Bitcoin Price: Searching For The Power To Grow

Bitcoin’s price continues its decline for the seventh day in a row. Strong economic data, which was published yesterday, pushed up BTC price a little but it’s too early to speak about the resumption of price growth.

Yesterday the US published the latest data on the index of consumer confidence, the index of manufacturing activity and new housing sales. The data came out better than forecasted the and EUR/USD pair reacted instantly with a decline, while Bitcoin’s price rose to $655.

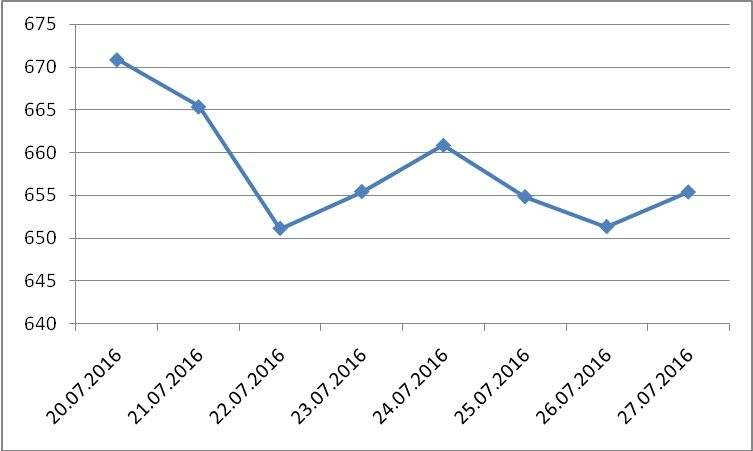

BTC/USD exchange rates for last 7 days (July 20 -27):

Today will be rich with other macroeconomic events. The UK will publish data on the GDP in the 2nd quarter of the year, and the US – data on the volume of orders for durable goods.

But the main event of the day will be the announcement of the results of the Fed meeting. Today, the basic interest rate is unlikely to increase, and will likely stay at the same level. But the Fed can say that in 2016 the rate increase will be held anyway. This would be enough for a sharp strengthening of the US Dollar. And along with it, the Bitcoin price may rise. Thus it is necessary to consider that the world's major central banks are preparing for stimulus measures against the backdrop of inflation by easing monetary policy. Therefore, despite the moderate demand for Bitcoin we see today, the main cryptocurrency price has every reason for a resumption of growth.

Today we expect Bitcoin to try to obtain a foothold at $655 again. In the afternoon it may strengthen its positions to $660 and $665.

$650 is a support level. Resistance level is $665.

This analysis and forecast are the personal opinions of the author and are not a recommendation to buy or sell cryptocurrency.

Price

Coin expert

Price

Price

Price

(0 comments)