Ethereum Shows Positive Signs of Uptrend as It Attempts to Break $366 Resistance

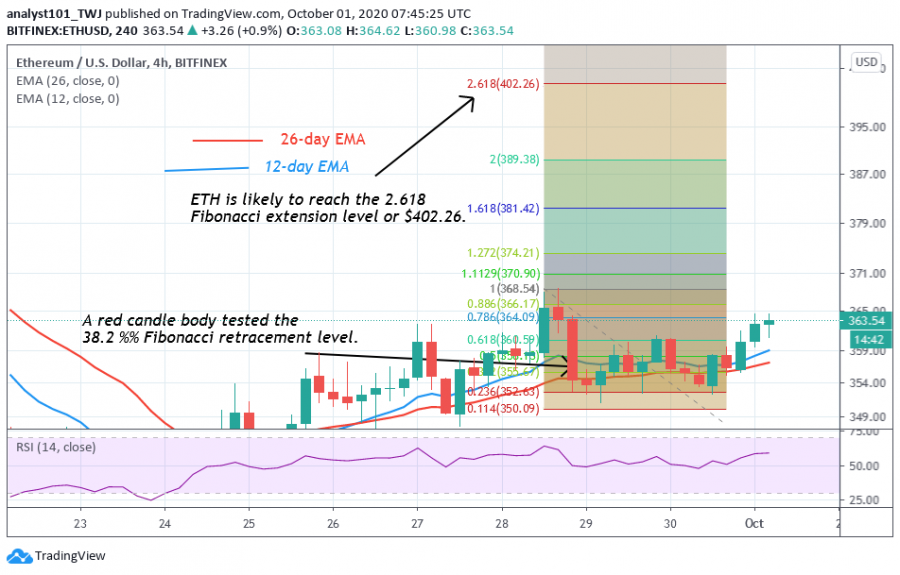

In the last 24 hours, Ethereum has made impressive bullish moves as it rallies to $364 high. Presently, the market stands the chance for a further upward move after a minor retracement.

Buyers are expected to break the minor resistance at $366 to rally above $380 high. Perhaps, it is expected that the resistance at $390 is cleared so that the altcoin is out of the bearish trend zone.

The biggest altcoin will resume the bull market once the resistance is cleared. Today, Ethereum is trading at $364 at the time of writing. The market is expected to reach a high of $415. Nonetheless, ETH's upward move will be in jeopardy if the bulls fail to break the minor resistance at $366. On September 28, buyers were unable to break the minor resistance as the coin fell to $352 low.

Ethereum indicator analysis

Ethereum price has broken the 12-day EMA and it is expected to break above the 26-day EMA. A break above the EMAs will propel prices to rise to the previous highs. Nevertheless, the breaking of the resistance line will ensure further upward movement of the coin. The coin is in a bullish momentum above the 50 % range of the daily stochastic.

Key Resistance Zones: $220, $240, $260

Key Support Zones: $160, $140, $120

What is the next direction for Ethereum?

The biggest altcoin is making a positive move after overcoming the initial resistance. On September 28 uptrend the coin was resisted. The retraced candle body tested the 38.2% Fibonacci retracement level. This indicates that the market will rise and reach the 2.618 Fibonacci extension level or $402.28 high.

Disclaimer. This analysis and forecast are the personal opinions of the author that are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol. Readers should do their own research before investing funds.

Price

Price

Price

Price

Price

(0 comments)