Algory Project: Trade More Profitably And More Effectively With The New Cryptocurrency Tool

Algory Project is a product created by traders for traders. We are delighted to bring the experience and tools found on the US stock exchanges, where we have been present for over 10 years, to the market in which we are now active - a market which still lacks professional tools to streamline trading.

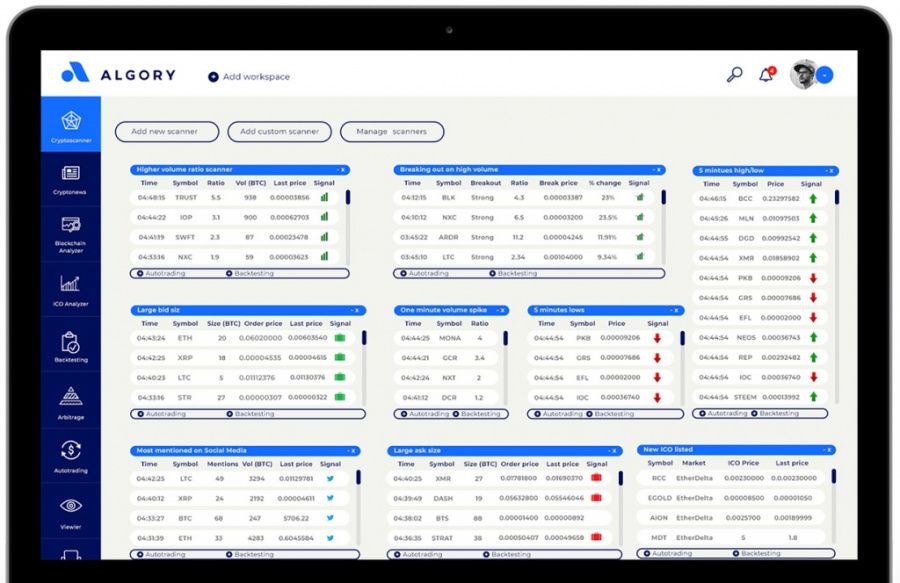

We are pleased to announce that – through its ICO – Algory Project wishes to introduce a crypto-trading tool that will change the way you perceive trading. Today I would like to show you the first flagship functionality of Algory – Cryptoscanner.

“The idea for the tool was born at the beginning of 2017. It was a period when we really did a lot of trading in the cryptocurrency market, carrying out several dozen to several hundred transactions a day. We realized we did not have enough time to quickly and efficiently analyze the cryptocurrencies with the greatest potential to generate above-average profit. On the US stock exchanges in which I traded, such tools were present and practically all professional traders used them. I cannot imagine a trading office where nobody uses such a boon as a scanner.”

– Dominik Gordel, Algory Project Cofounder.

What is CryptoScanner?

Cryptoscanner is the first truly versatile such tool to appear on the cryptocurrency market. It will allow you to scan cryptocurrencies in fractions of a second, taking your trading to a level you never knew before.

“I still remember the time when there were just a few cryptocurrencies available. Over the years, their number has grown to almost 1,200 and it is impossible to browse them in a matter of minutes, let alone seconds.” – Kuba Jodłowski, trader and dev team member.

