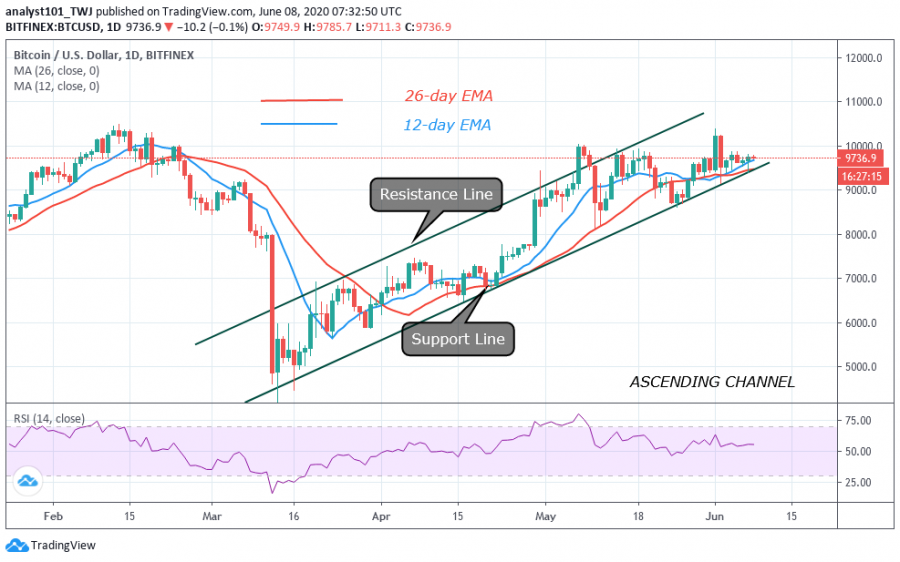

Bitcoin Under Pressure, Faces Rejection Twice at $9,800 Resistance

Notwithstanding the recent breakdown, the upside range for the Bitcoin (BTC) price is still on hold as bulls continue to retest the $10,000 overhead resistance.

Bitcoin Price Long-Term Prediction: Bullish

The upside range is between $9,300 and $9,800 where buyers fluctuate to retest the overhead resistance. The bulls have retested the overhead resistance but were resisted at $9,800. Price is now fluctuating below the initial resistance. Bitcoin will rally above $10.500 if buyers push the price above $9,800 resistance. Possibly, a breakout below the resistance will catapult price through the overhead resistance.

At the same time, the momentum is sustained. Conversely, if the bulls fail to breach the resistance, the market will fall to the support above $9,400. However, if the support cracks the downtrend will resume. Undoubtedly, buyers have been consistent since May as they sustain hold above the upside range.

Key Resistance Zones: $10,000, $11,000, $12,000

Key Support Zones: $7, 000, $6, 000, $5,000

Bitcoin Indicator Reading

Bitcoin is stable as it is at level 55 of the daily Relative Strength Index, indicating that it is in the uptrend zone. Price is above the centerline 50 meaning that it is likely to rise. Also, BTC is rising because the price is above the 12-day and the 26-day EMAs.

What Is the Next Direction for BTC/USD?

There is a strong possibility of breaching the overhead resistance if the bulls take hold of the upside range. Ensuring that price remains above $9,300 support at all times. There are strong indications that Bitcoin will reach a high of $12,000 if the current overhead resistance is breached.

Disclaimer. This analysis and forecast are the personal opinions of the author are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol. Readers should do their own research before investing funds.

Coin expert

Price

Price

Price

News

(0 comments)