Bitcoin Price Analysis: BTC Coming Down from its All-Time Heights

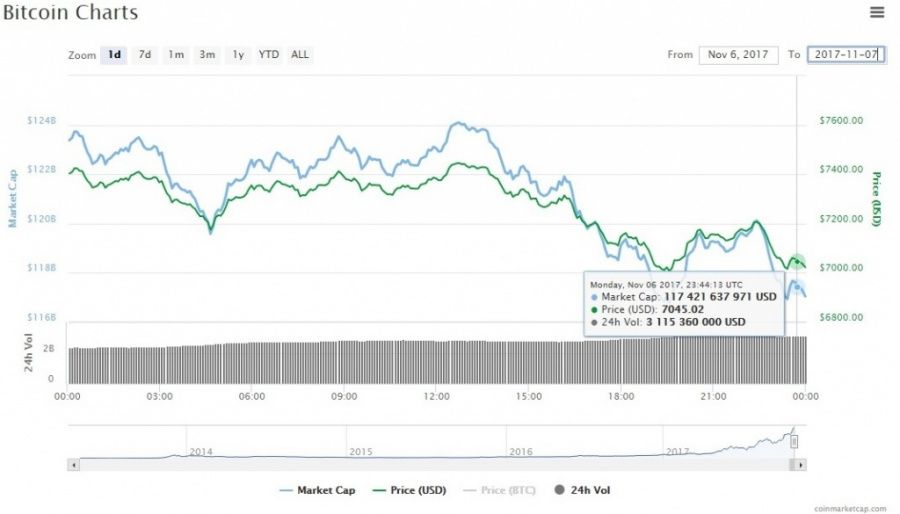

Bitcoin reached its all-time high of $7,617 on Sunday, November 5, due to the influence of CME Group’s announcement. It proved to be a quite lasting benefit to the market. However, by the end of the day, the price had decreased to $7,175.

Moreover, some experts believe the price will become even more volatile due to the increasing uncertainty of SegWit fork influence.

Daniel Kim, Head of Growth at SFOX, an enterprise-grade trading platform with algorithmic trading tools for businesses and traders to buy and sell bitcoins, former Director of Institutional Sales at Gemini Exchange and assistant of Vice President at BNP Paribas, stated that “overnight we started to see some pullback, and he wouldn't be surprised to see this continue for a few more days.”

Bullish Uptrend will go on

However, some experts believe that the uptrend will continue despite some volatility and fluctuations, and Bitcoin will scale new all-time heights.

Mattia Rizzi, a financial analyst, electronic trading and blockchain expert at Société Générale Corporate and Investment Banking, stated:

“As it happened in the past, we can expect continuation of the bullish uptrend until November 16, as anyone holding coins on the day of the fork will receive the split tokens as well, providing an incentive to buy more Bitcoin. After that, high price volatility can be expected a result of incertitude regarding to which coin the current hashrate will shift.”

He added:

“From a technical point of view, we can see that price is respecting the Fibonacci retracements drawn on the chart, as in the past few months the retracement levels have indicated pretty accurate support and resistance levels. Consequently, if Bitcoin will be able to pierce through the 6100$ level accompanied with good volume, price trajectory should continue upward, possibly hitting the 6700$ level, and then draw a long-term target of ~7800$.”

Price

Price

Coin expert

News

News

(0 comments)