Monthly Analytics: Which Cryptocurrency Has Lost the Most in August?

August has not been bullish for some of the major cryptocurrencies that are among the top 10 tokens by market cap (MC). Let’s review 5 biggest losers of August 2020 in the cryptocurrency market.

In the past 30 days, the market has not favoured several popular cryptocurrencies such as Bitcoin Cash (BCH, trading at $0.281.44) lose by -11.94%, Zcash (ZEC, $80.46) plunge by over -10.95%, Stellar (XLM, $0.0987) plummet by about -8.28 percent, Bitcoin Gold (BTG, $10.21) lose by -6.62% and Dash (DASH, $87.72) drop by more than -5.75%.

Also, the top losers in the last one week (7D) include; 0x (ZRX, which is currently changing hands at about $0.6096, and has lost by over -16.51%), Algorand (ALGO, $0.5376, lost by -15.11 percent), Enjin Coin (ENJ, $0.2109, -13.56 percent), OMG Network (OMG, $5.08, -13.02%) and DigiByte (DGB, $0.0269, -12.45%).

However, none of the above-mentioned tokens is on the list of the top 5 losers of the past month. The list is provided below:

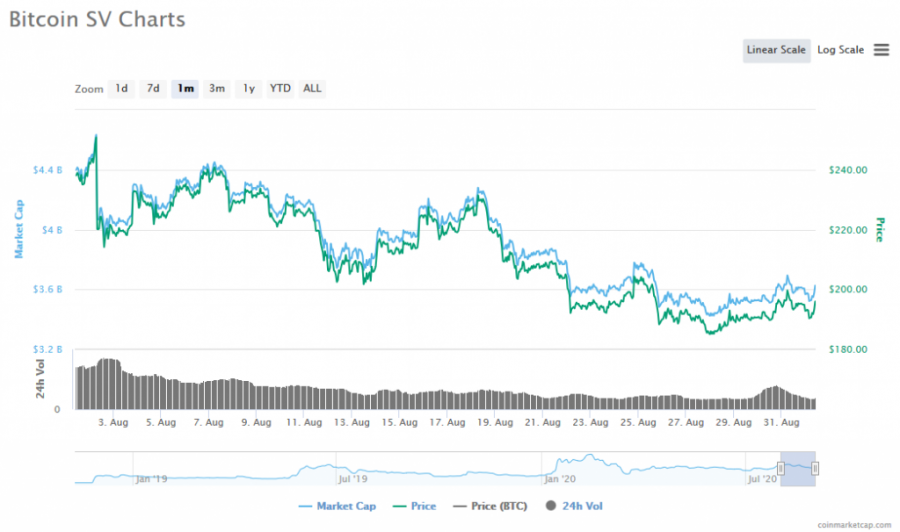

1. Bitcoin Satoshi Vision (BSV)

Bitcoin SV’s plunge began the day it hit its high of $252.98 (Aug 2, 2020). Even though this forked digital currency (its halving occurred on April 10, this year, and its block rewards of every block mined were lowered from around 12.5 to about 6.25 BSV) recovered from $184.25 (mid-August), the cryptocurrency has experienced a massive bearish pressure over the past 7 days.

Bitcoin SV which is currently trading in green at $200 (3.44%), has managed to lose by over -20.54% in the last 30 days and has topped the list of the best losers of August 2020. The token is in the 8th rank with a market cap of $3.63 bln and volume of $650.84 million.

Since its inception (Nov. 15, 2018), BSV has registered an all-time-high (ATH) and all-time-low (ATL) of $441.2 (Jan 14, 2020) and $36.87 (Nov 23, 2018 – about a week after the hard fork)

2. Ethereum Classic (ETC)

Ethereum Classic continues to struggle with the market and trading delays, a thing that has led its price to breakout below $7.0. In August, ETC registered a downtrend of over -14.01%.

Trading the first day of September is relatively progressive as sellers and buyers are trying to push the price beyond $7.0. At press time, ETC/USD is changing hands at about $6.73 (1.12%) with a market cap of over $782.218 million and volume of $585.25 mln. The close upside is limited at around $7.05. ETC touched a new monthly high and low on Aug 2 at $8.304 and $6.28 on Aug 28.

3. Cardano (ADA)

Unlike August, where Cardano has struggled to impress the buyers in the market, September seems to be a good start for ADA.

In the past 30 days, we saw Cardano hitting a bottom of $0.104409 and a high of $0.152014 – in the same month, Cardano lost by over -13.81 percent.

Nevertheless, the 11th token by MC has started the new month with a lot of momentum and is now trading in green at $0.125046, with a significant increase of about +8.62 percent, according to CMC data.

4. Celsius Network (CEL)

Celsius has been having brawls with some cryptocurrency exchanges including Bilaxy exchange and this has temporarily scared away some of its users, and this has made it decline in value. The last month saw Celsius Network drive to touch a bottom of $0.353255 and this made it register a decline of -12.31 percent.

At the time of writing, CEL, the 117th token by MC, is trading at approx. $0.406609 (-3.42%), with a market cap of $92.123 mln and volume of $1.335 million. Its 30-day high and low are $0.454995 and $0.353255, respectively.

5. Dogecoin (DOGE)

Recently, DOGE was among the few cryptocurrencies that found support on D’CENT’s biometric wallet.

In July, Dogecoin, the Internet’s ideal meme-coin, was in the limelight shortly after surging by more than 100% in just 72 hours. Since that time, nonetheless, Dogecoin has registered big corrections on the price charts. In the past 30 days, DOGE has managed to lose by -12.26 percent.

At press time, Dogecoin, ranked 46, is trading at almost $0.003258 (-0.33%), with a market cap of over $410.805 million and $89.468 million.

DOGE’s signals, albeit, are somehow neutral as while Awesome Oscillator is showing some promising market traction, Relative Strength Index is trying to move right between the oversold and overbought regions on the charts.

Price

Price

News

Price

Price

(0 comments)