Bad News From India Makes Bitcoin Price Fall

Updated: Jul 19, 2020 at 22:22

Bitcoin exchanges in India suffer bad times as the biggest national Banks of the country have frozen their accounts. The news led to turmoil in the domestic market as well as bringing the price of bitcoin down.

The general opinion is that such behaviour from state regulators was caused by a lack of trust in companies and the cryptocurrency market as a whole.

In fact, India is not the first country with such an aggressive attitude towards Bitcoin. Previously, the People's Bank of China announced its intention to block all cryptocurrency related options, including exchanges, wallets, and trading platforms.

The South Korean government also paid close attention to cryptocurrency related companies, having inspected 13 of the largest South Korean cryptocurrency exchanges including Bithumb, Coinone, Korbit and Upbit.

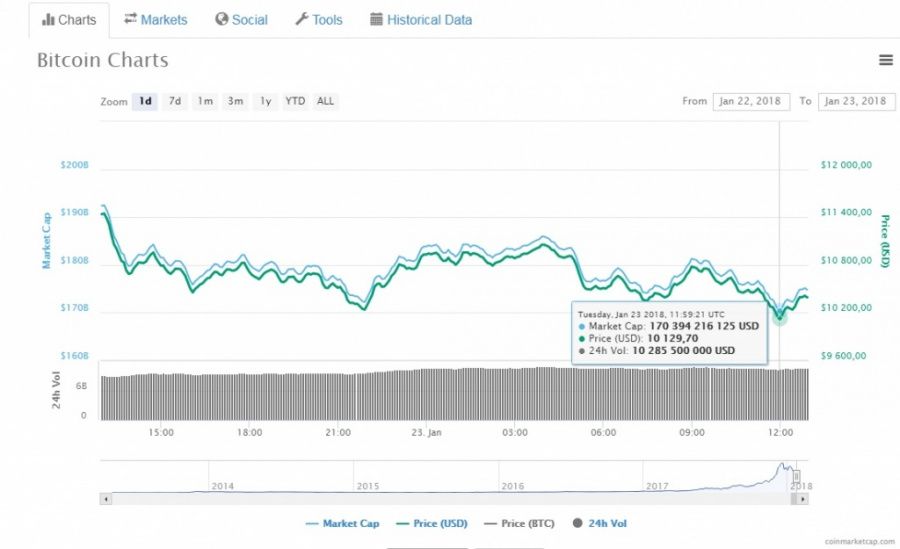

All that made the Bitcoin price fall dramatically at the end of 2017. And, as we may see, the downfall period still goes on as more bad news reaches the market. The lowest price fixed at a rate of $9,965 on Bitfinex. Coinmarketcap showed the lowest point at $10,129.

As of the time of writing, the price rose to a rate of about $10,600. However, there are forecasts that it could still fall below the support level of $9,000 and will not rise over $13,000 in the near future.

According to BlockTower’s Ari Paul, it is just a part of the market’s boom-bust cycle which is tied to new regulations. He wrote on Twitter:

The single biggest dynamic driving cryptocurrency markets on a long time frame is the reflexivity of regulation. Crypto value rises sharply - it invites regulation that kicks it back down. 3 steps forward, 2 steps back. https://t.co/6SuUC4n34T

— Ari Paul (@AriDavidPaul) 22 January 2018

Price

Price

Price

Price

Price

(0 comments)