Coinidol Weekly Crypto News Digest: BTC Overtaking Amazon Market Cap, SWIFT And Blockchain-Based Ledger, ETF Outflows

Updated: Oct 05, 2025 at 23:12

The five most interesting news from the period of September 29 to October 5, according to editors of Coinidol.com.

This week was marked by significant movements in market prices, institutional adoption milestones, and key technical developments.

Bitcoin hits new all-time high, surpasses Amazon's market cap

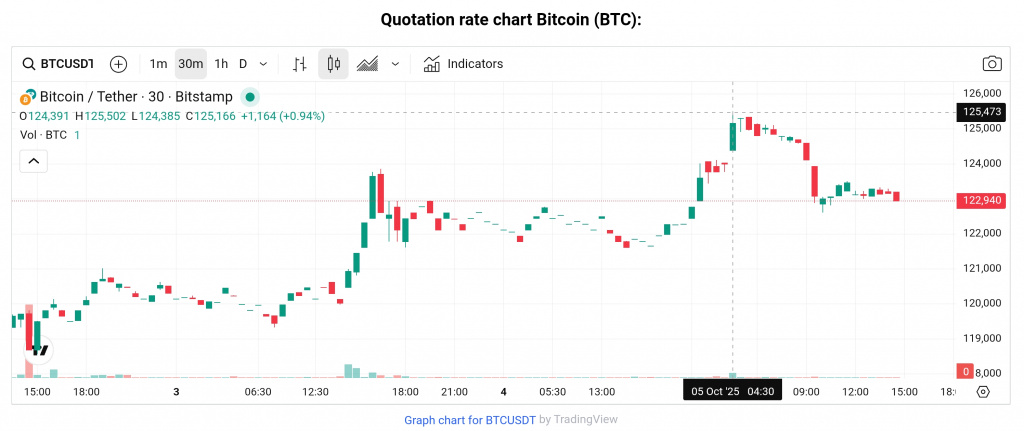

The most eye-catching news was Bitcoin's price surge to a new all-time high of over $125,000 on October 5, and its subsequent feat of overtaking Amazon in market capitalization to become the world's seventh most valuable asset, according to the Economic Times.

BTC price surpassed $125,00 before fasting corrections:

This milestone, attributed to strong inflows into US Bitcoin ETFs and a crypto-friendly regulatory climate, signals Bitcoin's continued transition from a purely speculative asset to a mainstream store of value that institutional investors are increasingly embracing, as Coinidol.com reported preveiusly.

The market cap comparison with a tech giant like Amazon highlights the growing legitimacy and scale of the digital asset economy.

SWIFT to integrate Blockchain-based ledger for cross-border payments

SWIFT, the global financial messaging system used by thousands of financial institutions, announced a groundbreaking move to add a blockchain-based ledger to its core infrastructure stack. The initial focus is on facilitating real-time, 24/7 cross-border payments.

SWIFT's involvement, in partnership with over 30 global financial institutions and Consensys, provides a clear roadmap for how blockchain technology can be leveraged by traditional finance. It aims to offer better efficiency and security while ensuring interoperability between Distributed Ledger Technology (DLT) and existing financial rails.

Crypto VC funding reaches $5.1 billion in September with a focus on infrastructure

Reports indicated that Crypto Venture Capital (VC) funding reached over $5.1 billion in September, one of the strongest months on record, despite a decrease in the overall number of deals. The capital was heavily concentrated in mega-deals centered on infrastructure, Real-World Asset (RWA) tokenization, and corporate treasury strategies on platforms like Solana and Ethereum Layer 2s.

The focus on RWA tokenization and L2 scaling solutions confirms that industry growth is shifting towards practical applications and integrating digital assets with traditional finance.

This trend suggests a maturing funding landscape. Investors are moving away from smaller, early-stage projects towards institutional-scale bets on foundational blockchain technology.

Bitcoin and Ethereum spot ETF outflows deepen cautious sentiment

In contrast to the overall bull market sentiment, spot Bitcoin and Ethereum ETFs experienced heavy outflows in the period, particularly on September 29. The outflows, including a record-setting week for Ethereum ETF withdrawals, highlighted continued investor caution and volatility.

ETF flows are a crucial barometer of institutional confidence. While major investors like Strategy (formerly MicroStrategy) continued to accumulate Bitcoin, the mass outflows from ETFs underscore the market's sensitivity to macroeconomic data and the lingering uncertainty surrounding future regulatory decisions, such as those related to Ethereum futures ETFs. It suggests the market is in a highly reactive state, balancing institutional adoption with short-term volatility.

Citrea launches Bitcoin's first zero-knowledge rollup

Galaxy Research highlighted the launch of Citrea, positioning it as Bitcoin's first Zero-Knowledge (ZK) Rollup. This technology aims to enhance the scalability and privacy of applications built on the Bitcoin network.

It is worth to note that for years, Bitcoin's base layer has been lauded for its security but criticized for limited smart contract capabilities and scalability. ZK-Rollups introduce a path to expanding Bitcoin's functionality beyond a simple store of value, enabling a more robust Decentralized Finance (DeFi) ecosystem directly on top of the world's largest blockchain. This development is a key technical milestone for the "Bitcoin Layer 2" narrative.

Price

News

Price

News

Price

(0 comments)