The Token Fund Offers Investors an ETF Alternative with Decentralized Digital Asset Portfolio

As the popularity of Bitcoin and other cryptocurrencies continues to grow, so does the userbase. Where at one time cryptocurrency trading was limited to technically advanced traders, the market is now seeing a new type of trader emerge, an "Average Joe." As more novice traders look to dabble their feet in the emerging market of cryptocurrency trading, they can find themselves overwhelmed by a complex environment, fraught with potential pitfalls such as volatile price swings and ‘pump and dump’ market manipulation schemes.

The Token Fund is an alternative for those who wish to invest in cryptocurrencies, without the high risk and time-consuming nature that accompanies digital asset trading. While Bitcoin and cryptocurrency ETF’s are still some time away, the Token Fund offers all types of investors a comparable level of stability and simplicity through a well-balanced decentralized asset portfolio.

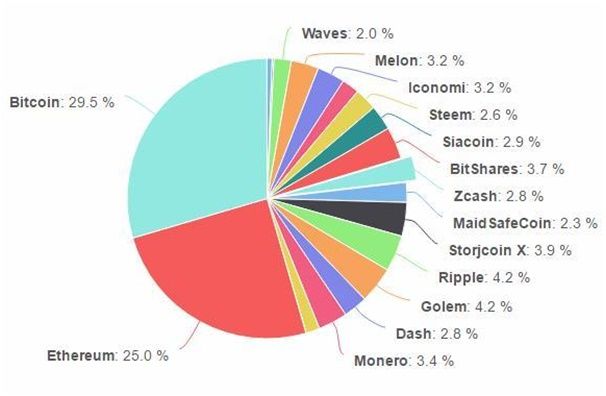

The Token Fund comprises of a carefully weighted portfolio of cryptocurrencies with the most potential. The assets and percentage of various individual cryptocurrencies that are part of the portfolio changes with the evolving market, to ensure a minimal effect of volatility on the user’s portfolio. The total portfolio of assets is represented in the form of TKN – the platform’s cryptotoken, which can be managed by the users as they deem fit.

The Token Fund adopts a user-friendly design that allows individuals to invest, receive, and redeem the tokens in few simple steps. The platform is currently focused on all the best performing cryptocurrencies. Bitcoin and Ethereum top the list of supported cryptocurrencies on the Token Fund portfolio. These two major cryptocurrencies are followed by the likes of Dash, Ripple, Monero and Golem, which makes up for a smaller percentage of the overall portfolio. The portfolio is balanced in a way that a sudden crash in one of the cryptocurrency’s values won't overly affect TKN’s value.

For a more in-depth explanation of the Token Fund’s investment strategy, potential investors are recommended to check out the company's Whitepaper. It will help them get a better picture of the program before committing themselves to the fund. The white paper paints a clear picture of the investment process adopted by Token Fund and the kind of commitment expected from both the parties. Investors should be aware that the supply of TKN depends on the movement of fund’s capital (deposits and withdrawals).

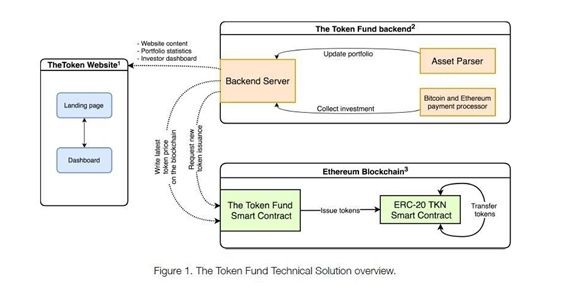

All Bitcoin and Ethereum transactions on the platform generates a TKN and these TKNs, once reverted to the user’s wallet will expire, leaving behind its associated value in the wallet. The TKN prices are calculated daily at 12:00 and 00:00 GMT.

The entire business strategy of Token Fund is controlled by two smart contracts on the Ethereum blockchain. The first contract stores the balances belonging to investors in the fund (TKN contract) and the other is responsible for issuing new tokens in exchange for invested money. TKN contract is based on the ERC-20 standard token contract with an extra function that allows new token emission. This feature is only accessible by the Token Fund contract.

Another great way for potential investors to track The Token Fund’s current portfolio distribution is on the company's real-time spreadsheet. The Token Fund is extremely transparent and exhibits a lot of potential when it comes to investing in and managing a crypto-asset portfolio while minimizing the investor's risk.

Although a relatively new investment vehicle, the Token Fund's TKN value has already increased by 79% (in USD) since its initial launch. With the Token Fund team's savvy business expertise and carefully weighted portfolio ratios, TKN offers a very simple and attractive alternative to new investors and crypto-enthusiasts.

This press release is for informational purposes only and should not be viewed as an endorsement by CoinIdol. We take no responsibility and give no guarantees, warranties or representations, implied or otherwise, for the content or accuracy. Readers should do their own research before investing funds in any company.

Coin expert

Coin expert

News

Coin expert

Price

(0 comments)