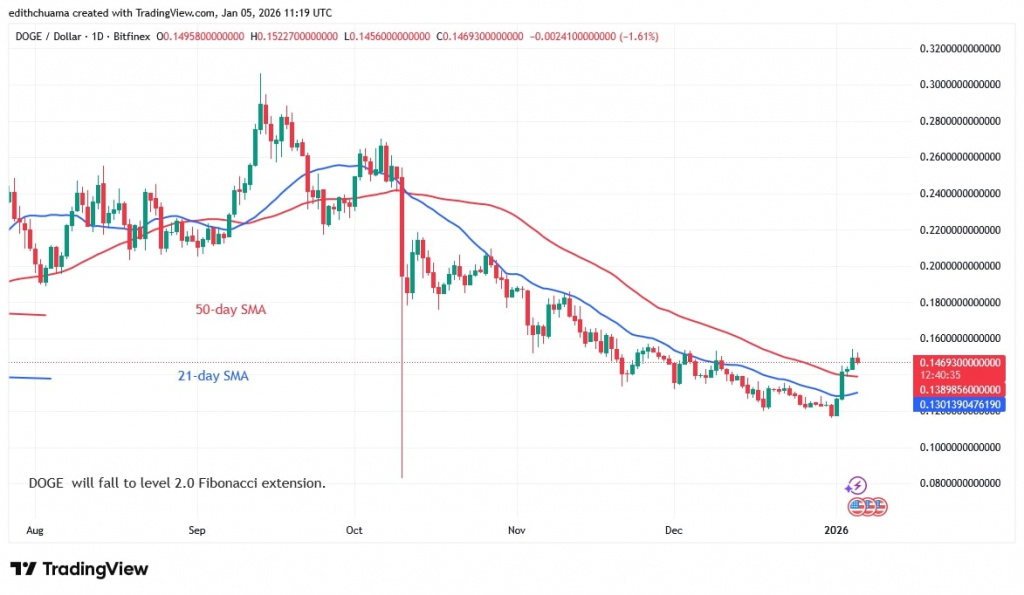

Dogecoin Rebounds but Struggles Below $0.155

Dogecoin's price has risen above the moving average lines after reaching a low of $0.115.

DOGE price long-term prediction: bullish

Buyers pushed the price above the moving average lines, reaching a high of $0.154. However, the bullish momentum stalled at $0.15.

Currently, DOGE is trading below its previous high but remains above the moving average lines. The upward trend will continue if the altcoin retraces and stays above the 50-day SMA support. If the current resistance is broken, DOGE will move towards the next barrier at $0.186. Conversely, the uptrend will end if the altcoin retraces and falls below the 50-day SMA support, in which case DOGE will test the previous low of $0.12.

Technical indicators

-

Resistance Levels $0.45 and $0.50

-

Support Levels – $0.30 and $0.25

DOGE price indicators reading

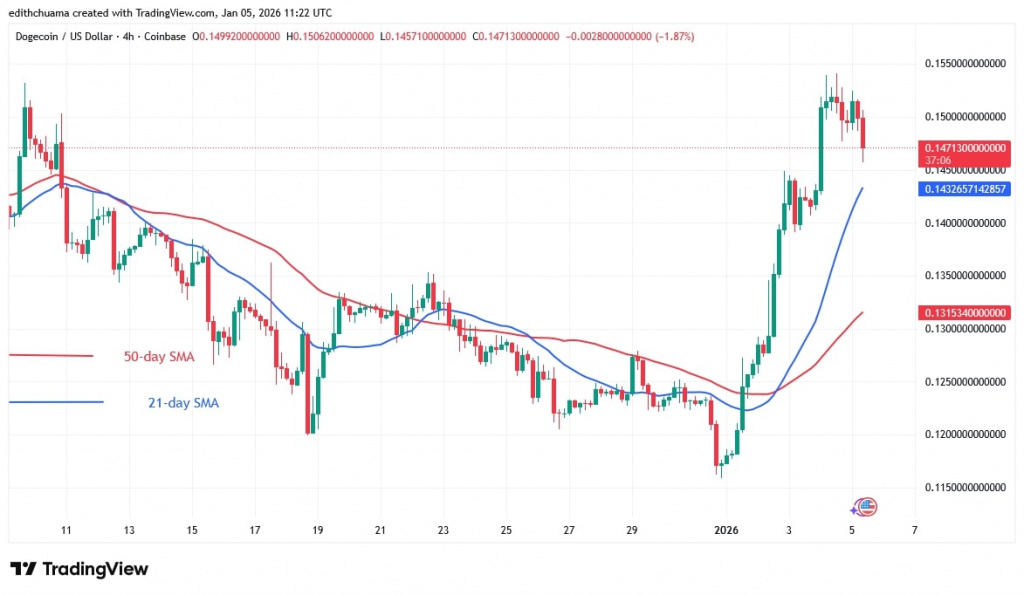

Dogecoin has regained its bullish momentum, breaking above the downward-sloping 21-day and 50-day moving averages. The cryptocurrency price will continue to rise if the 50-day SMA support holds. On the 4-hour chart, the moving average lines are trending upwards. The 21-day SMA is sloping above the 50-day SMA, indicating an uptrend.

What is the next direction for Dogecoin?

DOGE has surged to a high of $0.154. It is retracing as investors fail to sustain bullish momentum above the $0.155 level. The price is trading in a narrow range, above the 21-day SMA support but below the $0.155 high. The crypto outlook will remain favourable as long as the altcoin stays above the $0.138 support level.

Disclaimer. This analysis and forecast are the personal opinions of the author. The data provided is collected by the author and is not sponsored by any company or token developer. This is not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by Coinidol.com. Readers should do their research before investing in funds.

Price

News

Price

News

Price

(0 comments)