Ethereum, Ripple, Bitcoin Outlook, Analysis of Top 16 Cryptos

Updated: Jul 19, 2020 at 22:22

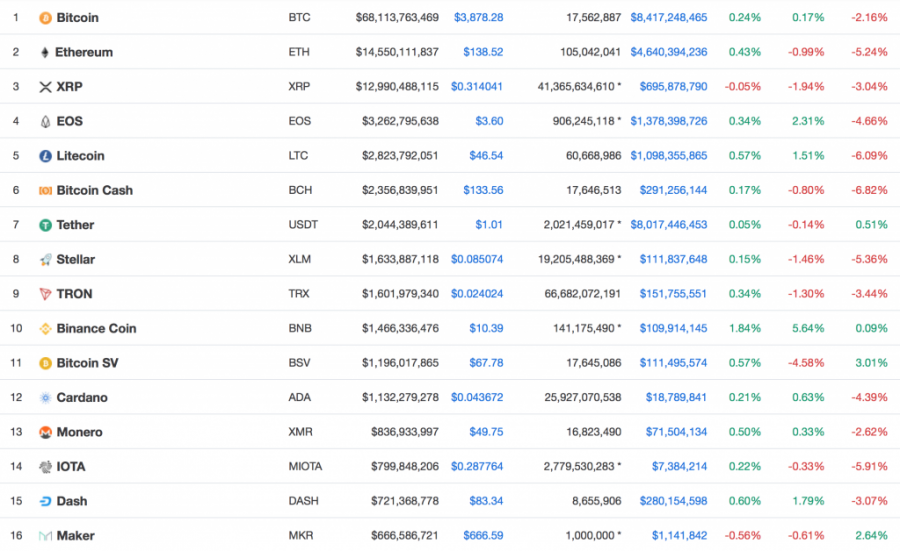

The price of Ethereum soared with high momentum by 15.13% over the weekend recovering from its Friday lows of $146 to Sunday highs of $168.58. At press time, Ethereum is trading at $138.52 (-0.99% 24h), Bitcoin (BTC) trades at $3878.28 (0.17% 24h) and Ripple at $0.314041 (-1.94% 24h).

![]()

![]()

On the daily view, as you can see, many of the

Top 16 cryptocurrencies are in “the Green”, while Bitcoin SV (Satoshi Vision) has dratically decreased and is traded at $67.78 (-4.62% 24h). Surprisingly its only Tether (0.51% 7d), Binance Coin (0.09% 7d), Bitcoin SV (3.01% 7d) and Maker (2.64% 7d) that have a weekly trading price in Green.

ETH/USD

From that time, the price of the second largest cryptocurrency by market cap, Ethereum, started sloping down by more than 20% to $138.44 on February 25.

When you look at the hourly chart, the price had the support of a 0.618 Fibonacci level on Monday’s demise and the price trend begun creating a symmetrical triangle, particularly around those levels.

This triangle could be taken by many as a bearish pennant, a trend continuation configuration so another collapse from this point could be in pipeline.

Further consolidation and a slanting trend would now be anticipated before another major breakdown as the market players are becoming muddled by these present crypto market conditions.

XRP/USD

Ripple, the third crypto by market cap, has been making occasional independent trends from time to time but it appears to have lost its upbeat charisma.

Some experts believe that the Ripple plunge is due to the dominant entry of JPMorgan’s crypto “JPM Coin,” while others think its XRP/USD unstoppable collection. Ripple has been trading out of sync with Bitcoin and the other market as well. As a matter of fact, the daily chart for XRP/USD indicates the Ripple is heading for a significant breakout if at all the golden cross observed on the chart comes to completion.

So far, there is a threat prompting to stop the golden cross to come to fruition and that’s indeed the death cross on XRP/BTC. But if it comes to fruition, Ripple investors will wait for some good time for the price to rebound again even to its latest levels.

Price

Coin expert

Price

News

Price

(0 comments)