Bitcoin Price Weekly: Bitcoin’s Popularity Does’t Allow Price To Decrease

Last week the Bitcoin price showed movement. Traders are in no hurry to sell bitcoins and are waiting for the resumption of price growth. Moreover, the unstable situation in the world economy and deferred demand for Bitcoin confirm these expectations.

Bitcoin price last week (July 10 – 16)

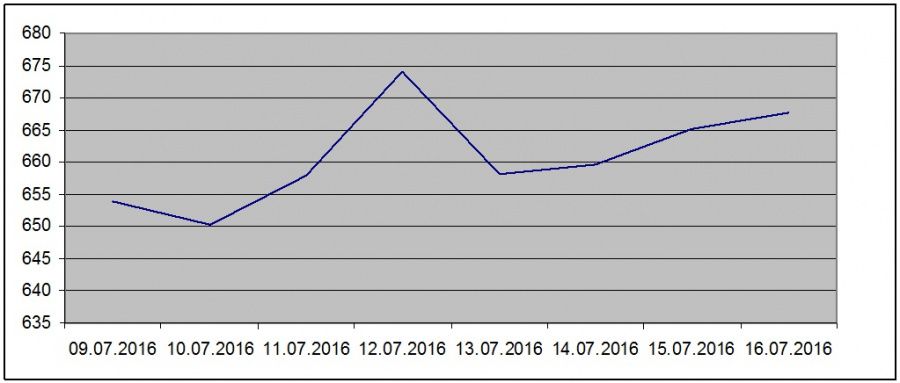

The Bitcoin price last week moved in the range of $650- $675. The rise on the stock markets and positive financial reports from the US companies on July 12 gave impetus for BTC price growth to the upper boundary of this corridor.

The Bank of England has shown a traditional British conservatism and did not raise interest rates. The British pound reacted instantly by increasing to $1.35.

On July 13 most major currencies rose against the US Dollar, which put pressure on both the USD and Bitcoin.

On Friday, China published their GDP for the 2nd quarter, which was 6.7%. This is a higher rate than predicted by experts. The same number of 6.7% was published in the first quarter. The pace of China's economic growth has not slowed down, which is a good sign for traders.

Also on Friday, July 15, the US published its results on the macroeconomic statistics. The base index of retail sales was 0.7% against the expected 0.4%. Retail sales rose by 0.4%. The volume of industrial production was 0.6% against the expected 0.4%. This positive information was immediately reflected in the foreign exchange markets, where EUR/USD fell by 100 points from $1.1150 to $ 1.1050.

Experts opinion

CoinIdol decided to ask well known cryptocurrency experts to comment on the situation with the price of Bitcoin last week and to make their forecast of further price movements. Here are the answers we received:

Michael Patryn, co-founder of Quadriga, and Founder of Fintech Ventures Group, an active trader:

“I feel that the value of bitcoin is too volatile, and uncertain, for long term placement into one’s investment portfolio. Bitcoin is fantastic for day trading, I would not park six figures in there for 3+ years.”

Daniel Dabek, founder of Safe Exchange, curator of Alt Coin Trading Community:

"Additional indications are that price changes become smaller prior to significant changes in price, that stagnation has been happening all week. A precursor to a volatile swing, I evaluate to be upward."

On the chart below we can see the reactions of the Bitcoin price on the events on the markets last week.

BTC/USD exchange rates for last 7 days:

Bitcoin price forecasts

As the chart shows, the Support level of $650 doesn’t allow a price decrease. The level of $675 at this stage limits the desire of traders to take risks. It is obvious that at the moment the corridor $650 - $675 is the optimum area of interest for traders. At the same time, today’s price is $100 lower than it was a month ago on June 18th. A correction that lasts longer than a month gives reason to believe that there is a deferred demand for Bitcoin and next week we could see BTC prices move to the upper levels of $680 and $690.

It should be noted that not only does the economic situation in the world put pressure on the exchange rates and the price of Bitcoin. This week, political factors, too, had enough power to influence the price. The terrorist attack in Nice, the election of Theresa May as head of the British Government, the difficult food shortages situation in Venezuela, etc. And do not forget the recent Brexit.

Political and economic factors are inextricably linked. And all the factors together today determine the movement of prices on the market. Including Bitcoin’s price.

What do you think, can the political factors in the world influence the growth of Bitcoin more than other factor.

Coin expert

Price

Price

Price

Price

(0 comments)