Bitcoin Price: The Upsurge Goes On

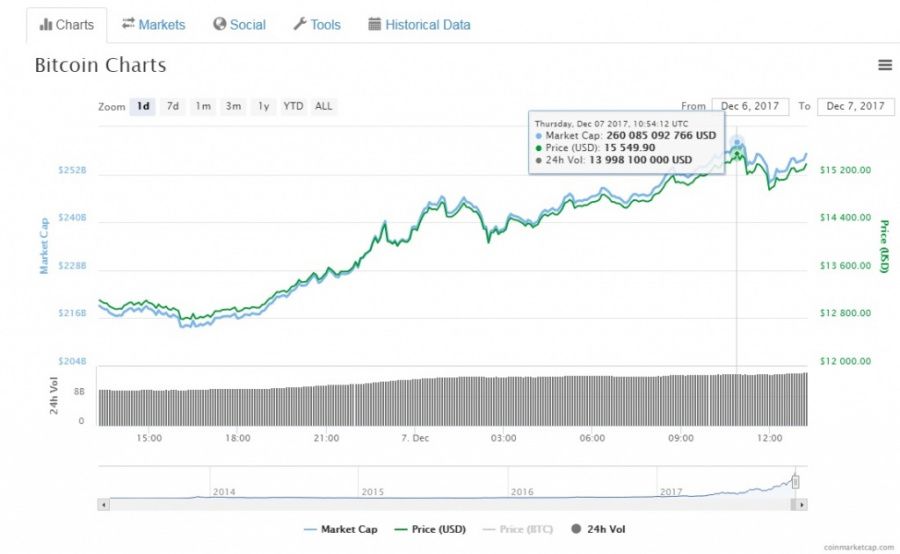

Bitcoin price broke through the $15,000 threshold as CME’s launch comes closer.

Cryptocurrency is attracting more and more investors, which makes its price go up. The prominent fact is that Bitcoin market cap is now exceeding that of the fiat banking giant, JPMorgan Chase.

Some minor cryptocurrency markets are attracting new investors by increasing premiums. For example, in South Korea, BTC is traded at a rate of over $17,000, which is about $2,000 more than in the global market. Following this example, Ukrainian cryptocurrency exchange btc-trade.com.ua also trades Bitcoin at a rate of $17,064.

These markets are quite small. According to CryptoCompare, a cryptocurrency market data provider, the South Korean cryptocurrency market takes less than seven percent of the global bitcoin market share. The Ukrainian market is also small, though the country has the largest programming talent pool in Eastern Europe, boasting numerous blockchain solutions.

Such an upsurge in minor markets probably can’t cause a revolution, however, it still impacts the global market, strengthening the overall optimism towards cryptocurrency. Nevertheless, the situation remains quite unpredictable and unexplainable as to the reasons for such a surge.

Andrei Popescu, Vision-Driven Entrepreneur, Crypto and Blockchain Technology Investor/Evangelist, CEO of COSS VENTURES and Co-Founder of COSS.IO, shared his vision with Coinidol:

“Bitcoin recently hit a high of $15,549! This is an all-time high. So what exactly is driving this surge in demand for Bitcoin? This is still quite unclear. There has been lots of suggestions that “institutional money” has been joining the party and thus responsible for this recent upsurge. However, these stories are not new, a similar take on “institutional money” has been around since 2013.

The marketplace still lacks the framework and the infrastructure to safely, efficiently and feasibly handle institutional money. I believe the recent hype is more focused on the fact that there is something cooking in this space of frameworks and infrastructure. Singapore, for one, is clearly headed into this direction and the wheels of change are now spinning faster than ever. Do keep an eye on the MAS’s and Singapore’s upcoming announcements in this space.

On this note, there are several Bitcoin derivative products coming to market soon, namely: CBOE BTC Futures on December 10th 2017 and CME on December 18th, 2017. The NASDAQ and Tokyo Financial Exchange have also stated plans to launch Bitcoin Futures as early as Q1 2018.Traditional investors are thus finally seeing Bitcoin as an “accepted by mainstream” asset with trading alternatives.

With regards to the BTC price, I believe we will see increased volatility in the very short term, fueled by increased volumes and profit-taking. A pullback or correction is also due. In the mid-term view, we will see the momentum continue on its current path, and with more price support from the demand that comes with a growth of the “crypto newbie” population. The market will also see increased selling pressure for most of the altcoins as investors reallocate and switch boats over to the BTC cruise.”

News

News

Price

Coin expert

Price

(0 comments)