The First Cryptocredit Aggregator is Sudden but Not Surprising

CRYPTOCREDITCARD's token pre-sale access until November 29, and ICO open on December 4.

The uprising global blockchain economy makes financial industry and banking open, fast and secure as never before. First time in the history we are complicit in the true business network creation based on peer-to-peer operation model. The business community in the world now starting utilizing a completely new blockchain infrastructure with a new credit and investment players linked with each other without significant boundaries and blocks. It is a time when we are inextricably linked with the global union crypto-network and without any surprise it is very predictable the service like Cryptocredit Aggregator to emerge with the aim to help users not be confused by a very rapid pace of the trend development as well as with a wide range of cryptofinancial products and services the world market never faced.

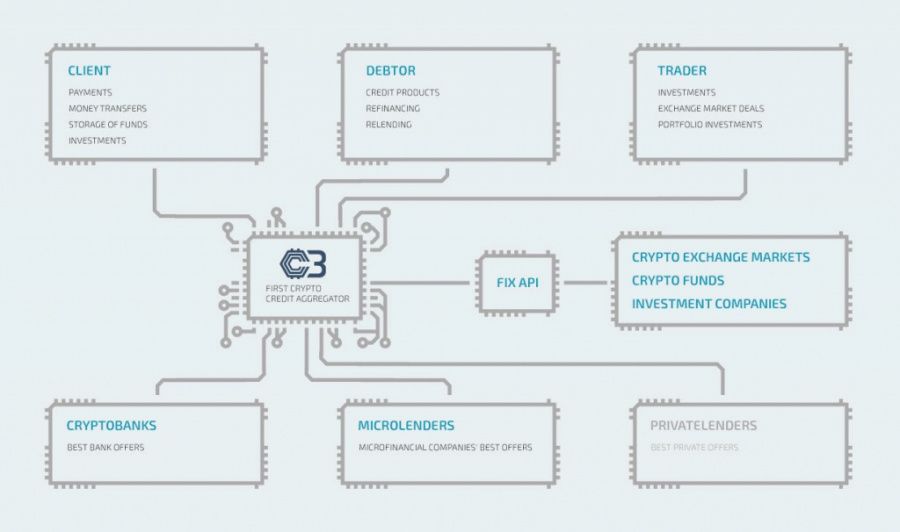

CRYPTOCREDITCARD is the first crypto credit aggregator. The goal of the project is to monitor and aggregate the best credit offers based on the blockchain technology. The implementation of the project will simplify the management of cash, including crypto currencies, in one convenient payment system and will provide an opportunity to select the most balanced credit product and invest in crypto currencies, ICOs or trade on the global investment platforms.

CRYPTOCREDITCARD has a huge potential for supporting innovative companies when making investment decisions.

Consumer Crediting

Banks will be able to grant loans on the basis of blockchain technology smart contracts, which will allow them to reduce costs and simplify accumulation of information about the solvency of the clients. The clients will be able to obtain loans on the most favorable terms by choosing the most optimal credit product or by use all credit limits that will be approved by banks, managing thereby a pool of their limits.

Crypto Crediting

Crypto crediting is the provision of loan in traditional currency pledged by crypto currency on the platform account. This is an innovative solution in the credit market. Banks will be able to grant loans secured by crypto currency based on smart contracts even to the clients with a low credit rating or by reducing the number of procedures necessary to grant a loan on favorable terms and guaranteeing a minimum interest rate.

Micro crediting

Now on the market there are many micro crediting offers from banks and micro financing funds. The platform will allow choosing the optimal solution for the client without going through additional procedures of solvency analysis. For banks and micro financing funds, the platform will give access to an additional sales channel for their products.

Mobile Banking

The C3 international payment system will allow:

- Make purchases paying anywhere.

- Transfer money to other users without commission.

- Pay the bills.

- Receive a cash back up to 30%

- Convert currency.

- Withdrawal cash using Crypto Credit Card.

- Investment opportunities

The received financing in the form of micro credit or crypto credit on the platform is easy to invest in any crypto currency, ICO or fund. The platform will provide access to the global network of exchanges and investment platforms to any user.

Cashback Aggregator

We plan to integrate C3 into the all major retail chains, hypermarkets, cafes, restaurants and service centers for establishing joint affiliate programs. When paying for goods and services by Crypto Credit Card in these places up to 30% of the amount spent will be refunded. We have already reached agreements with partners to organize joint programs at the international level.

