Bitcoin Jumps the $9,000 Resistance Level, Could the Coronavirus in China be the Reason?

This week has been a bullish trading period for most of the popular cryptocurrencies across the world including all the ten leading altcoins by market cap such as Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP). The spread of the deadly coronavirus (CoV) in some parts of the world may be a cause of this Bitcoin breakout.

Many participants would argue that some of these figures are inflated or they are just another fakeout – but the prices seem to be real comparing the movements, charts and technical analysis available.

The world’s number one cryptocurrency Bitcoin has finally managed to hit and surpass the $9,000 level o'er and BTC traders are now confident and optimistic that the market might record further positive price trajectory. A massive number of retail traders is brawny on Bitcoin at the time expecting further surge in value.

This isn’t coming as a surprise to many of us to observe before the next halving and the entire story of a possible bull run that seem to be rotating and revolving around it. Looks like the entire digital currency market indeed risks a deep negative trend in the few weeks or months from now if and when the value drops below the 200-day MA once more. This would eventually demonstrate that this was a trend that was somehow similar to that of October last year.

BTC/USD Price Analysis

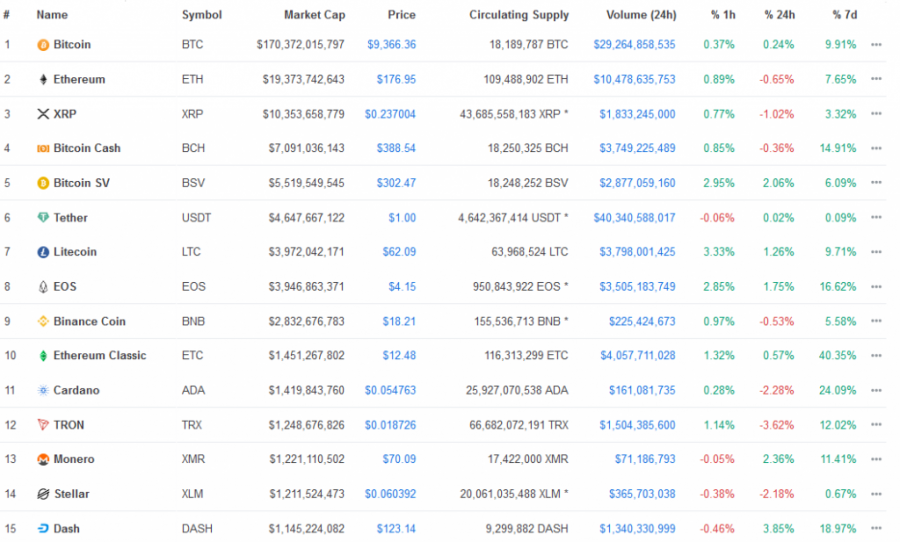

At the time of writing, BTC/USD is trading in the green standing at over $9,300 (+0.24%) with a market cap of more than $170 billion and volume of over $29 bln. Bitcoin is still dominating the digital currency market with over 66%.

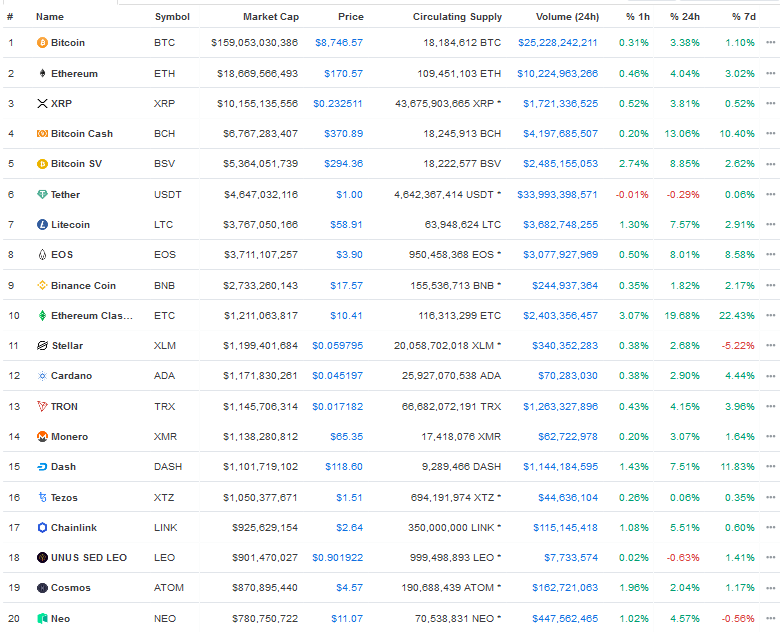

Yesterday, all the top 40 cryptocurrencies managed to trade in green, and the highest performer among these being Ethereum Classic (ETC) that had a price of $12.30 (17.7%) and MC of $1.43 bln and volume of $3.9 billion, according to data from coinmarketcap.

However, at press time, Ethereum ( ETH/USD) is trading in red at above $176 (-0.65%) with a MC of $19.4 bln and volume of above $10.5 billion. Ripple ( XRP/USD) is changing hands in red at $0.237004 (-1.2%) with a market capitalization of around $10.4B. The entire market cap of over 5,070 cryptocurrencies across the known 20,324 markets is sitting at $257.2 billion and the entire 24h volume is at $112.5B.

All that are happening in this lucrative industry are not immune to what is taking place on the universal economic, financial and political sphere. The Coronavirus that is spreading like wildfire in China a few days ago gained much momentum mostly due to its massive dispersion to other neighboring countries and other parts of the globe as well.

Yes, this factor cannot be neglected because it is a big and severe development which could play an important part in what explains what is coming next on a macro scale which is more likely to possess huge implications, effects and consequences for evolving markets such as this of Bitcoin, blockchain and cryptocurrency market.

Price

Price

Price

News

Price

(0 comments)