Experts Expect Exponential Growth of Bitcoin Price

There are dynamics in Bitcoin that regulate the available supply which affect pricing. In this article we will focus in on the Bitcoin Halving and its historical pattern and relevance.

The Bitcoin Halving is one of the most static mechanisms that govern the distribution of Bitcoins in that it is predictable to occur every 210,000 Blocks or roughly every 4 years and some months. This event that has taken place just this past weekend is significant to you as a Bitcoin owner and also a prospective Bitcoin purchaser because the readily available supply has been directly affected by this recent and recurring event. Price is regulated based on supply and demand dynamics; therefore, this is an important subject to pay attention to and understand.

Bitcoin Halving historical pattern

Most of us know that Bitcoin has a community known as Miners who earn Bitcoins on a consistent basis. A miner is a participant in the Bitcoin network who uses their computing power to produce a confirmation moment for other participants to conform to with regard to the most current validity of transactions. At the start Miners had been earning 50 bitcoins every time this confirmation happened. After 210,000 blocks had been confirmed the reward for each block went from 50 to 25 and this took place on November 28 2012.

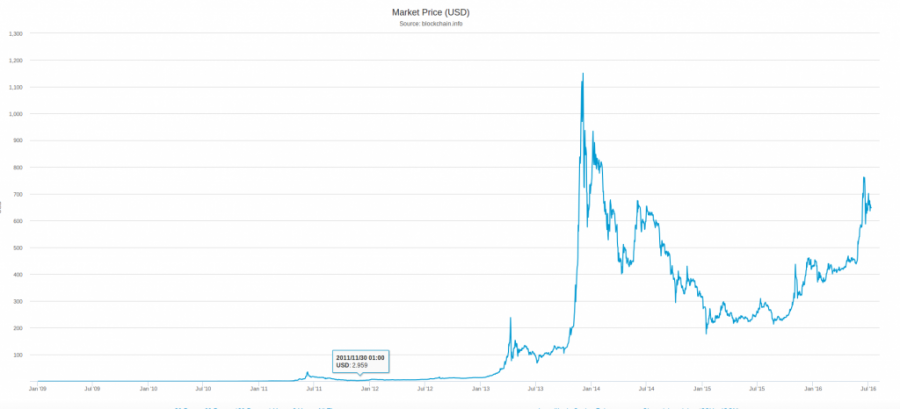

All time high prior to the first Block Reward Halving, First major peak.

The graph above depicts the low point that occurs in the Bitcoin price after a major peak to $35.00. This low is approximately 1 year prior to the halving of 2012. During the entirety of the year to follow this low point, the price of Bitcoin rallies until nearly half that of its original major peak of $35.00.

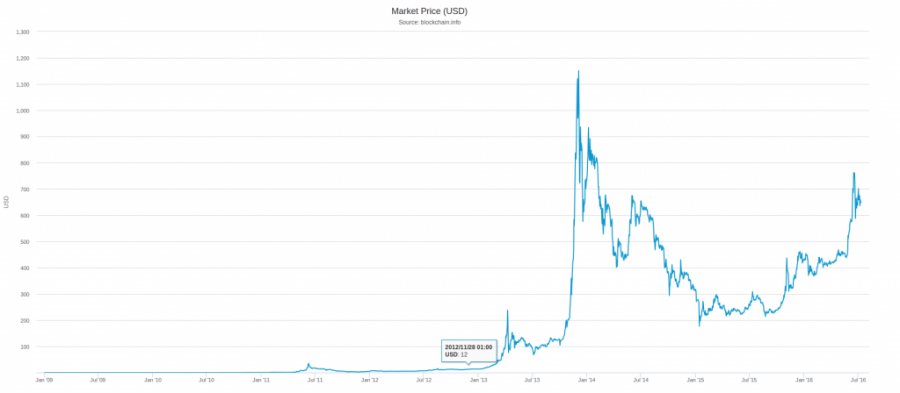

First Block Reward Halving Day.

Bitcoin price reaches a height 4 months after the Block Reward Halving of 2012.

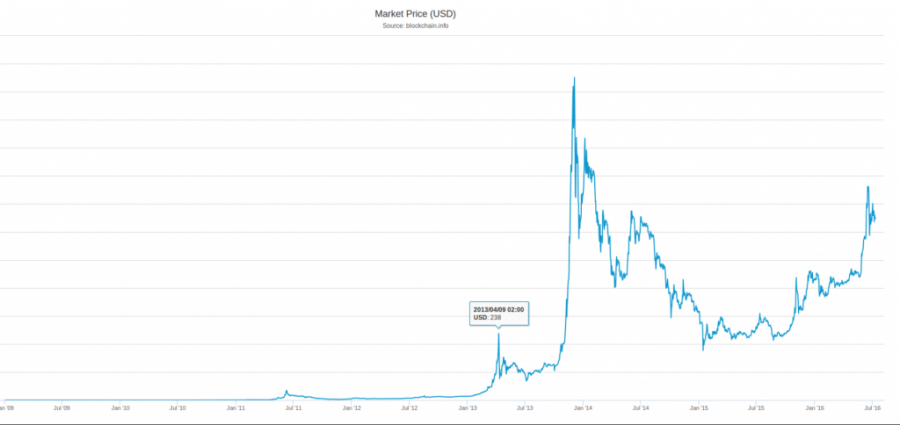

Concluding the halving the price of Bitcoin rallies continuously and consistently until a high of $238.00. And later much higher until $1,151.00.

