How to Choose Which Altcoin to Invest In?

Updated: Sep 03, 2020 at 13:56

The emergence and growth of the popularity of the alternative currency Bitcoin has led to the creation of many other cryptocurrencies based on Bitcoin Blockchain code. All these cryptocurrency have the generic name - Altcoins.

All who wish to deal with cryptocurrency need to know that there are more promising coins which offer their own value, such as transfers, decentralized computing, data storage, etc. to customers. Cryptocurrencies have uncertain nature and so there is a possibility of making profits, losses or even losing your investment.

Notwithstanding the striking boost in this nascent industry, the cryptocurrency and blockchain field still undergoes fecund market manipulation, and there’s no big effort on compliance since just 1% of virtual currency derivatives platforms are well monitored and regulated.

The good thing to do before investing in this industry is to conduct research to help identify the best coin, trade digital currency on a reliable crypto exchange, as well as tracking your transactions and trades.

At any rate, here are CoinIdol’s picks for the top 5 cryptocurrencies on the market in which to invest in 2020.

Ethereum (ETH)

If an investor had invested $1k at the beginning of the year (on January 1, 2020), in both Ethereum (ETH) and Bitcoin, he or she would have earned bullishly more from these ETH holdings, when related to the value appreciation of Bitcoin.

Since Jan 1, 2020, a $1k BTC investment has managed to appreciate by almost $660 which is approx. 66%. Ethereum has increased by about 204 percent, so the investor’s initial $1k investment at the beginning of the year would have earned him over $1,040. Surprisingly, the invention of Vitalik Buterin has overcome the flagship crypto by popularity in 2020.

Bitcoin (BTC)

The digital currency industry cannot operate without Bitcoin, the world’s first cryptocurrency. The coin is used as the currency of entry/exit to the market. BTC is also used as a measure of value as well as a base currency for trading purposes.

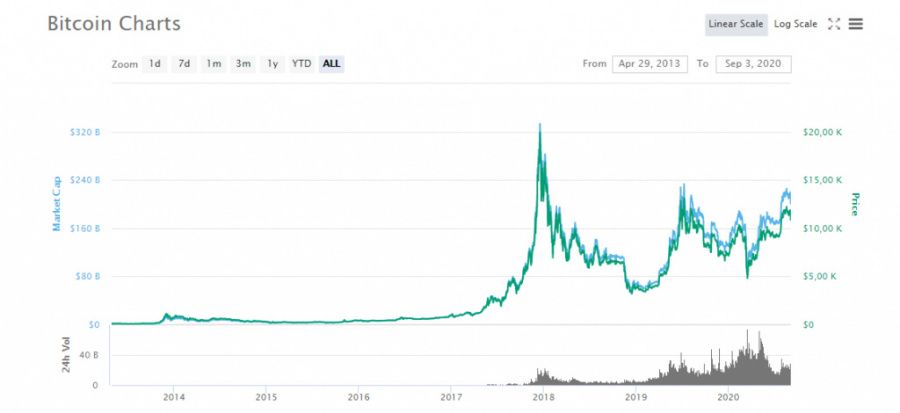

Since its launch on Jan 3, 2009, Bitcoin has remained on the top of other coins and the number one choice for investors in the industry. The former few spells including the cryptobubble that happened in December 2017, have helped BTC to gain a huge adoption and has done it much better for its value and popularity.

Since there has been a significant increase in the use of digital payments including Bitcoin due to Covid-19, several venture capitalists now are optimistic that the BTC/USD price might hit and surpass the 2017’s all-time-high of $20,000 and set a new record-high before 2020 ends.

Since August, Bitcoin has been trading above the $11,000 price level – its price has not fluctuated as much as it used to in the recent past.

Because of the surge of Bitcoin as an authentic asset class, some cryptocurrency exchanges such as Coinbase, are considering letting certain groups of users borrow cash using BTC.

Ripple (XRP)

Apart from Bitcoin, XRP is doubtless the most used cryptocurrency in transborder payments by individual users, giant financial organizations including banking institutions, globally.

The coin has been used to conduct easy and affordable international monetary transfers. Ripple has provided a variety of products including xRapid, RippleNET, xCurrent, etc., which are highly used by entrepreneurs and businesses to help them find and connect with their clients and service providers.

Litecoin (LTC)

One of the most promising altcoin Litecoin is sometimes referred to as the ‘silver to Bitcoin’s gold’.

LTC looks more similar to its prototype coin Bitcoin – it also wants to be the leading currency option to fiat. Also, Litecoin employs a proof-of-work (PoW) consensus algorithm known as scrypt for safeguarding its distributed ledger tech (DLT) network.

Scrypt is faster than BTC’s PoW sha-256, more democratic, and is economical since it consumes less power from miners. All these features make LTC a cheaper and faster alternative to make transactions than BTC, hence making it more important for day-to-day purchases and trades.

Chainlink (LINK)

Chainlink is doing well when it comes to blockchain. LINK looked for the secure, trusted and decentralized means of extracting info in and out of a blockchain – Chainlink is the first-ever distributed oracle network – and this helped it to formulate a vibrant bit of smart-contract-infrastructure, and this is considered as a secure bridge which is contingent on real-world information.

Main criteria for choosing the right coin

Using the review of the major altcoins we will try to identify the top-5 most important criteria when buying cryptocurrency.

1. Investment attractiveness. The rising cost of a cryptocurrency over a time interval is an important criterion when selecting an object of investment. Stable growth for 2-3 years speaks to the confidence of players in the cryptocurrency. Moreover, using collected information, the investor should be aware of the direction of the trend.

2. The cost of production of coins - a factor that consistently affects the market value of the coin.

3. The number of coins that can be mined. An unlimited number of coins in circulation have a negative impact on the growth of altcoin price. Too limited a number of coins can also scare away investors.

4. The volume of sales and the number of participants. The more activity around a certain cryptocurrency, the greater the likelihood of its price growing.

5. Appearance on the cryptocurrency exchanges and partnerships with other existing payment systems. It is important to select the exchange with higher prices, and for depositing or withdrawing funds when buying or selling cryptocurrency.

Each investor must independently determine the feasibility of buying a particular investment instrument.

Updated by: Coin Idol

This analysis and forecast are the personal opinions of the author and are not a recommendation to buy or sell cryptocurrency.

News

Price

News

Coin expert

Price

(0 comments)