers and add these tokens to their platform. Users get offered to buy these tokens as one of the investment tools. But, as we mentioned before, not all tokens manage to survive in the cryptocurrency market.

A lending and borrowing firm Cred that had its own cryptocurrency CRED declared bankruptcy in November 2020. CRED coin was among the cryptocurrencies available on Uphold. Uphold is a digital money platform offering exchanges between national currencies, cryptocurrencies, precious metals. Among their services is a debit card, both virtual and plastic, available for users in the USA and some other countries.

On October 23, 2020, Uphold had to block deposits into Cred which was a total surprise to users holding Cred in their wallets. And this is what some of Uphold users stress about now:

What cryptocurrency companies are checking?

No company provider of the cryptocurrency cards explains clearly and openly what must be done if customers don’t want to get in the situations described above. The list of the reasons why customer accounts may be suspended or frozen is so long that it sometimes may mistakenly seem that companies would prefer users doing absolutely nothing with their funds.

Each cryptocurrency company provides a user agreement and its terms and conditions available to be checked online at any time. Unfortunately, while signing a crypto account or crypto card users may not read them carefully enough and accidentally break the agreement he/she signed to. So we highly recommend every user to read all these documents patiently and carefully even if it looks long or boring.

The most common reasons why the account may be suspended or frozen by a company provider of crypto card include if they:

-

Suspect money laundering, terrorist financing, fraud, or any other financial crime;

-

Suspect opening multiple accounts on the platform, which is usually prohibited;

-

Suspect that card has been used for any debt-collection purpose;

-

Suspect that a transaction is erroneous;

-

Suspect that the card or account has been used or hacked by a third party;

-

Suspect user in providing false, inaccurate, incomplete or misleading information;

-

Suspect the purchase or sale of any of illegal goods or services;

-

Suspect the intentions to use the crypto account to manipulate the price of any asset or currency on the market;

-

Suspect violation of any applicable electronic payment network rules or card association rules;

-

Suspect the presence of a Malicious Software on users’ computer or smartphone;

-

Suspect that the user does not pay all applicable taxes in accordance with the laws;

-

Suspect that the account has been used for commercial speculative trading purposes;

-

Suspect that the user is trying to test credit card or companies behaviours;

-

If a user refuses or fails to provide further information about his/her activities when it is requested.

If a company has ANY suspicion that one of these actions has been taken most companies reserve the right to limit, restrict or delay the number of services provided to a customer. One of cardholder agreement states it clear:

“We reserve the right, in our sole discretion, to limit your use of the Card, including limiting or prohibiting specific types of transactions. We may refuse to issue a Card, revoke Card privileges or cancel your Card with or without cause or notice, other than as required by applicable law.”

Automatic algorithms check all the transactions and accounts and alerts if a suspicious action from the list above has been made. As a rule, these alerts should be then checked by company employees and the security team. However, users should keep in mind:

How to use your crypto card and have no (or less) problems

Considering the complaints from the customers mentioned above Coinidol.com, the world blockchain news magazine, gives its short recommendations on what should crypto card users do or not to do to keep their funds (and nerves) safe:

Check if the chosen cryptocurrency card provider operates for customers from your country;

Read the customers agreement thoroughly when creating an account and follow it;

Do not send a significant amount of fund on your account before you finish the verification process;

Check the exchange rates provided by the company and compare it with the rates on other platforms;

Check if you have all the required documents and make them ready if needed;

Check all the fees you might have to pay (for crypto to fiat transactions, POS payments, withdrawals, inactive account, etc);

Check the limits available to your card on a daily, monthly and yearly basis;

If you don’t use your cryptocurrency card often, remember at least to make one payment or transaction every 6 months;

Try to avoid atypical big transactions while in foreign countries;

Double-check the history, roadmap and background of every token you are offered to invest in. And if you do decide to make this investment - follow the value of the token on the market;

Use safe passwords and 2-factor authentication;

Don’t hold all of your funds on one platform;

Do not pass passwords and PINs to your card to a third party;

Do not use crypto cards for illegal activities, or to buy or sell illegal goods and services;

Remember that crypto cards may not be accepted by all 100% merchants and have several means of payment with you.

Companies offering cryptocurrency cards in 2021

Company and Card | Available in countries | Cryptocurrencies | Fiat | Useful information |

EEA, Guadeloupe, Guernsey, Isle of Man, Jersey, Martinique, Monaco, Reunion, San Marino, Saint-Martin, The Aland Islands | BTC, BNB, SXP, BUSD | EUR | ||

EEA | BTC, LTC, DACH, BAT, BCH, ETH, DAO, XMR, ONT, ONG, TRX, USDT, XRP, ZEC, XLM | EUR | Information | |

EEA | BTC, LTC, DACH, BAT, BCH, ETH, DAO, XMR, ONT, ONG, TRX, USDT, XRP, ZEC, XLM | EUR | ||

USA | BTC, BCH, ETH, GUSD, USDC, PAX, BUSD), XRP | USD | ||

EEA | BTC, ETH | EUR | ||

USA; EEA coming soon | XLM, BTC, ETH, TERN | USD | ||

EEA, UK, USA | BTC, ETH, LTC, BCH, XRP, BAT, REP, ZRX, XLM | GBP, EUR, USD | ||

Crypto.com Midnight Blue, Ruby Steel, Jade Green, Royal Indigo, Icy White, Rose Gold, Obsidian VISA Debit | USA, EEA, Canada; Singapore temporarily suspended | BTC, LTC, ETH, XRP, PAX, TUSD, EOS, XLM | USD, EUR, GBP | |

EEA, UK | BTC, LTC, ETH, XRP | EUR, GBP | ||

BTC, ETH, LTC and others | EUR | |||

EEA, UK, Gibraltar, San Marino, Monaco, Guadeloupe, Reunion, Martinique, Isle of Man, Jersey, Guernsey, The Aland Islands, Saint-Martin | ETH, aDAI, DAI, TKN, USDC, USDT, SAI, MKR, DGX, MATIC, KNC, RLC, DGD, QNT, NPXS, GUSD, GNO | GBP, EUR | ||

BTC, ETH, XRP, and others | GBP, EUR, USD | |||

EEA, UK, USA, Australia, Canada, Singapore, Switzerland | BTC, ETH, BCH, XRP, LTC, XLM, ZRX, XTZ, EOS, OMG | AED, AUD, BGN, CAD, CHF, CZK, DKK, EUR, GBP, HKD, HRK, HUF, ILS, JPY, MXN, NOK, NZD, PLN, QAR, RON, RUB, SAR, SEK, SGD, THB, TRY, USD, ZAR | Pricing | |

EEA | BTC, ETH, BCH, LTC, XRP, DASH, NEM, USDT, XLM | EUR | ||

EEA | BTC, ETH, BCH, LTC, XRP | EUR | ||

BTC, ETH, BAT, XRP | USD, GBP, EUR, CNY and 23 more currencies | |||

EEA, Australia, Hong Kong, New Zealand, Philippines, Singapore, Taiwan, UK | BTC, ETH, LTC, WXT, DAI, Waves, XRP, NANO, XLM | USD, EUR, GBP, SGD, AUD, JPY, HKD, CZK, MXN, CAD, CHF |

* European Economic Area (EEA), which includes: Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, and the United Kingdom.

News

Price

PR

Coin expert

News

(0 comments)