Bitcoin Price Restored To Its Position After Corrections

After the slight decrease that we have seen over the past two days, the Bitcoin price returned to a level around $660. At the moment, this level supports the price and doesn’t let it to move down. The lack of sellers in the market, speaks to the imminent resumption of the uptrend.

By the end of the week the price of Bitcoin has decreased, but over the weekend Bitcoin lost its weight a little. CoinIdol.com asked Daniel Dabek, founder of Safe Exchange, curator of Alt Coin Trading Community, about why the price has declined over the last few days and got this answer:

“Bitcoin dropped slightly, and lightly in the past week during a low volume week. It has been two weeks post the block reward halving, and the effects of diminished supply and lack of selling interest means we could still see Bitcoin reach higher prices.”

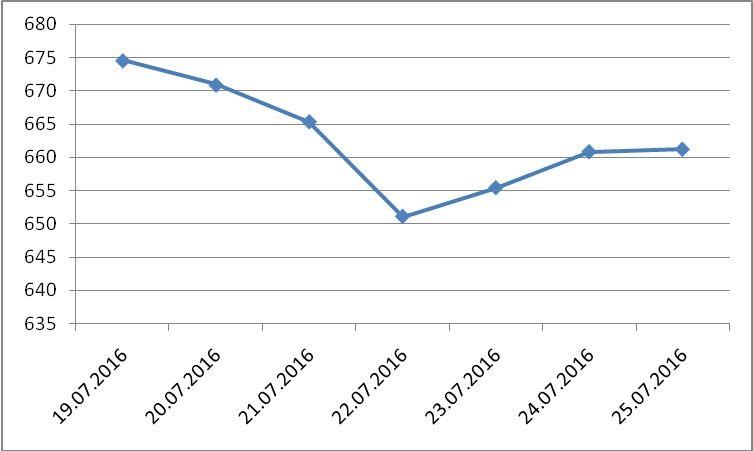

BTC/USD exchange rates for last 7 days:

We believe that Bitcoin is strong enough for a resumption of its price growth. The rise of the US economy, which in the second and the third quarter showed a significant increase, will contribute to the growth of Bitcoin price. Moreover, many oil companies have started to increase production capacity after the price of oil had firmly entrenched itself in the corridor of $45 - $50 per barrel. The increase in supply in the market again will reduce the price of oil to the levels of $35 - $40. This factor will force the ECB to go for quantitative easing. Thus, we can expect the strengthening of the US Dollar and a depreciation of the Euro. A decline of EUR/USD exchange rates, traditionally supports Bitcoin.

Today we expect a sideways trend in the corridor up to $660-670. Support level is $655. Resistance level is $670.

This analysis and forecast are the personal opinions of the author and are not a recommendation to buy or sell cryptocurrency.

Price

Coin expert

Price

Price

Price

(0 comments)