Blockchain Split: Bitcoin Cash Was Born

Updated: Oct 29, 2017 at 07:14

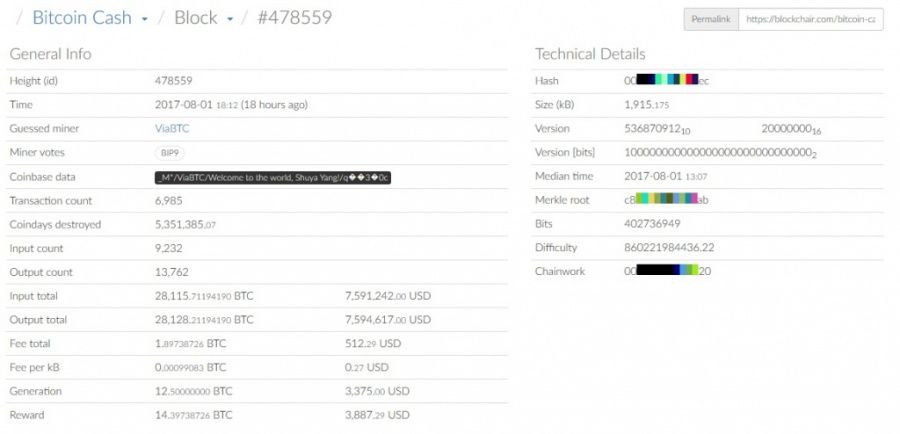

A Bitcoin Hard fork has occurred yesterday, August 1. The first Bitcoin Cash (BCH) block was mined only five hours later after the launch of the hard fork at 12:20 UTC.

The first BCH blocks were mined by the Chinese mining pool, ViaBTC, and one of them exceeded the size of 1Mb (max size of a BTC block) at 1,9Mb. So far, most BCH blocks are less than 1Mb and most probably it will take a lot of time until 2Mb blocks will be mined permanently.

Bitcoin Cash Price

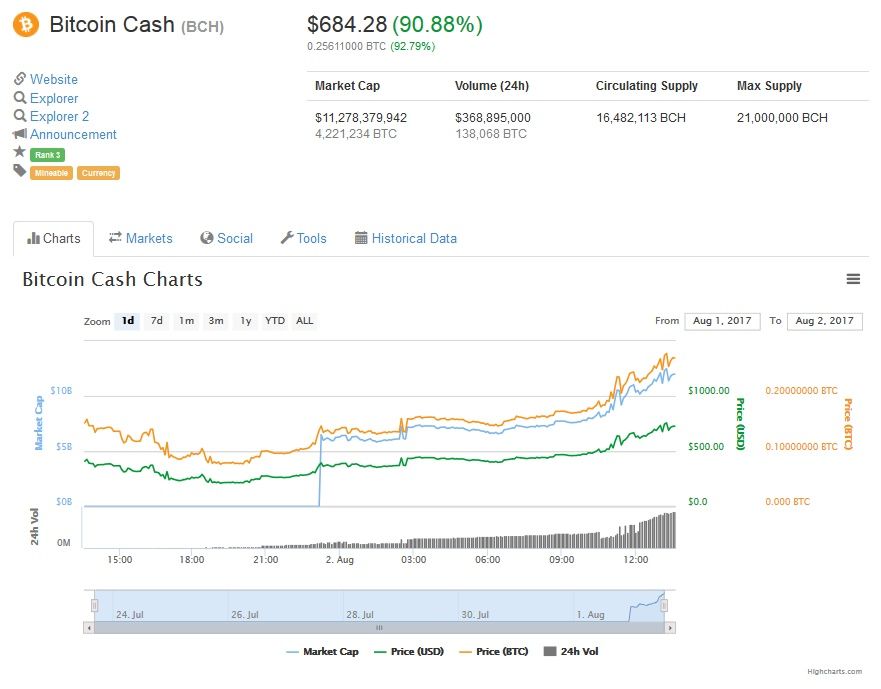

Following the launch of the hard fork, the price of Bitcoin Cash was slipping down to $216. However, successful mining of the first blocks gave a little turbo acceleration to BCH and it surpassed a level of $450.

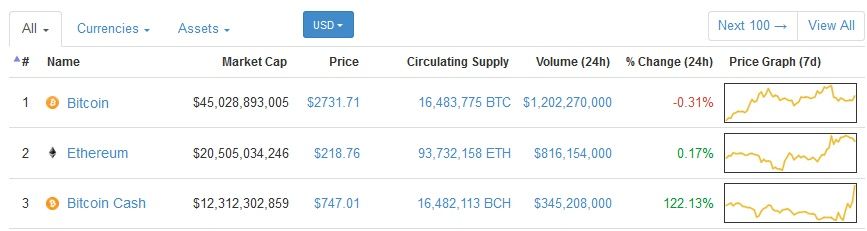

Soon after Bitcoin Cash was born, it actually jumped up into the top-3 cryptocurrencies with a market cap of $11 billion according to

coinmarketcap. Now, on August 2, the price of one BCH token is above the level of $690. And this price is expected to grow as more cryptocurrencies exchanges add support for BCH trading.

After the hard fork, several large exchanges that already support BCH faced problems with trading functionality. The Kraken exchange, one of the first cryptocurrency exchanges to add BCH, reported that it was affected by the influx of users seeking to start trading with new Bitcoin Cash token. And today it has announced that BCH deposits and withdraws may not be available for several days.

BCH deposits + withdraws may not be available for several days. We won't enable funding until we think it's safe.

— Kraken Exchange (@krakenfx) 2 August 2017

Coin expert

News

Politics

Price

Price

(0 comments)