Bitcoin Price Is In A Range And Striving For The $40,000 High

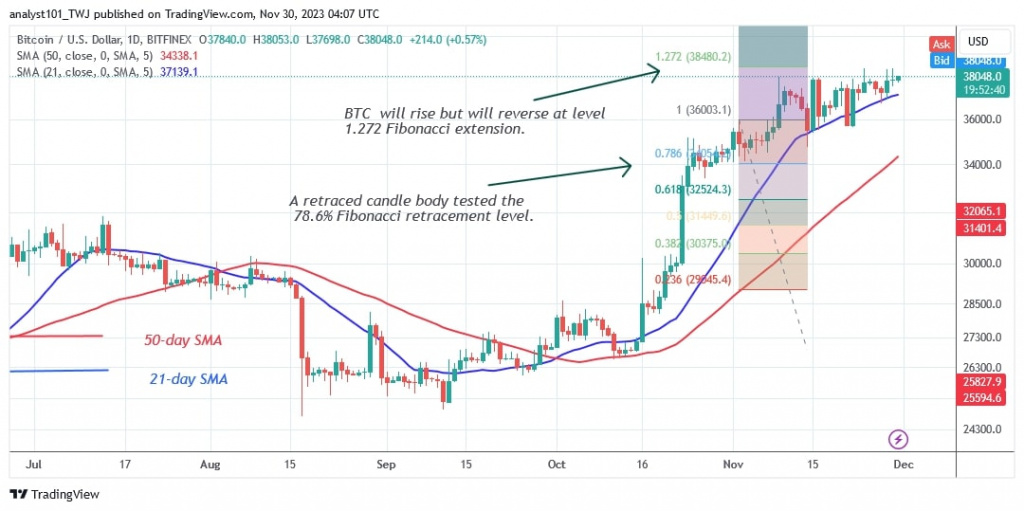

Bitcoin (BTC) price has continued its uptrend above the 21-day (SMA) and has risen just above the $38,000 high.

Bitcoin Price Long Term Prediction: Bullish

Bitcoin buyers have won the battle and kept the price above the 21-day SMA since the rise on November 9. However, the bulls and bears are fighting over the Bitcoin price, which is fluctuating between $37,500 and $38,400.

The largest cryptocurrency has encountered resistance three times but has been unable to maintain its positive momentum. On the positive side, the current resistance level is likely to be weakened by the frequent retest. Once the recent peak is broken, Bitcoin will reach the USD 40,000 mark. At the time of writing, the BTC price stands at $38,018.

On the downside, the bullish scenario will invalidate if the bears break the 21-day SMA support. Bitcoin price will first drop to its previous low of $36,000 and then to $34,000.

Bitcoin Indicator Reading

The price bars on both charts are above the upward sloping moving average lines. This has caused the value of the cryptocurrency to rise. The price movement is currently being delayed by the presence of doji candlesticks.

Technical indicators:

Key resistance levels – $30,000 and $35,000

Key support levels – $20,000 and $15,000

What is the next direction for BTC/USD?

BTC is still trading in the $37,500 to $38,400 range. Since the start of the rally, the price of the cryptocurrency has made a series of higher highs and higher lows. The higher highs have come to a halt at $38,400. A price rise to $40,000 is possible as long as the bulls continue to test the barrier.

Disclaimer. This analysis and forecast are the personal opinions of the author and are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol.com. Readers should do their research before investing in funds.

Price

Price

Coin expert

Coin expert

Coin expert

(0 comments)