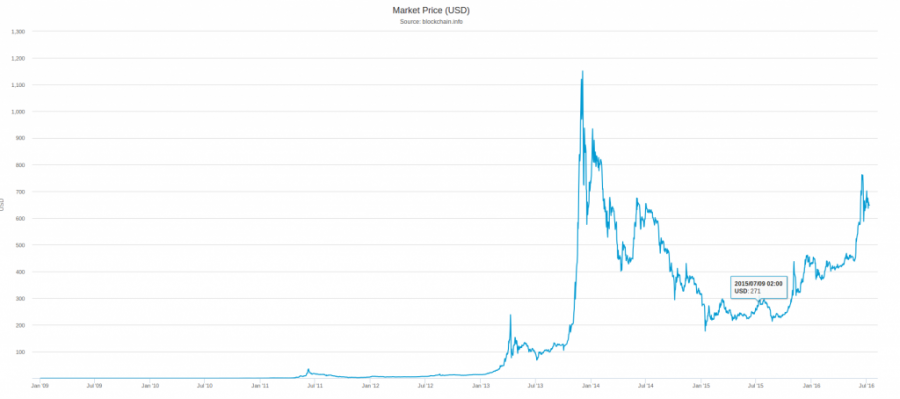

Block Reward Halving of 2016

1 year before 2016 Block Reward Halving, price is at a low point.

Price of Bitcoin has rallied for the entire year up to the point of the Block Reward Halving of 2016.

We can now see a similar pattern unveil itself during the 2016 halving. The price reached a low point approximately 1 year prior to the Block Reward Halving of 2016. Then during the year up until the event the price increased. We are now yet to see if this trend will continue and there are a number of reasons that affect the price increase. As of July 9 2016, Bitcoin Miners are now earning just 12.5 Bitcoin per Block confirmation.

Bitcoin introduction mechanism

As we know, the Block Reward is the mechanism through which new Bitcoins are introduced into circulation. These Bitcoins are specifically obtained by miners who consume electricity and operate equipment that takes up land space. This process has a residual cost that must be met in order to persist the operation and therefore participants of mining often are selling Bitcoin consistently in order to meet the regular expenses of paying electricity bills and paying for rent of land.

This being said, the exchanges have experienced a shift from 50 Bitcoins of potential liquidation, to 25 Bitcoins of potential liquidation after the 2012 Block Reward Halving, and now 12.5 Bitcoin of potential liquidation. The rise in price can be attributed to a reduction in regular selling pressure especially from miners who are selling a quantity that is normalized through time because miners will be collecting fewer coins and thus sell fewer at regular intervals.

An additional factor that attributes to greater fluctuation is the possibility of utilizing Margin when speculating in the Bitcoin markets. Only in the recent couple of years have these services for trading on leverage existed, where traders are able to use a small deposit and command a position size that is greater than their deposit through borrowing of the exchange's Bitcoins or Fiat. This leads to further volatility and capability for higher price points to be obtained especially when coupled with reduced selling consistency coming from Bitcoin Miners.

Bitcoin's utility is found in high integrity value transfer at an immediate pace. When you send a quantity of Bitcoin to someone else, that quantity is there or it's not; thus, it's price simply determines how much of it you need to perform a value transfer. The usual transfer to Fiat does take place, though the fiat transaction is bi-directional where Fiat reenters the Bitcoin at the same moment where someone takes the other side of the Fiat/Bitcoin trade.

Bitcoin's price is in an uptrend since its inception overall, and reductions in the fiat price often are due to complete Fiat conversion by Bitcoin holders in one shot, and also short selling.

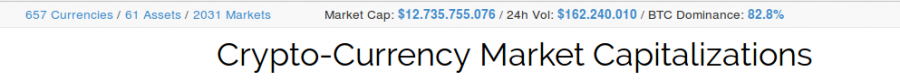

17.8% of all cryptocurrency “valuation” is stowed in AltCoins.

Altcoins role

Another point of interest is the effect the price of Bitcoin has on other crypto tokens also known as “AltCoins”. Since there is a fixed number of Bitcoins, only so many of them can be used to support the price of these other crypto assets. It is my opinion that their value versus Fiat will remain relatively stable; however, as Bitcoin rises against Fiat the AltCoins will reduce in price against Bitcoin. Most of the coins that are not utilized will experience this, though crypto tokens in the AltCoin space that have a utility through consumption or through their value to businesses that are not ready to liquidate that particular AltCoin will gain versus Fiat and remain stable against Bitcoin and some may perhaps rally higher in price versus Bitcoin.

Though very few AltCoins would rally against Bitcoin as can be seen presently that the closest coin on comparison to Bitcoin so far has been Ethereum, reaching a market capitalization of over $1.7 Billion until it collapsed below $1 billion in market capitalization recently. The only other coin to have done so is Ripple reaching more than $800 million market capitalization before reducing by 75%. Most AltCoins bear only speculative value, therefore their volatility is fantastic and thus Bitcoin's transaction value continues to exceed any potential value to be gained from any AltCoin so far.

Crypto economy and ecosystem

The rising price in Bitcoin will serve many of the projects in the crypto ecosystem. If the past holds true to the present and into the future then more resources will be made available to all participants in the crypto economy. This will permit those who hold Bitcoin or AltCoins which can be generally liquidated into Bitcoin and then in Fiat with great ease to benefit from greater purchasing power for equipment, personnel, rents, and other utilities necessary for sustaining business. Should the Bitcoin price continue its historical pattern, things will be very exciting with new developments and an ever expanding ecosystem. A survey of many traders and Bitcoin holders points to possibilities of prices of Bitcoin in the $2000.00 to $3500.00 range. Expectations certainly can materialize price. There is so much to look forward to. The main question to see answered: Are we going to realize more exponential growth in the price of Bitcoin?

Price

Coin expert

News

News

Price

(0 comments)