Crackdown on Cryptocurrency Mining Makes Top 50 Coins Trade in Red

Updated: Jun 28, 2021 at 11:01

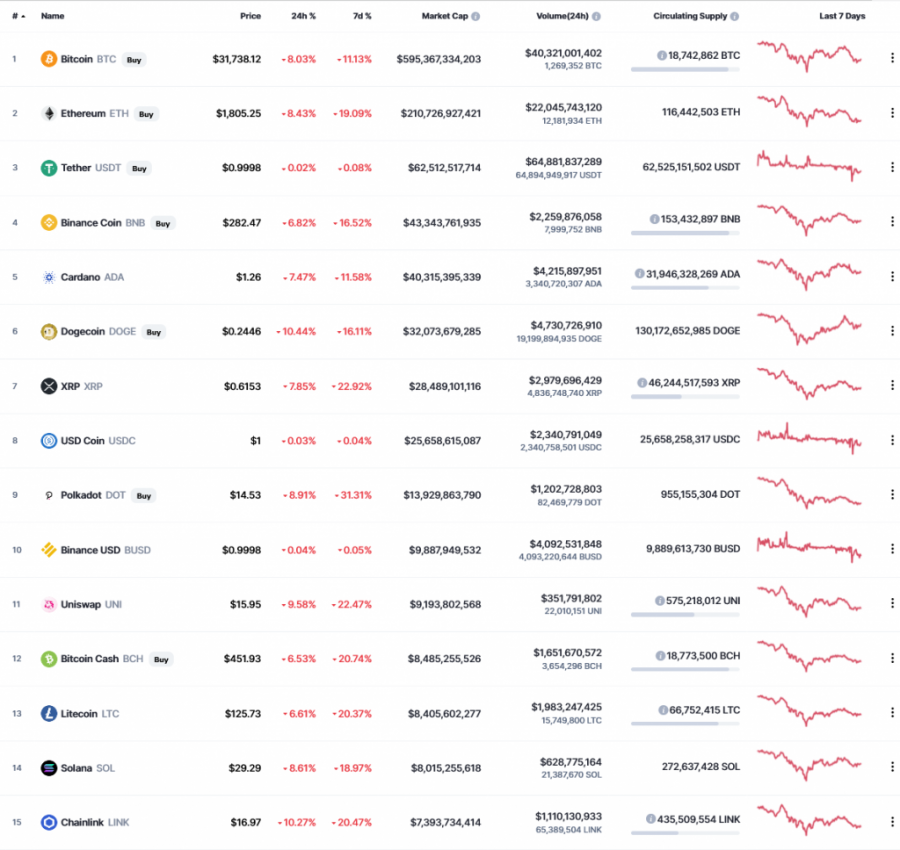

For the first time in 2021, all of the top 50 cryptocurrencies are trading in the red as both their 24-hour and 7-day prices are in negative territory.

The global market capitalization of cryptocurrencies is $1.28 trillion. Several cryptocurrencies plunged to 2-week lows amid a growing digital currency crackdown in several countries including China and Iran.

Total crypto market capitalization shrinks over 15% in one week

The ongoing crackdown on cryptocurrency mining and trading activities in China and Iran has caused the global crypto market capitalization to drop from $1,517T to $1,284T now, a decline of over 15.4% in the last 7 days.

During the week, the crypto market cap touched a low of about $1,164T (June 22) and that is when Bitcoin was trading at a low of about $28,893.02, and had a 24hr trading volume of $58,964B and MC of $609,180B.

Ever since China started chasing crypto asset miners in the country, the cryptocurrency industry has been struggling with both feet. Various billionaires and market influencers including Elon Musk, CEO Tesla and SpaceX, have done a lot of hype to bring the market back to normal, but the bearish trend doesn't seem to stop soon.

