Bitcoin Remains Stagnant at $8,000 as US-Iran Tensions Decline

In the past few days, Bitcoin formed a weird correlation to normal hide-out assets such as Gold, when its trading price skyrocketed as political turmoil between the United States and the Middle East region started increasing earlier this year, and the price began plunging as tensions slighted relaxed. Due to the fear of losing their holdings, it is expected that most people living in both regions, decided to seek safe haven in cryptocurrencies especially BTC, and because of that its price had to surge.

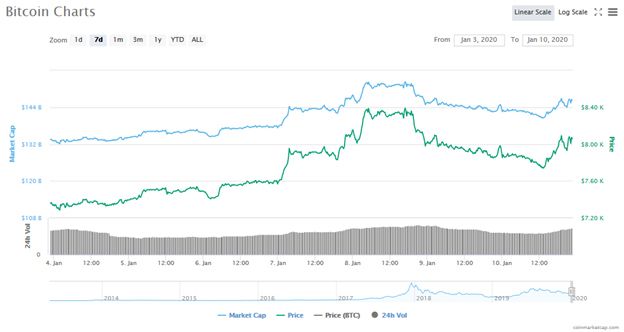

There is a time when Bitcoin gained momentum hit and surpassed the $8.3k cap, however, when the situation started to calm down, the cryptocurrency broke below $8k overnight, and now, market experts have started to note that the coin could be in for a considerably bottomless pull back, and further stated that this could put it use in great jeopardy.

BTC/USD Price Analysis

At press time, Bitcoin is changing hands at around $8,100 which is an almost 5% drop considering its notable 7-day high of $8.4k that happened on Wednesday January 8. The current market cap is standing at $146.3 billion and the trading volume is at $28.9 bln. The entire market capitalization is at $214.4 billion, and overall volume at $94.5 bln, according to coinmarketcap data. Bitcoin is not willing to stop dominating the entire cryptocurrency market, that is why its dominance is above 68%.

The major rally actually began in early-January when the United States drone strike on a top Iranian military leader Gen Qasem Soleimani, and the rally gradually amassed traction until Jan 7, when giants hit and surpassed the resistance which existed at $8. level. This price, which consequently became a key support level, was finally cracked below on Wednesday when whales bolstered their trading pressure.

The rise in trading pressure especially selling appeared immediately after the world discovered that – for the moment – the U.S. doesn’t seem to have plans of hitting back against Iran for their missile attack on an Iraqi military base.

Price

Price

News

News

Price

(0 comments)