THE GLOBAL C3 PLATFORM it is based on, is the true database HUB of Bank Credits, Private Loans, Investment Venues and ICO offers. Using the API of system is possible to monitor and compare the world crypto financial products and make and investment plans based on your comprehensive worldwide credit and investment potential with the highest rate of efficiency.

C3 PLATFORM:

- an aggregator that selects the best credit offers form the private lenders and institutionals around the world and makes it easier to receive a loan on favorable terms. A C3 user easily selects the most profitable credit product and receives a fiat or a crypto loan in one click;

- convenient mobile banking for making payments, storing and converting fiats and crypto currency, available immediately after registration a client on the platform or issuing a Crypto Credit Card;

- a platform that allows to manage funds on top crypto exchange markets. C3 clients easily manage funds by investing credit or debit funds on global investment platforms;

- C3 allows to monitor the best upcoming ICO, make proposals, private placement, and participate in the crowd sales.

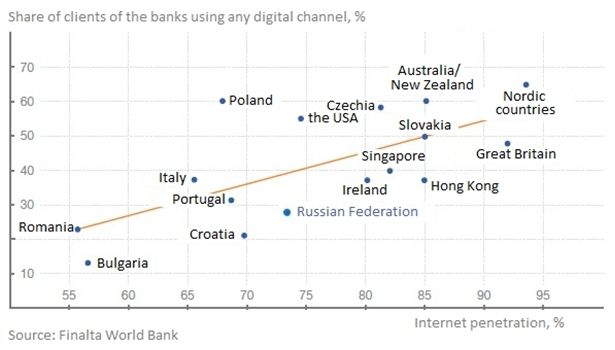

According to Finalta World Bank research the share banks’ clients using remote banking services in Nordic Countries, Australia and USA is about 60%, in Russia (no more than 30%), in Great Britain and Singapore (about 40%).

The main problems and inefficiencies of the credit market are related to the following factors:

- Bureaucratic procedures associated with solvency verification. Lending is connected with multiple risk factors that can lead to the non-repayment of a loan within a specified period. Therefore, the provision of loan, according to the bank, is a subject to the solvency verification, or analysis of the factors that can lead to the non-repayment.

- Low solvency rate of debtors. Banks seek to offer higher rates or require pledges to sell their credit products to debtors with low solvency rates. For the clients such conditions often appears to be unfavorable.

- High debt overburden. If a debtor has a problem with debt repayment, it often becomes necessary to take another loan to repay the previous one. The time for obtaining a new loan is usually limited, therefore each new loan is taken on more and more worse conditions.

- Refinancing needs. The interest rates of long-term loans or loans previously obtained in foreign currency, with time, become the least favorable among the credit offers on the market, and it becomes necessary to look for more relevant credit products to refinance the original debt.

- Speed of processing requests. Usually, the time spent for processing of requests by banks is not fixed and depends on time of the provision of all the necessary information by the clients. Requests are processed manually, only part of the processed information can be automated. The process of obtaining a loan is sometimes delayed by months.

However, the crypto currency revolution implies that customers do not need unnecessary intermediary elements anymore. Decentralized principle and transparent transaction makes all industrial players equal and one game rule compliant. That is, today we have a permanent P2P system to be a basis for the new global union civilization. That means that the easy and plain CRYTPTOCREDIT AND INVESTMENT HUB in the mobile linked with the unique CRYTOCREDITCARD is essential tool for the new era for everyone regardless size or originality.

The C3 platform API opens new markets for the industrial players around the world

Cooperation with C3 for banks will imply access to new client segments, including clients interested in blockchain technologies, multi-currency wallet, mobile banking for making payments, as well as clients interested in investment possibilities of blockchain ecosystem. The decentralized principle will allow the platform to cooperate with banks and clients on a smart contract basis, which will reduce costs, accelerate the launch of new credit products and time for processing information and making decisions.

C3 PLATFORM is a great opportunity for the B2C and B2B models in the industry. With the fast and simple integration, companies can connect with the global marketplace and access private customers willing to take a loan or invest. Also business-to-business or interbank activity based on the business product range aggregated can be performed.

Participate in the Pre-ICO and get CCCR tokens

Disclaimer. This article is paid and provided by a third-party source and should not be viewed as an endorsement by CoinIdol. Readers should do their own research before investing funds in any company. CoinIdol shall not be responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any such content, goods or services mentioned in this article.

Price

News

Price

Price

Price

(0 comments)