Top winners and losers among the top 10 coins

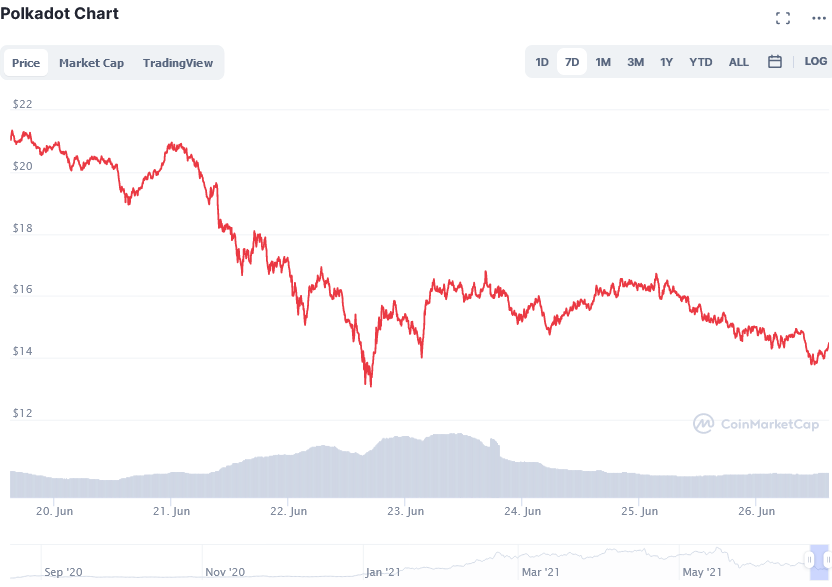

According to the weekly performance results, the best and worst performers of the week among the top 10 coins were USD Coin (USDC, $1.00, -0.03%) and Polkadot (DOT, $14.11, -33.32%).

At the beginning of the week USDC market cap stood at $24.988B and volume of $4.276B, but as the week reaches to an end, it's MC is at $25.66B and volume of $2.361B, meaning that it gained over 672 million worth.

Also, 7 days ago, DOT had a MC of about $15.045B and volume of $2.426B, but now the MC is sitting at $13.447B and it's volume is at $1.208B - meaning that the coin lost $1.598B in value.

The crackdown has not spared Bitcoin (BTC), the world's largest cryptocurrency by market cap. Bitcoin opened the week with its price at $35,641, with MC of $593,627B and volume of $52,809B, but as the week nears its end, the BTC/USD price stands at $31,140, with MC of $584,393B and volume of $42,886B. This shows that the price and MC has increased by about 14% and 2% in the time of just 7 days.

Top 5 gainers

However, the top 5 gainers of the week among the top 100 cryptocurrencies on the market are Celo (CELO, $3.56, 46.51%), TerraUSD (UST, $1.00, +0.10%), HUSD (HUSD, $1.00, -0.03%), USD Coin (USDC, $1.00, -0.06%) and Binance USD (BUSD, $1.00, -0.06%).

Top 5 losers

Also, the week's top 5 losers among the top 100 tokens include Kusama (KSM, $164.92, -46.61%), Internet Computer (ICP, $29.14, -40.31%), NEAR Protocol (NEAR, $1.81, -37.67%), Theta Fuel (TFUEL, $0.3977, -34.74%) and Neo (NEO, $30.25, -34.21%).

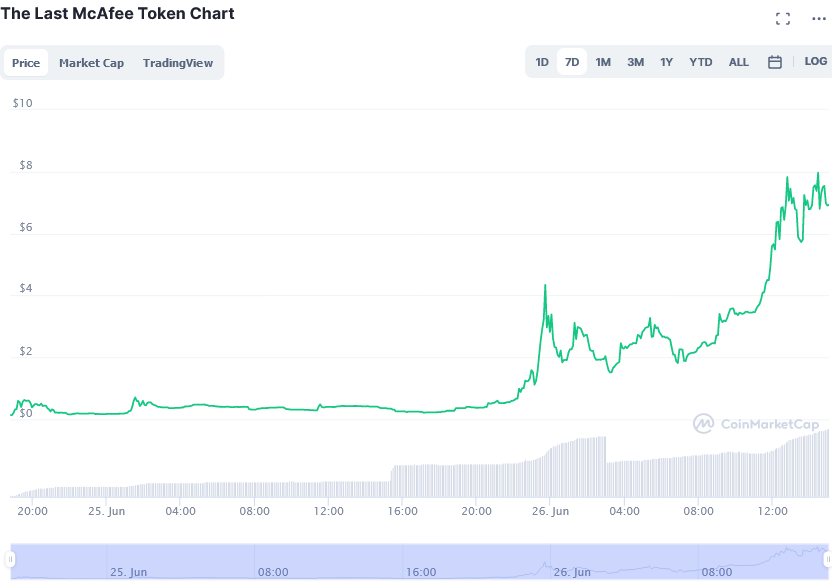

The overall cryptocurrency gainer and loser of the week across the market is The Last McAfee Token (MCAFEE, $7.22, +1600.92%) and Cavapoo (CAVA, 0.00000001, -65.93%), respectively.

Bitcoin to trade $325,000

Although the overall market is facing challenges, most cryptocurrencies are estimated to grow soon and reach and surpass their previous all-time highs (ATH), according to industry experts, including PrimeXBT.

Once it starts to sycotize, Bitcoin's price is predicted to reach a high of $325,000 in 2021 and a high of $275,000 in 2022, a high of $145,000 in 2023, and then an ATH of $1,000,000 in 2024-2025 and beyond.

Price

Coin expert

Price

News

Price

(0 comments)