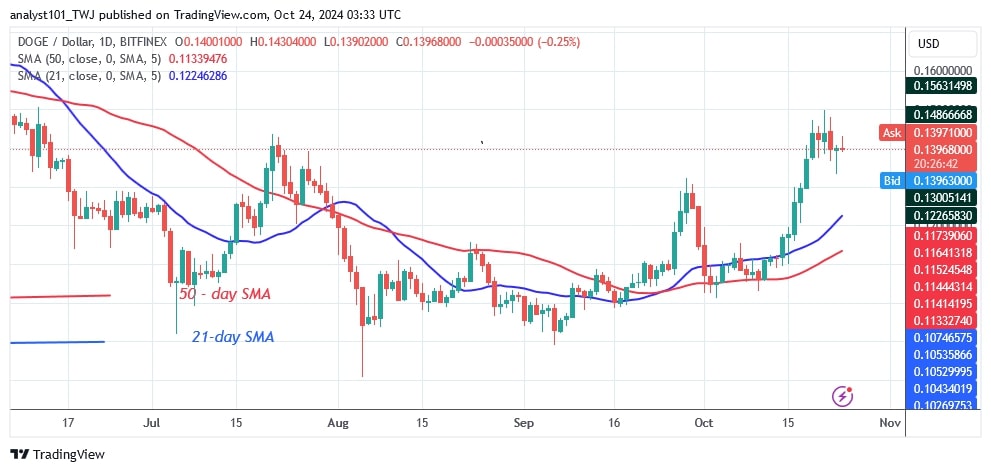

Dogecoin Returns Above $0.13 As The Uptrend Ends

Dogecoin (DOGE) price has continued its uptrend and has risen above the previous high of $0.143.

Dogecoin price long term forecast: bullish

The uptrend was halted at a high of $0.15. DOGE has pulled back above the breakout level of $0.14 and is consolidating above current support.

If the current support level holds, DOGE will resume its uptrend. The price of the cryptocurrency will rise and retest or break through the barrier at $0.15. The altcoin will rise to highs of $0.18 and $0.20 if the current barrier is broken. DOGE is currently trading slightly above the current support level of $0.14. If the altcoin loses support, it will fall back above the 21-day SMA. DOGE is now worth $0.139.

Technical indicators

Resistance Levels $0.22 and $0.24

Support Levels – $0.14 and $0.12

Dogecoin price indicator reading

On the daily chart, the price bars are above the moving average lines, which is pushing the altcoin higher. However, on the 4-hour chart, the price of the cryptocurrency is between the moving averages. This indicates a likely movement of the cryptocurrency between the moving average lines.

What is the next direction for Dogecoin?

DOGE is in a sideways trend on the 4-hour chart after reaching the $0.15 mark. The altcoin has pulled back below the 21-day SMA but remains above the 50-day SMA. In other words, the market is trading above the support of $0.135 and below the resistance level of $0.150. Once these levels are reached, the altcoin will start a new trend.

On October 23, a long candlestick tail pointed below the 50-day SMA, signaling strong buying pressure above the 50-day SMA.

Disclaimer. This analysis and forecast are the personal opinions of the author. They are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol.com. Readers should do their research before investing in funds.

News

Price

News

Price

Coin expert

(0 comments)