Ethereum Holds Above $2,200 And Continues Its Strong Rise

Ether will fall and return to the psychological price threshold of $2,000.

Ethereum price long-term analysis: bearish

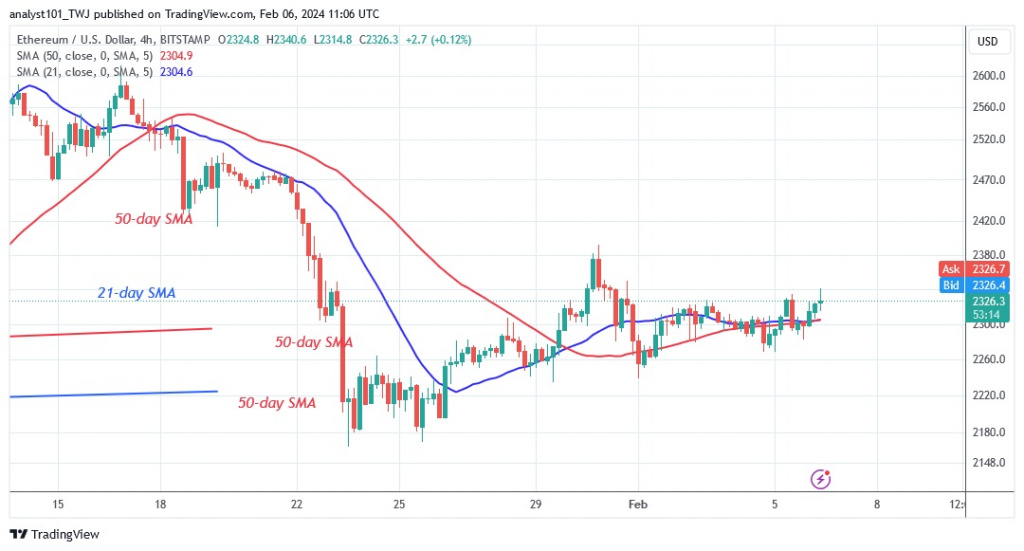

The price of Ethereum (ETH) has been below the moving average lines since the price drop on January 23, 2024. During its upward movement, the largest altcoin held firmly above the low of $2,200. The crypto price retested the moving average lines twice but failed to sustain its positive momentum. After rejecting the recent high, Ethereum is now trading in the price range of $2,180 to $2,350. Currently, rising movements are being hindered by moving average lines and resistance at $2,400. If the cryptocurrency value is rejected at the moving average lines, it could lose value. Currently, Ether is trading at $2,327 after being rejected. On the downside, selling pressure will return if Ether retraces and falls below the $2,200 support.

Analysis of the Ethereum indicators

Following the rejections of the recent high, the cryptocurrency's price bars have held below the moving average lines. This indicates that the cryptocurrency is at risk of declining. On the lower timeframe, the price bars are above the moving average lines.

Key resistance levels – $2,200 and $2,400

Key support levels – $1,800 and $1,600

What is the next direction for Ethereum?

On the 4-hour chart, Ether is in an upward correction but has resumed a sideways trend after rejecting the resistance zone at $2,400. The price of the cryptocurrency has pulled back above the moving average lines and support at $2,300. The uptrend will continue if the current support levels hold.

Disclaimer. This analysis and forecast are the personal opinions of the author and are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol.com. Readers should do their research before investing in funds.

News

Price

Coin expert

News

Coin expert

(0 comments)