3 Indicators We’re Absolutely in a Bitcoin and Cryptocurrency Bull Market

This week has seen more signs that bullish trends have returned to Bitcoin (BTC) and the entire cryptocurrency market. The next bull run could be near.

Since the beginning of 2020, BTC has been trading bullishly and its 30-Day High / Low is so far sitting at $9,824.62 USD / $7,726.77 USD respectively - which is a good figure. The blockchain and digital currency community is optimistic that a five figure price is on its way coming.

BTC Futures Market is Gaining Traction

The number one cryptocurrency by market cap fleetingly hit and surpassed the $9,500 support, and it is spending a day over $9,700. But the shift downside was just a brief blip on the radar as Bitcoin soared once more above $9,600.

With this current price BTC is doing very well, but there are other indicators showing higher prices than these. The $10k tier signals again, and the entire feeling within the cryptocurrency community has increased the BTC fear and greed index. And the recovery of Tesla (TSLA) to be above the $900 level lifted the positive feeling on the cryptocurrency markets and this influenced both BTC and other popular tokens including Ripple (XRP), Ethereum Classic (ETC), Centrality (CENNZ), KickToken (KICK), and others. Albeit, the futures markets are poking particular markets signifying Bitcoin is getting ready for yet another bullish trajectory.

The Bakkt digital asset trading platform reinforced another time, with a record in open interest, as Bitcoin steps in a more exciting price move. Last month, Bakkt undertaking was watchful, in spite of the value advances seen by Bitcoin.

But the largest hub of undertaking remains the BitMEX futures, that is up to now is attracting a wide range of institutional traders. The important price caps for the leading cryptocurrency by market cap can lead to a more intense short-term trends, and a fight of positions while trying to ascertain the exact potential and forte of bullish market movements.

The CME futures gap, that indicates a trade $200 beyond the latest values, are also assumed to temporarily trigger high the markets. Gaps have a habit of being occupied by cryptocurrency markets, and are normally applied as a signal of bullish market trends. All these factors indicate that BTC is skyrocketing higher soon.

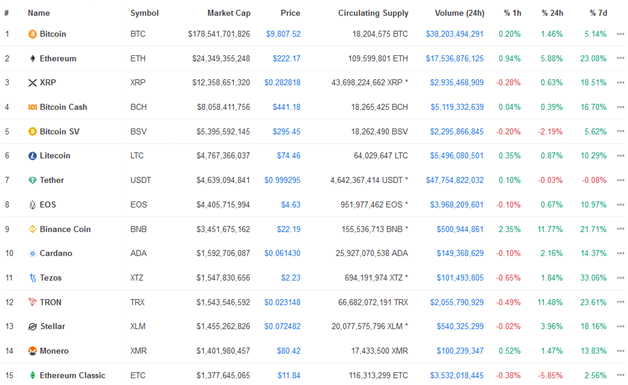

Meanwhile, the BTC/USD price is standing at above. $9,800 (1.5%), with a market capitalization (MC) of $178.34 billion and 24-hour of $38.28 billion – still dominating the market by 63.9%. According to the data by coinmarketcap, the entire MC is sitting at over $279 billion and the entire volume is at $141.7 billion.

Price

Price

Price

News

Price

(0 comments)