Bitcoin Struggles to Touch $8000, Will the Community Lose Hope in Crypto?

The entire cryptocurrency market is continuing to register massive losses. It is not even a month ago when Bitcoin was trading more than $1,450 (on Feb 13), but look at it now crawling in a price range of $7,600 - $7,900. That means that BTC alone has managed to decline by over $6,100 (declined almost by a half). And it brings more worry and loss of hope among the cryptocurrency community.

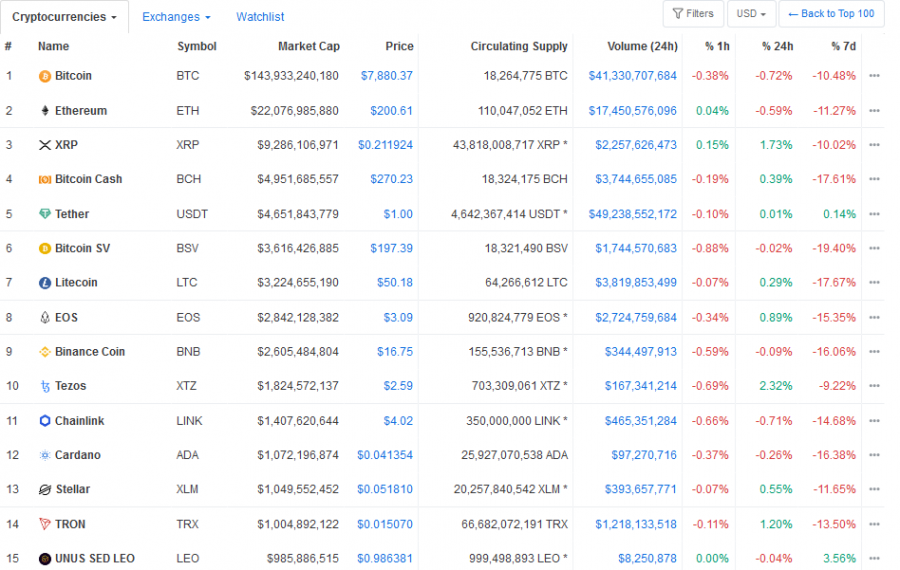

Yesterday, the cryptocurrency market continued to rise overall. The rise in major coins except BTC increased compared to the morning. Nine of the top 10 stocks rose, and 87 of the top 100 came on green lights, indicating a rise. According to the coinmarketcap, Bitcoin's price rose 1.29% to $7916.92 at 4 pm New York time. Ethereum 2.05 percent, XRP 3.64%, BCH 2.02%, BSV 2.48%, Litecoin 2.82 percent, EOS 2.79%. At that time, the market capitalization (MC) of the cryptocurrency market reached $2263 billion, and the share of BTC increased to 64.1 percent.

Bitcoin futures prices on the Chicago Mercantile Exchange (CME) declined intraday. March traded the most, trading at $80, up $80, April at $7,995 down $95, and May at $30, up $8,000.

The Crypto Market Ended with an Overall Uptrend.

Bitcoin rebounded to the $8100 level, but continued to move sideways after falling below the $8000 level, as trading volume declined slightly to $41 billion.

Most of the major cryptocurrencies such as Ethereum and BCH surged compared to what they were trading in the morning, and Tezos soared by nearly 10 percent.

The total MC is seeking stability after massive losses in cryptocurrencies such as BTC have resulted in a loss of more than $20 billion in BTC's market cap and more than $40 billion in the market's MC over the past three days.

Cryptocurrency analyst PlanB predicted that after investing in the half-life of Bitcoin scheduled in May, many investors will enter the market and raise prices based on the analysis of the Stock-to-Flow (S2F) model.

The volume of Bitcoin options also hit record highs as volatility in the global financial market led to an increase in the volume of commodities. The trading volume of Bitcoin options in the entire market the previous day was at an all-time high of about $200 million.

US New York stocks rebounded. The Dow rose 4.88%, Nasdaq 4.95% and the S&P 500 4.93 percent.

BTC/USD Price Level

At press time (02:05 Wednesday, 11 March 2020 (GMT-4) Time in NY, USA), thr BTC/USD price is still in the red trading at about $7,881 (-0.77 percent), with a MC of approx. $143.953 billion and volume of over $41.336 bln as well as dominance of 64.0%.

Thanks to this beautiful Wednesday morning, all the top 10 cryptocurrencies are now back in green except just 4 stubborn tokens (Bitcoin, Ethereum, BSV and Binance Coin).

Coin expert

News

News

Price

Price

(0 comments)