Bitcoin Price: New All-Time Heights - It Is Market Cap This Time

From the very beginning of this week, we might watch BTC getting back on its feet. Or, rather, its market.

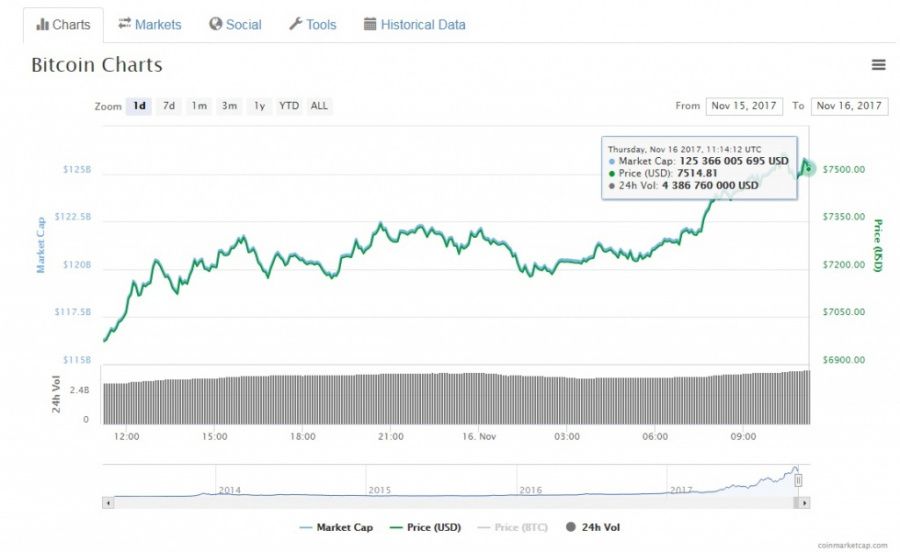

By the evening of Wednesday, November 15, Bitcoin cost $7215.03. Thus, it recovered its position lost during the correction. Seems encouraging enough. At least those who bought the coin before its crush may calm down for some time, as they won’t lose their money if they need to sell.

The price recovery basically owes itself to the increase of BTC market cap to an all-time high of $217.1 billion. This has probably happened because of Man Group’s announcement this week. The company’s CEO, Luke Ellis, stated that Man Group “will add bitcoin to its investment universe if CME launches futures contract as planned” at the 2017 Reuters Summit. That should bring new buyers to the market. At the moment BTC price has increased even more. It costs $7514.81.

Besides, Square Cash, a mobile financial service application, is testing bitcoin integration, which also adds to the bullish sentiments of the traders. And let’s not forget that Senator Paul Rand announced his plans to cancel the individual mandate portion of Obamacare in line with tax legislation. This has a negative effect on the dollar, improving the position of BTC.

In general, the forecasts are more than bright. However, some experts believe there is also a chance of another pullback in the case of some unfortunate events in the market. Mattia Rizzi, a financial analyst, electronic trading and blockchain expert at Société Générale Corporate and Investment Banking, stated to Coinidol:

“It looks like the market has recovered pretty strongly from the sell-off, drawing a double bottom at around 5800$, which usually indicates market bottom and the start of a bullish recover. Nevertheless, bears are still in control of the market, and there is strong resistance at around 6750-6800$. As a result, we can likely expect further price consolidation, unless said resistance is broken which will send price to >7000$.”

According to Michael Morton, the founder of Morton Bitcoin Management, a niche IT investment firm that specializes in Bitcoin investing and startups using blockchain technologies, and GNEISS, a universal Ethereum peer-to-peer smart contract asset exchange, there are two possible outcomes. He told Coinidol:

“The cancellation of the SegWit2x Fork is definitely good news for bitcoin. New Investors won't get confused about which blockchain is the original bitcoin blockchain. I would expect this to be bullish news for bitcoin that might make it resume its long-term bull trend to $10,000. Otherwise, I would expect a return to around $5,000 over the next few weeks.”

Price

Price

Price

Price

Price

(0 comments)