Belgium to Restrict All Transactions with Bitcoin

Updated: Oct 29, 2017 at 07:14

The Belgian Minister of Justice has proposed to confiscate all cryptocurrencies in circulation and start regulating all transactions with digital currencies. This might mark the end of free use of digital currencies in Belgium.

Koen Geens, the Minister of Justice of Belgium, believes that cryptocurrencies are used by terrorists, criminals, and drug dealers, and thus companies dealing with cryptocurrencies should be under strict control of the government and courts.

Koen Geens said to VRT news:

"All of our anti-abuse legislation is based on the responsiveness of an intermediary in the financial sector and networks, like banks. The legislation we have now doesn’t include any virtual currencies because it they were no such at the time when this legislation was written. It is necessary to change the law so that we can deal with abuse with bitcoins."

Koen Geens proposed to enact a strict legislation for cryptocurrencies like Bitcoin. The Ministry of Justice is currently working on new procedures for how to detect virtual coins. Moreover, together with experts they want to find a solution to handle the confiscation of cryptocurrencies in Belgium.

In the past, the Belgian police has already confiscated Bitcoins from drug dealers during criminal case investigations. But it is still unclear whether any authority could ever confiscate all cryptocurrencies in circulation, even in a single country.

Crypto experts say

Coinidol.com asked crypto experts of the Belgium market to comment the point of view of the minister, if it is possible to make such kind of restrictions for Bitcoin, how it can be done in a proper way.

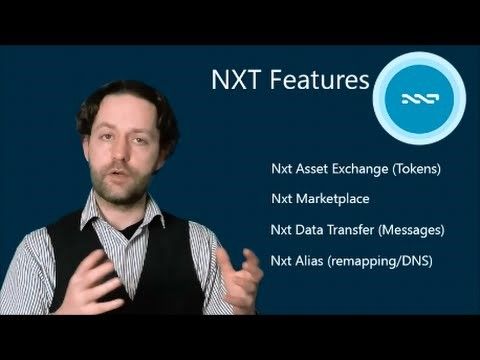

Bas Wisselink, Board Member at NXT Foundation, Co-Founder and Co-Owner at Blockchain Workspace said:

"The minister's point of view is that all finance is a priori a tool for bad actors and is acting from that PoV. I think that's a narrow view.

What they are doing is anticipating the new amendments to the European AML, where any intermediate trading crypto will fall under the same compliance rules as "normal" finance businesses. And yes, they can do this. Whether it's proper depends on your perspective how useful such rules are now and how much they are effective in combating money laundering and terrorism at this moment. I have no insight into that, but my guess is that bad actors will usually find a way regardless of rules. So at best it's a hurdle to them. It won't be perfect."

Jean-Luc Verhelst, Blockchain expert and Strategy Consultant at Monitor Deloitte Belgium also commented to Coinidol.com:

"Unlike what can be read in crypto space, there is no reliable source indicated that Belgium wants to ban bitcoin. Such a proposal would make absolutely no sense as we all know bitcoin can't be banned or regulated by its design.

The suggestion was made to expand current banking regulations to bitcoin middlemen (exchanges, etc) to avoid money laundering etc. I assume this means applying KYC and AML ruling, which is already mandatory in many countries that investigated bitcoin, including France. Having such a framework is actually a positive thing for start-up and bitcoin companies willing to operate in Belgium.

Finally, the administration is in possession of a Bitcoins after arresting criminals. They are investigating a way to value and, I guess, re-sell them in a way that would be compliant with their legal processes."

Roderik van der Veer, co-founder & CTO at SettleMint, a Belgian company to develop a suite of modular middleware solutions and SDK's to remove the complexity of blockchain technologies, said:

"It is not that he is proposing anything radical. The Belgian legal system just has no concept of cryptocurrencies and as such have no legal basis to do anything with them. Most importantly impound them during criminal investigations.

He is proposing now to give them some legal status (also opening the doors for further legal rights we do want).

Maybe in a few months there will be some nice auctions to make a fair penny. On the way to do it, apart from getting the private keys from the criminals and moving the funds to (hopefully multisig and paper) government wallets, there are no alternatives. Except forcing exchanges to block funds.

While I'm not a criminal, I guess the smart ones are moving to zcash or monero :)"

Danny De Cock, Senior Research Manager, Critical Advisor and Post-Doctoral Researcher in Applied Cryptography at University of Leuven in Belgium said to Coinidol.com:

"It is technically impossible to implement such restrictions. What the minister says is that he wants to stimulate the users of virtual currencies to cooperate with the investigators when confronted with illegal activities."

Belgian Bitcoin Association asks government to support Bitcoin projects in banking

Chris D'Costa, founder of Meek inc., company that develops the basic proof-of-concept for a retail PoS system based on Bitcoin and connected with SAP, founding director of Belgian Bitcoin Association:

"This will not really change much for members of Belgian Bitcoin Association, and indeed anything that goes beyond the current legislation would severely impact banks in Belgium who are currently working on their own Bitcoin-like cryptocurrencies to improve their own operations. We have worked with at least two banks that would likely have to stop their projects if a blanket ban was to come into force, so we believe it would not be in the interests of even the financial sector in Belgium to take such extreme stances against technologies that are clearly beneficial to them."

News

Coin expert

News

Price

Price

(0 comments)