Most of the Stocks Start Edging Up, Bitcoin Touches $7600

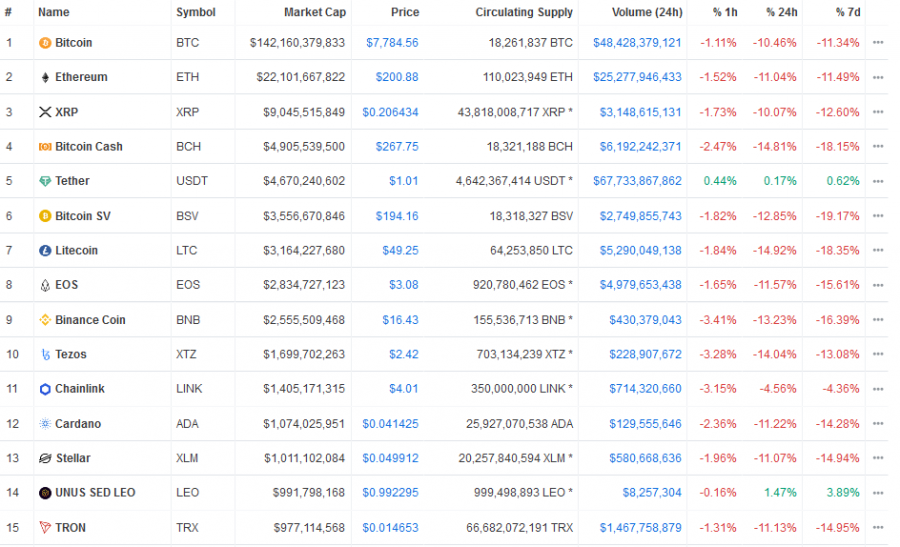

Yesterday (March 9), the cryptocurrency market started with the price of most stocks plummeting. All of the top 10 stocks fell, and 96 of the top 100 received a red light, meaning a drop.

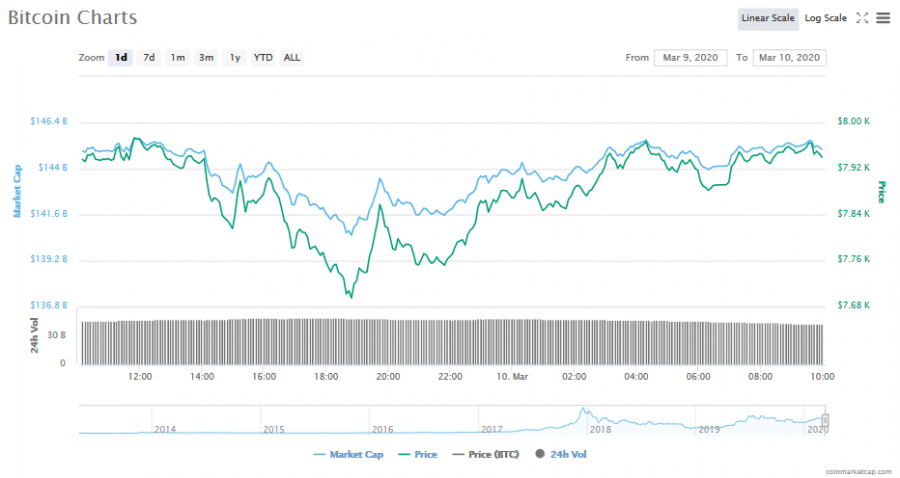

According to CoinMarketCap, yesterday’s price of Bitcoin fell about 10% to touch a low of $7,690.10 as of 9 a.m. New York time amid an overall slump. Bitcoin's "Fear & Greed Index" showed "extreme fear". In the current market, the index is 17 out of 100, an extreme fear state.

Bear Market is Looming

At 10:00 on Monday, 9 March 2020 (GMT-4) in NY, USA, the BTC/USD price was sitting at

$7,784.56 (-10.5 percent). Ethereum was trading in red at about (ETH/USD $202, -10.92%), Ripple (XRP $0.208747, -9.15%), Bitcoin Cash (BCH $271, -13.67%), Bitcoin SV (BSV $196, -12.47%), Litecoin (LTC $49.84, -14.45%), EOS (EOS $3.1, -11.71%).

Bitcoin futures prices on the Chicago Commodity Exchange (CME) also fell. The most actively traded March was $7860, down from $1305, April at $7925, and May at $7935.

The cryptocurrency market started off with a stronger downward trend from the weekend. Most stocks have fallen by more than 10 percent, and the market as a whole has plummeted.

The value of BTC/USD continued to plunge after retreating below $8000 before the start of the chapter, pushing it to $7800, and trading volume surged to $48 billion.

Almost all major altcoins such as Ethereum and BCH have plunged more than 10 percent, while the 11th-place Chainlink (LINK) in MC has fallen by 2 percent.

Bitcoin Value “Still Spot On”

According to CoinTelegraph, cryptocurrency analyst PlanB noted that despite the fact that BTC has fallen below $8000, it is still within the scope of its stock-to-flow (S2F) model, and that bitcoin wants a price of less than $10,000 for a rise in the May half-life.

At the same time, the analyst predicted that regardless of the price fluctuations in BTC/USD, the difficulty of the BTC network will be soaring, which means the amount of effort required to verify the blockchain, making it difficult for small and medium-sized miners to participate in the market.

However, there is some hope that the digital asset market will rally soon. At this time (03:11 Tuesday, 10 March 2020 (GMT-4) Time in NY), the digital currency market capitalization (MC) is at approx. $226,431,802,816, and bitcoin's share is 64 percent. BTC/USD price is now sitting at around $7,937.41 (0.22%) with a MC of $144,961,869,212 and volume of $41,993,916,320.

Tether (USDT) has managed to register a massive steady progress for a consecutive couple of months now. The 5th cryptocurrency by MC is now changing hands at around $1.00 (0.17%) with a market capitalisation of about $4,652,571,999, and 24h volume of $54,488,083,342. Actually, among all altcoins including Bitcoin, USDT has the highest volume (approx. 47.97 billion euros).

Price

Price

News

Price

Price

(0 comments)