USD Coin Volume Increases Following Visa's Acceptance of Cryptocurrency Payments

The trading volume of USD Coin (USDC) has increased dramatically following the announcement by Visa of accepting the cryptocurrency for payments. Visa Inc. will become the first payments giant to allow its over 60 million merchants to settle transactions in USDC, a 12th cryptoasset by market cap and a stablecoin that is backed by US dollar (USD) created on the Ethereum blockchain.

On March 29, Visa revealed it will accept the utilization of digital currency USDC to settle transactions via its payment network. The move shows growing interest and adoption and acceptance of virtual coins by the orthodox financial sector.

USDC trading like a hot cake

The news has triggered users, investors and traders to start buying, using and trading the cryptocurrency in large quantities hence raising the trading volume of USD Coin. At press time, the volume of USDC has increased from $1,294,220,918 to $1,748,206,622, which indicates an increase of about +42.15%.

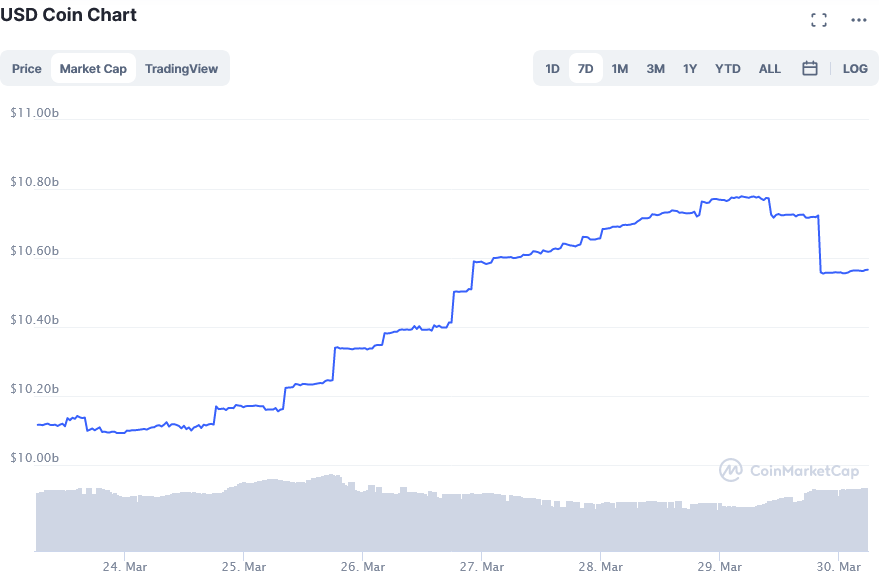

The market cap of USDC has also started to skyrocket and is now standing at about $10.6 billion and its price is expected to hit and exceed the $1.1 price cap, the level it last touched on October 15, 2018.

Acceptance of stablecoin has increased dramatically

The USD Coin originally rolled out on a limited basis in September 2018. But ever since the coin was launched, its price has been rotating between the $0.9292 to $1.1 price level. The price volatility for USDC is very low compared to other cryptocurrencies including Bitcoin. This is because USDC is a stablecoin.

The adoption of stablecoins has gained much momentum since they are trying to provide the best of both worlds free stable valuations of fiat currencies. for instance, USDC stablecoin was valued at about $2.9 billion on December 2, 2020, but at press time the coin is valued at $10.726 bln - this shows how much the stablecoin is being highly used to conduct businesses especially during this period of the Covid-19 pandemic when digital payments are the order of the day.

Embracing blockchain-based innovative projects

Visa is also continuing to expand its innovative projects including financial technology (fintech) initiatives using blockchain. The company partnered with IBM to roll out a blockchain-powered platform B2B Connect in 2019 to enable fast, transparent and secure SWIFT payments, according to a report by CoinIdol, a world blockchain news outlet.

In the same year, Visa also rolled out a Fast Track program to enable fintech startups to accelerate their businesses and activities and a large number of startups have joined the program and taking advantages of a variety of services that this program offer including card issuance, PCI compliance, push payments integration, anti-money laundering and know-your-customer support. Visa is also researching the Lightning Network along with distributed ledger technology (DLT) to achieve real instant payments.

Visa also offers cryptocurrency cards and it has partnered with other crypto-exchange giants such as Binance to promote and widespread the cryptoasset-backed Visa payment cards. Innovative initiatives of such caliber help to increase people’s trust towards blockchain and cryptocurrency hence increasing its adoption and use.

Coin expert

News

Price

Price

Price

(0 comments)