Cryptocurrency Hodlers Aren’t to Blame, Bitcoin Hits $6,800

In March 2020 Bitcoin price volatility surged to a record high, due to massive sell-offs and panic on the market. However, recent researches of the cryptocurrency show that long term Bitcoin holders, aka Hodlers, are not in a hurry to sell their tokens.

Even when Bitcoin price gets drawn by bearish trends, Hodlers don’t seem to have changed their tactics of doing things. In fact, they are the one, who help to keep the cryptocurrency market perspectives.

Who is selling cryptocurrencies in fear of bear trades

March 12 was one of the most dramatic and volatile days for Bitcoin. Bitcoin price suddenly fell from $7,380 to $6,040 and continued falling. On the night from March 12 to March 13, Bitcoin fell sharply to $4,563 and reached its lowest level of $4106. Massive sell-offs caused panic on the market and more traders began to sell their activities. However, long-term hodlers were not the one dragged by panic attacks.

CoinMetrics ascertained that short-term holders that were hawking away their tokens at a loss were the primary cause of the bear market at the time – Black Friday, March 13. Users and investors who held BTC for not more than a year had cash-out their positions as the international financial market signalled a massive bearish trend.

HODL Factor demonstrates that it still seems like most of the recent price action has coming from short term holders that acquired #Bitcoin in the last 12 months. Longer term holders (>1yr) still seem unmoved by the recent prices pic.twitter.com/p0TAl2eMqg

— Benjamin Celermajer (@CelermajerB) March 17, 2020

Last week, Bitcoin (BTC) registered one of the mammoth sell-offs ever in its entire life after plummeting by more than 45% in just 24 hours. Actually, the low price of BTC/USD was $4106, a level that last happened about 10 months ago. This was one of the highest volatility that the Bitcoin market has seen in its entire history.

Don’t blame BTC hodlers for record 50% price drop

According to research released on March 17 by Unchained Capital, the previous volatility in the BTC value “did not come” from those holding tokens for a good couple of years or longer.

Nevertheless, the hodlers that were afraid of the massive market crash are now seen to be optimistically changing their hearts and returning.

#Bitcoin HODLer Net Position Change has been positive during the recent price dump.

— glassnode (@glassnode) March 17, 2020

This means long term investors have been accumulating discounted $BTC and increasing their positions.

Live chart: https://t.co/3dQGl4yZix pic.twitter.com/yxiWo8w3en

The BTC’s on-chain data analytic company, discovered that one of its tools used to ascertain when the whales in the industry are selling or buying Bitcoin – actually turned green after the deep price plunge that happened a few days ago.

This, therefore, implies that long-term hodlers applied certain major principles and theories of contrarian investing – purchasing more and more units in the times when there is blood in the streets (when the prices are rapidly falling).

Market updates: BTC/USD price analysis

As Coinidol reported earlier, March 12-13, 2020, was one of the worst trading days on the cryptocurrency market. Now, the cryptocurrency market is back in a more positive trend.

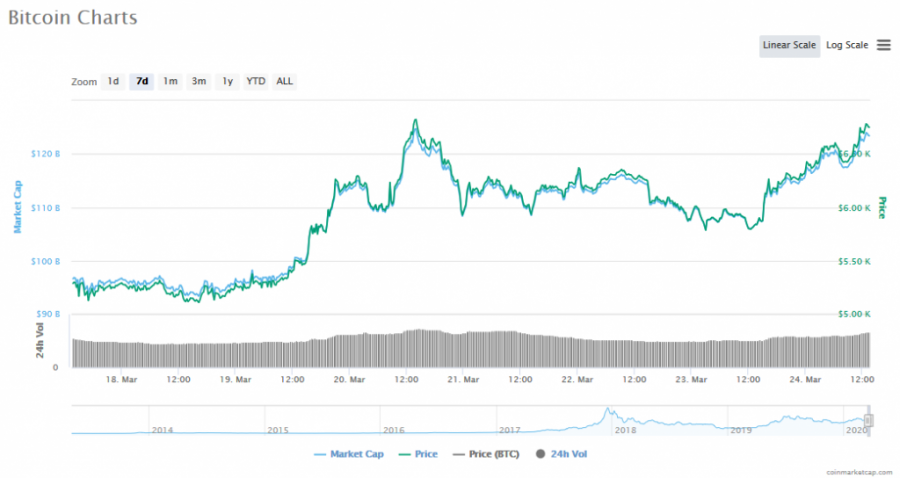

At press time (March 25, 2020), Bitcoin is still changing hands in green at $6,630 (-2,04 percent), with a market cap of just $121 billion and volume of almost $52.99 billion as well as the dominance of 65.8 percent. The volatile nature of cryptocurrencies keeps on scaring away institutional investors. But of course, just like any other business, losses and profits are expected – those who make profits become happy and the reverse is true.

Bitcoin could be in the new accumulation phase. On March 25, the bulls have been making frantic efforts to breach the $7,000 overhead resistance.

Ethereum price fell to $135 (-2,72%) with a market cap of $14.96 bln and volume of $12.3 bln. Ripple was also changing hands at around $0.16195 (-0.33 percent).

What is surprising is that just a month ago, amidst all the fears caused by the coronavirus pandemic, according to coinmarketcap.com, BTC/USD managed to hit a high of $10191.68 and a high of $10457.63 in the last 90 days, but to see it crawling at just above the $6,500 level appals the community. Are there some hopes that Bitcoin will in 2020 break the record it set back in 2017 when it hit over $20k? Well, it's the only time that can answer that question.

Price

Price

Price

Price

News

(0 comments)