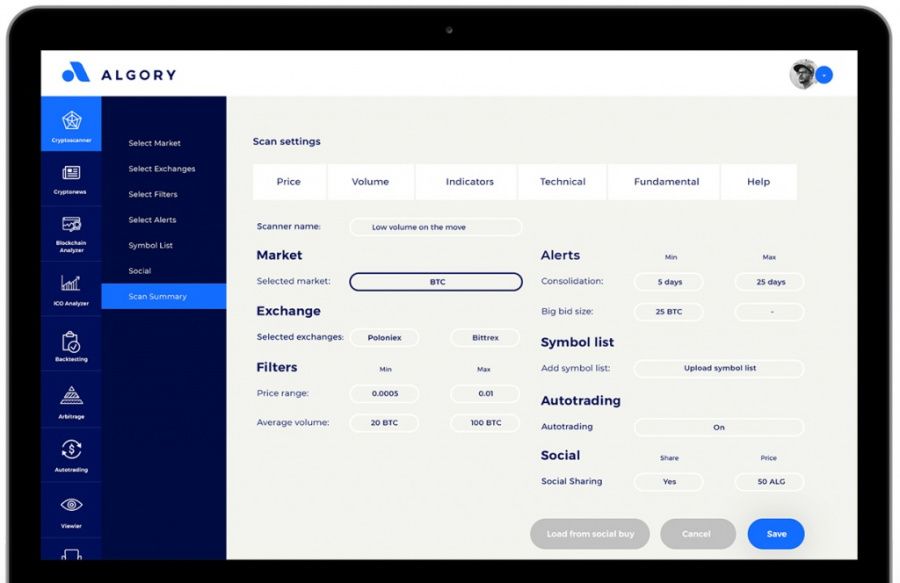

CryptoScanner will allow you to choose from hundreds of available filters and alerts. The tool will be based on the data collected from the cryptocurrency exchanges all around the world and properly processed on our servers.

Traders who already have their own trading strategies will be able to improve their trading and increase the number of signals they receive for potentially successful transactions by specifying the appropriate filter and alert values on the platform. Once the parameters are set, the scanner will start scanning the specified markets to find cryptocurrencies that meet the established criteria.

Difference between success and failure in the cryptocurrency market

Often, after I made a very profitable transaction, my friends asked me how I opened a position even before the most important traffic occurred on a given financial instrument.

I told them it was due to several factors:

1. The speed at which you get the appropriate information on the market

2. Your response time

3. Your strategy’s effectiveness

I tried to make them realize how important the information I gave them was, so they would try to use the tools that are available on the market even if they had to pay for them. It was certainly worth their while as they would be compensated quickly for the cost.

In general, when it comes to capital markets across the world, there are many things and assumptions that smoothly transcend from one market to another. This is what we do when we transfer our behavior, strategies, and approach to trading from stock exchanges to cryptocurrency exchanges.

Preparation for trading, analysis, access to data and information. First of all, building the correct trading strategy – this is how you make money in the market. Cryptoscanner and the features associated with it, such as Backtester and Auto-trading, are designed to accelerate, streamline, and make the decision-making process much more efficient.

Once the user sets up any of the following filters and alerts, the Cryptoscanner engine will find cryptocurrencies that meet the predefined values.

Hundreds of filters and alerts

The filters available on the platform include:

– Price (/BTC /USD /ETH)

– Spread (/BTC /USD /ETH)

– Medium volume (BTC, cryptocurrency, USD)

– Volume variability (every 1/3/5/10/15/30/60 minutes, daily)

– Session volume (every 1/3/5/10/15/30/60 minutes, daily)

– Big Bid size

– Big Ask size

– Cumulative Bid size

– Cumulative Ask size

– Average daily reach

– Bid/Ask ratio

– Spoofing orders

– Rate variability to /btc /eth /usd (every 1/3/5/10/15/30/60 minutes, daily)

– Variability in recent days/weeks/months/years

– Technical indicators, such as MACD, RSI, SMA, EMA, MA, Momentum, Oscillator, SAR, RVI, Stochastic, Bollinger, TRIX, VWAP, VWMA, VECS, Williams, and CCI

– Market cap

– Circulating supply

– Algorithm

– Proof type

– Block reward

– Difficulty

– Minimum transaction size on

All of which you will be able to associate with alerts to make the developed scanner more precise.

The alerts that will be available on the platform include:

– New 1/3/5/15/30 minutes high/low

– Volume ratio changes on different intervals

– Sudden spike up/down move

– Deviations from the average market price from different exchanges

– Deviations from average volume from different exchanges

– Cross between bid and ask

– Up/Down Candles

– Consolidation breakout/breakdown (different intervals)

– Consolidation channel

– Daily low/high breakthroughs

– Systematic (several candles) move up/down

– Move above open/below close

– Volume spike (different intervals)

– Social media activity (Twitter, Reddit, Stocktwits)

– Support/Resistance crossed (different intervals)

– Candle pattern recognition (doji, hammer, topping/bottoming tail etc.)

