5 Cryptocurrencies That Will Keep Investors Cautious in 2021

Despite the global economic recession caused by the Covid-19 pandemic, the cryptocurrency markets have soared significantly in value in 2020. The New Year is expected to be even more favourable for the growth of the industry, opening vast investment opportunities.

Despite the Covid-19 pandemic that seemed like a disaster due to the Black Thursday price collapse in March, most cryptocurrencies have managed to restore their value. Moreover, some of them even skyrocketed to new value highs. Bitcoin gained over 160% in 12-months, from approx. $7,400 to $23,423.56. Ethereum (ETH) has managed to gain by about 338% in value since the beginning of 2020.

However, there were a couple of cryptocurrencies that plunged more than 90% of their value in this year due to unavoidable circumstances and some tokens registered a loss of more than 99%. This includes cryptocurrencies such as aleph.im (ALEPH) that lost about 99.95 percent, kimchi.finance (KIMCHI) that plummeted by almost 99.51%, orion protocol (ORN) also lost by over 98.97%), and covesting (COV) dropped by about 97.97%.

Even though the cryptocurrency market looked so lucrative for traders in 2020, the coming year may be a shocking period for some cryptocurrencies. One of the reasons is that the coins are ending 2020 bearish and other reasons are regulation-related.

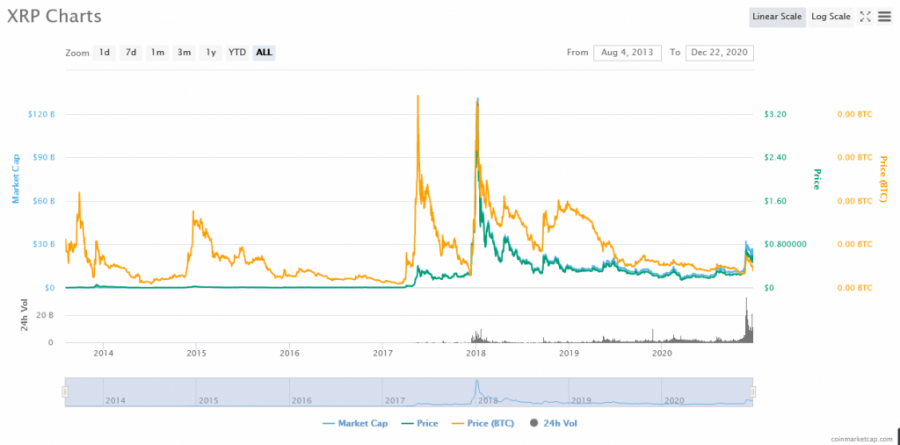

Ripple

Ripple (XRP) coin has performed well this year as aforementioned. However, currently it has serious trouble with the United States Securities and Exchange Commission (SEC). The watchdog plans to file a lawsuit on investor-protection laws violation.

Ripple is accused of selling unregistered securities to investors from different parts of the world. If the troubles last, it may influence the price of the coin negatively. Currently, XRP has lost over 30% of its value, with further perspectives being unclear. For this reason, investors should remain careful before investing in the coin in early 2021.

Ethereum Classic

Ethereum Classic (ETC) was formed through a hard fork of the original ETH network following the hack of the Decentralized Autonomous Organization (DAO). While several coins have performed well, ETC has been a major straggler in 2020. In this year, the coin has declined by over 45%, and is still finding it hard to recover.

Since hitting its all-time high of $47.77 on December 21, 2017, Ethereum Classic has never touched that level again. In fact, ETC has plummeted to as low as $3.30 in the last 52 weeks. The coin is expected to end the year below the $6.

The poor performance of ETC in 2021 will be due to poor user adoption since several developers prefer creating apps using Ethereum’s network. The coin will also struggle in 2021 due to the increased number of attacks in its network.

EOS

EOS price is predicted to drop to $2.35 before this year ends. In the last 52 weeks, EOS has recorded a low of $1.46.

In 2021, EOS will start recovering and is more likely not to go above $3. However, the future EOS price could hit about $4.83 by 2023.

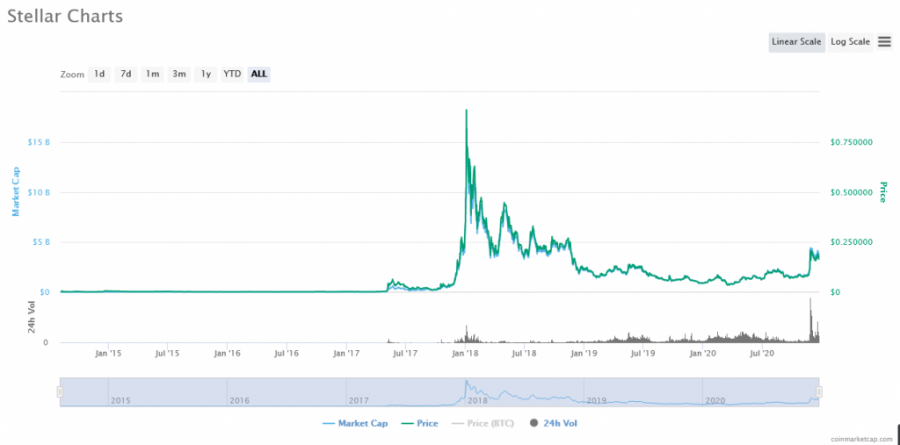

Stellar Lumen

Stellar Lumen has been following a downward trajectory close to 3 years, after hitting its all-time high of $0.938144 on January 4, 2018.

XLM is more likely to close the 2020 year at about $0.11. However, Analysts are predicting an increase of up to $0.19 by 2023 and $3.33 by 2025. While it might be a good investment choice in the long run, the coin will hardly attract investors aiming at big profits, for its growth is quite slow.

HedgeTrade

In the year 2020, HedgeTrade (HEDG) has been facing a lot of resistance in the market. HEDG has touched a low of $0.365783 in the past 52 weeks. Currently, HedgeTrade is the biggest loser among the top 100 cryptocurrencies.

HEDG has dropped by over 32.34% in the last 30 days. It is expected that the coin will enter 2021 with a bearish trend, so traders and investors should be careful while investing in HEDG.

Price

Price

News

Price

Price

(0 comments)