Ripple Pulls Back in a Downtrend, Poises for Upside Momentum

Ripple is moving up after it slumped to $0.24 low yesterday. After it slumped and pulled back, a candlestick was indicating a long tail.

This long tail indicates that there is strong buying pressure at a lower price level. Nonetheless, the bulls buy the dips as the coin moves up to $0.28 high. The upward move is facing resistance at the $0.28 high. On the downside, if XRP faces rejection, the crypto will drop to $0.23 low, and subsequently, the price will fall again to $0.16 low.

On the other hand, if the bulls break the resistance at $0.28, the price will rally to $0.32 high. The bullish momentum will extend to $0.36 high. In the meantime, XRP is trading at $0.27 at the time of writing. The crypto is likely to fluctuate between $0.26 and $0.28 if the bulls fail to break the current resistance.

Ripple indicator analysis

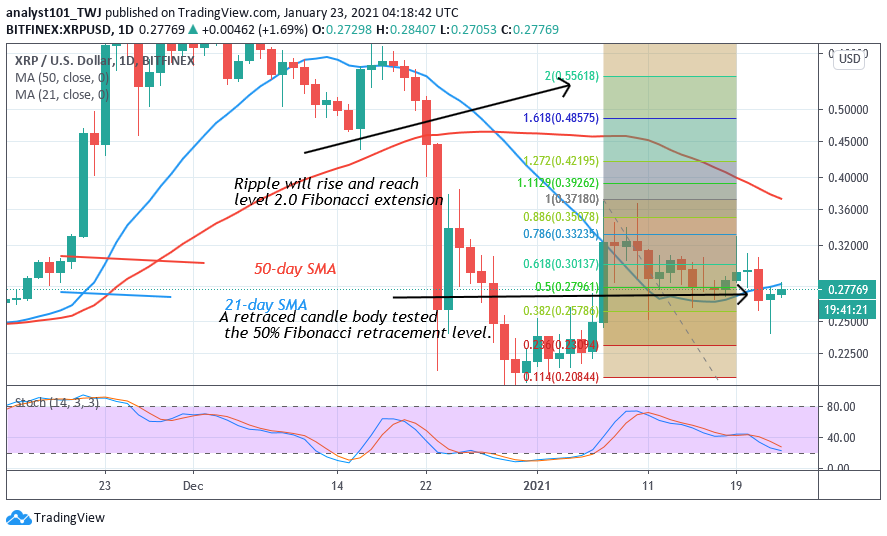

From the price action, XRP is consolidating above the 21-day SMA support but below the resistance line of the descending channel. A breakout above the resistance line will propel the coin to resume upside momentum. On the other hand, a breakdown below the 21-day SMA will cause the coin to decline.

Key Resistance Zones: $0.35, $0.40, $0.45

Key Support Zones: $0.25, $0.20, $0.15

What is the next move for Ripple?

Ripple is likely to make a further upward move given the strong buying pressure. XRP will rise if the recent resistance levels are breached. On December 7 uptrend; a retraced candle body tested the 50% Fibonacci retracement level. The retracement indicates that Ripple will rise to level 2.0 Fibonacci extension. That is a high of $0.556.

Disclaimer. This analysis and forecast are the personal opinions of the author that are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol. Readers should do their own research before investing funds.

Price

Price

Price

Price

Price

(0 comments)