The trader will receive all these signals when the specified conditions are met.

In addition, the user will get access to the scanners prepared and used by our top traders in recent months to generate terrific return rates. Predefined scanners are great for beginner traders, so they will be able to understand the decision-making processes used by the experienced players and could develop their own strategy and adapt to their personal style and risk aversion level.

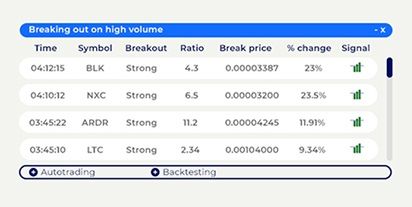

To illustrate this clearly in an example

The trader is focused on finding consolidation breakouts which are the most effective when the breakout occurs on a turnover volume that is several times higher relative to its average turnover.

In that case, they will use several Cryptoscanner filters:

1. Price range of cryptocurrencies (possibility of choosing price in relation to BTC, ETH or fiats).

2. They will determine the average volume.

3. They will determine the volume ratio, i.e. how much the volume should increase. E.g. volume ratio 3 (3 times bigger than the average).

Then they will go to the alerts where they will choose:

1. Consolidation breakout – where they will determine at what intervals the prior consolidation had to be delineated.

When the criteria above are met, they will receive all information about the events that occurred in the scanner window:

The trader will be able to choose from a very wide range of

1. Filters

2. Alerts

In addition, they will be able to specify:

1. The cryptocurrency exchanges to be scanned.

2. A list of symbols that they would like to be scanned.

3. Enabling the auto-trading feature that will open/close positions based on pre-defined parameters.

4. Strategy backtesting to simulate its efficiency on the basis of its historical data.

We are also planning to add a social aspect to our platform so that traders will be able to share their filters/alerts with others.

Development of trading tools

Are there any similar tools or functions available on the market?

“There are some free cryptocurrencies browsers, such as cryptocompare.com and cryptowat.ch and cryptomarketscanner.com. However, their functionality is limited, and users cannot filter them based on their own filters and alerts. Not to mention the possibility of adding backtests or auto-trading” – concludes developer team leader Marcin Gordel.

There is currently no product on the cryptocurrency market that will scan cryptocurrencies the way Algory will. Some can catch price changes or volume increases. But that’s about it. Users cannot set their own filters and alerts in such a sophisticated way as to receive feedback within seconds.

Our product goes out to a market where there are close to 30 million users with accounts open across all of the world's cryptocurrency exchanges. This is a huge target group to fall in love with our product from the very start. We do not hide the fact that this is what we’re counting on when creating this powerful tool.

Friendly interface of Algory Project

The Algory web-based application is designed for the most intuitive and simple use. It is prepared in the form of drag & drop windows which you can embed on your dashboard depending on your preferences and priorities.

The application is accessible to the end user and does not require them to know anything about programming. Your task will be to select values for certain filters and alerts.

About Algory Project

Algory Project was founded by two traders who come from the American stock exchanges: Tomasz Przybycień and Dominik Gordel. In cooperation with developers and technology specialists focused on trading tools, they started to develop a multifunctional tool to support cryptocurrency trading – Algory.

Sign-ups for the Whitelist ICO – Algory.io started on November 15. Join the Whitelist to be sure that you will be able to purchase the Utility Token ALG with a 20% bonus.

Check our website: https://algory.io

Disclaimer. This article is paid and provided by a third-party source and should not be viewed as an endorsement by CoinIdol. Readers should do their own research before investing funds in any company. CoinIdol shall not be responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any such content, goods or services mentioned in this article.

Price

Price

Price

News

Price

(0 comments)