Coinidol.com: Bitcoin Maintains Its Range Above $65,000

Updated: Feb 21, 2026 at 15:41

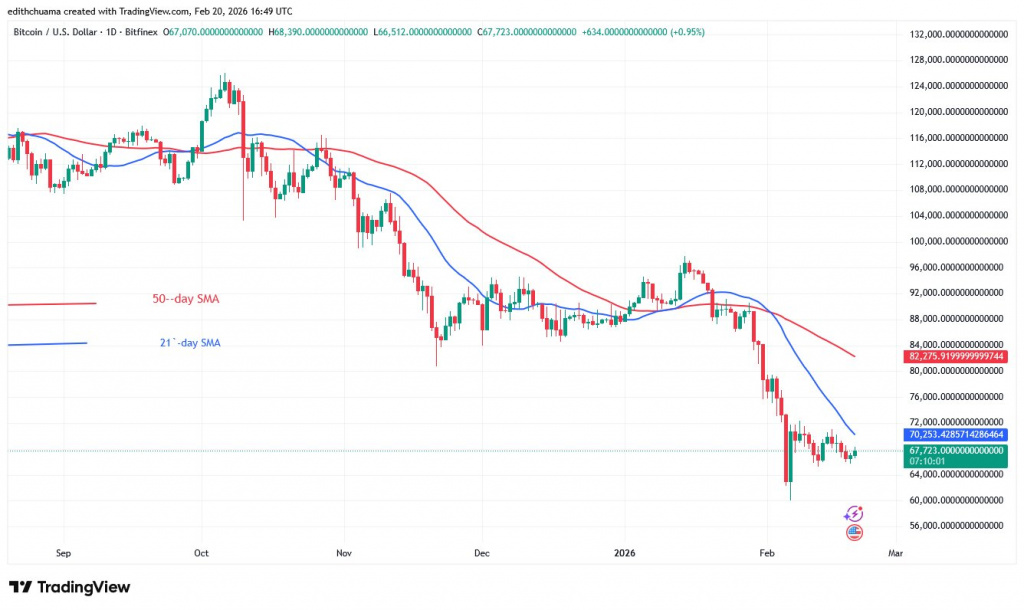

Bitcoin (BTC) is currently trading in a narrow range above the $65,000 support but below the 21-day SMA barrier.

BTC price long-term prediction: ranging

The largest cryptocurrency has been consolidating above the $65,000 support level after the bullish momentum was halted at the $70,000 high.

Additionally, the formation of Doji candlesticks has kept price movement stable. If the 21-day barrier is surpassed, Bitcoin could rally to a high of $82,000 or reach the 50-day SMA barrier. The 21-day SMA has slowed the upward trend over the past two weeks. If bears breach the $65,000 support, Bitcoin may fall to its previous low of $60,000. Bitcoin is currently priced at $67,032.

Technical indicators

-

Key supply zones: $120,000, $125,000, $130,000

-

Key demand zones: $90,000, $85,000, $80,000

BTC price indicators analysis

Bitcoin price bars are stabilising and moving sideways below the 21-day SMA threshold. The moving average lines have a downward slope, indicating a decline.

On the 4-hour chart, the price bars are positioned between the horizontal moving average lines. The price action is marked by small-bodied, indecisive candlesticks known as Doji. These Doji candlesticks have kept the price range-bound.

What is the next move for BTC?

Bitcoin remains in a sideways trend, trading above the $65,000 support but below the moving average lines and the resistance at $68,000.

Following the recent bullish advance, the 4-hour chart shows BTC price caught between the 21-day SMA support and the 50-day SMA barrier. The price is expected to trend once these barriers are breached.

Disclaimer. This analysis and forecast are the personal opinions of the author. The data provided is collected by the author and is not sponsored by any company or token developer. This is not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by Coinidol.com. Readers should do their research before investing in funds.

Price

Price

News

Coin expert

News

(0 comments)