Ethereum Battles the $380 Resistance for a Possible Rally

Following the recent rebound above the $310 support, buyers made impressive moves as price reached the high of $380.

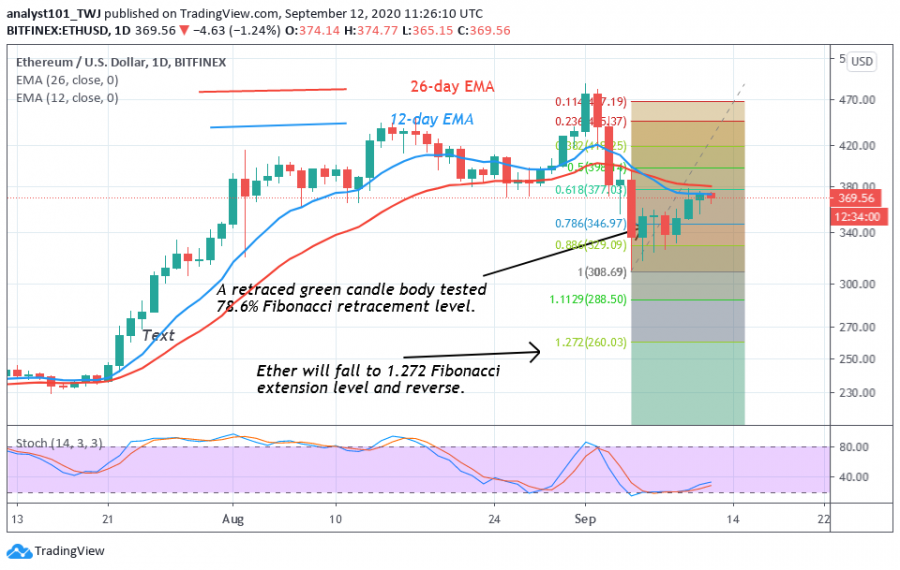

The biggest altcoin could not continue the upward move as the coin faced rejection at the recent high. Perhaps another rebound below the resistance could have propelled the price above it. The bullish scenario will return if the price breaks above the current resistance and the momentum is sustained.

In the meantime, Ether is retracing and trading at $370 at the time of writing. Sellers will attempt to break the current support if price retraces to the support level. ETH will decline to $260 if the selling pressure persists. For the past week, the $310 support is holding as buyers are poised to defend it. Nevertheless, the current fluctuation will linger if the key levels remain unbroken.

Ethereum indicator analysis

Ethereum price is still below the EMAs; therefore the price will always fall. It is only when price breaks above the EMAs, the bullish trend will resume. In the meantime, Ether is in a bullish momentum as price is above the 25% range of the daily stochastic.

Key Resistance Zones: $220, $240, $260

Key Support Zones: $160, $140, $120

What is the next direction for Ethereum?

The current direction of Ethereum will depend on the price action. The market will resume the upside momentum if price breaks above $380 high. A break below the current support level will mean the resumption of the downtrend. After the last bearish impulse on September 5, the retraced candle body tested the 78.6% Fibonacci retracement level. This indicates that ETH will fall to 1.272 Fibonacci extension level or $260 low if the current support is breached.

Disclaimer. This analysis and forecast are the personal opinions of the author that are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol. Readers should do their own research before investing funds.

Price

Price

Price

Price

Price

(0 comments)