Bitcoin Price Loses its $10k Support, Trades Around $9,600

The daily and weekly trading price of Bitcoin (BTC) is back in the mud. It has moved downwards to change hands below the $10k cap. The world’s most used token has dropped by about 6% within a shortest time, which is an indication of futures-related instability tied to the long-term contracts of BitMEX, a peer-to-peer (P2P) cryptocurrency trading platform. The exchange could see more pitfall before the bearish market ends.

At the beginning of this week, Bitcoin was holding above $10,500 level with a market cap of more than $188.104 billion and volume of over $15.971 billion. But as we talk right now, it is trading in negatives. In fact, the way Bitcoin is going down, it will soon discover oil – if at all it continues with this falling velocity rate.

BTC/USD Price

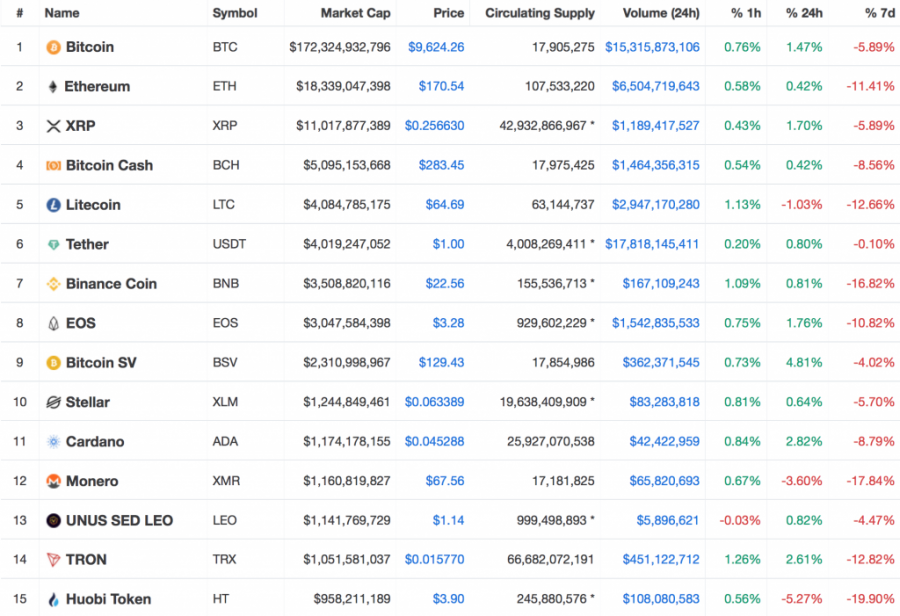

At press time, Bitcoin (BTC/USD) is trading in the green at around $9,624 with a 7d change of -5.89% and a market capitalization (MC) of about $172.324 billion. The daily trading volume is standing at approx. $15.315 bln and it is still dominating the market by 69.1%.

However, the overall MC of over 2500 cryptocurrencies being traded in over 20250 markets around the world, is standing at $249.536 billion, and their overall daily volume is at $52.826 billion, according to coinmarketcap

data.

In actual fact, Bitcoin is not the only cryptocurrency that is trading in negatives. All the world’s top 170 tokens are facing it rough except HedgeTrade ( HEDG), Bytecoin ( BCN), Lambda ( LAMB), Egretia ( EGT), Dai ( DAI), Golem ( GNT), Solve ( SOLVE), Stratis ( STRAT), and LINA ( LINA).

The Price of Ethereum and Ripple Plummets

The two potential rivals of Bitcoin, i.e. Ethereum (ETH) and Ripple (XRP), are also nursing wounds. ETH/USD price is standing at about $170.54 (ETH, -11.41% and MC of $18.33 B). XRP/USD price is also at $0.256630 (XRP, -5.89% and MC of $11.01 B).

Coin expert

Price

Price

Price

News

(0 comments)