Why High Trading Costs Have Become an Industry Norm

Updated: Apr 21, 2021 at 12:08

No trader is immune from risks and losses when trading cryptocurrencies. Investors have to put up not only with the high volatility of coins, but also with the various fees that crypto exchanges charge. If someone doesn’t correctly plan out their trades, then the cost of commissions can quickly absorb a significant portion of profits.

Below we will take a look at the types of trading fees on top crypto exchanges. This article will help novice traders, or those who trade small volumes, to save their money and pocket the maximum profit when trading.

Types of fees on crypto exchanges

-

For deposits: A certain fee is paid to add assets to the account. Usually, when crediting in cryptocurrency, users do not have to pay fees nor a minimal amount. However, when crediting with fiat, fees are typically charged for payment operation.

-

For withdrawal: Traders must pay commission when withdrawing funds from an account, however, the fees are much lower when withdrawing cryptocurrency than when extracting fiat funds.

-

For trade: A certain amount is charged for opening and buying an order. Many exchanges have recently introduced a differentiation of transaction fees depending on the category of traders: makers or takers.

A maker is someone who draws up deals and puts them up for sale.

A taker is someone who buys open orders created by a maker. Usually, the exchange charges a lower commission for makers than for takers, since the former improves liquidity, and the latter decreases it.

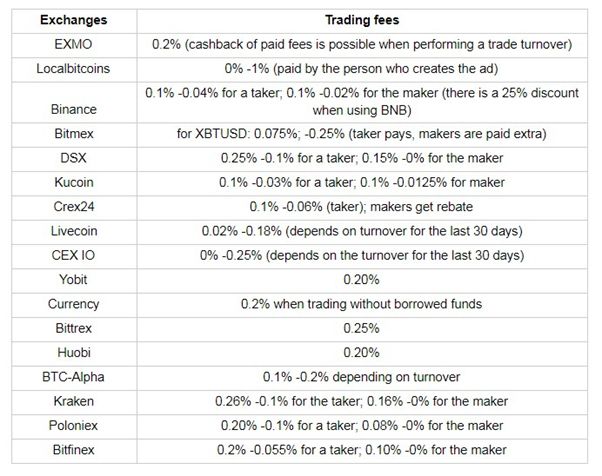

The difference in commission depends on the categories of traders on Bitfinex, Binance, Poloniex, Coinbase Pro, and others:

Ratings do not always help in making the right choice, however they do help with navigating various exchanges. On the official website of almost every exchange, it is indicated what fees the platform charges their users. The exact fees depend on a number of factors including the role of the trader (maker or taker), which specific cryptocurrency is interacted with, and the volumes for each currency.

How to save on trading fees

Using the native exchange token will help to save on commissions. For example, the South Korean exchange Bithumb has announced plans to issue its own token on the Bithumb. The company said that their altcoin will become a means of paying exchange fees, transaction fees, and rights to use the trading platform systems. Other major exchanges already have their own tokens with discounted internal fees on platforms such as BitMax Token, OKEx Utility Token, Huobi Token, KuCoin Shares, and BNB.

BitXmi Exchange is a young, but already well-known Singaporean crypto exchange, which has been successfully operating in the CIS countries; the Middle East, India, Europe, and Africa for over a year, has offered to pay commissions using the internal BXMI token. BXMI can be bought directly from the exchange and a flat fee of only 0.1% is charged for trading. In addition to this, they have the lowest trading fees in the entire cryptocurrency exchange market.

Disclaimer. This article is paid and provided by a third-party source and should not be viewed as an endorsement by CoinIdol. Readers should do their own research before investing funds in any company. CoinIdol shall not be responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any such content, goods or services mentioned in this article.

Coin expert

Price

Price

News

(0 comments)