Bitcoin Price Analysis: BTC/USD Defends $5,200 Price Level

Updated: Apr 10, 2019 at 10:00

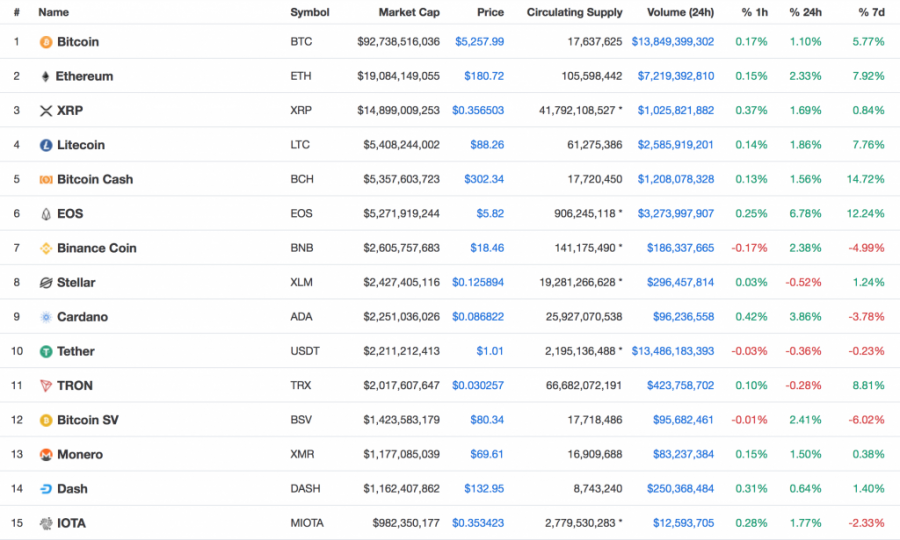

The volatile nature of cryptocurrencies seems not to settle quickly, Bitcoin (BTC) was seen skyrocketing during last weekend’s trading periods, it’s now less than 24 hours later but the market is back in the red. At press time, BTC/USD is trading at $5,257 – dropping with gravity from $5,343, Ethereum (ETH/USD) is at $180 – it has dropped from $182 and Ripple (XRP/USD) is changing hands at $0.356 after failing to break beyond $0.38, with a 24-hour change of 1.10%, 2.33% and 0.84% respectively, according to CMC data.

Is Crypto Winter Over?

In the world of cryptocurrency, investors who ardently refuse to sell their crypto are known as “HODLers” (i.e. “holding on for dear life”). It has been a nightmare-fest-worthy 16 months on the side of several bullish crypto HODLers, for that bellwether and indicator of the attracting-but-contentious crypto market.

The soaring cryptocurrency prices caused a big impact on the entire market cap as well as the daily trading volume. The total market capitalization (MC) is now sitting at $182.250 billion, dropping from Monday's $185 billion – a loss of nearly $3 billion.

Recently, the Chicago Mercantile Exchange (CME) revealed a new top score volume that was traded on Thursday April 4. It surpassed 20k contracts, or its equivalent 112.9k Bitcoin’s.

The Next Bull Run is Loading

Since CBOE is the only competitor in the industry, it closed its trading platform on BTC towards the end of last month and this has helped it to hit these figures, though this is not the only attributable factor.

The failure to rally beyond last week’s record-high led to the formation of a double-top pattern which is now greasing the wheels for a bearish reaction. The crypto bulls must underprop the short-term support at $5,200 in order to prevent plunges which could pull back the price levels to $5,000 or below.

If at all the bulls maintains the $5,200 support level within the short-term, the market will see BTC/USD staying in the range above $5,300. But if that fails, the key support levels will now be $5,000, $4,800 and $4,000, according to the technical indicators.

News

News

Coin expert

(0 comments)