Bitcoin Price Has Not Enough Strength To Grow

Bitcoin price movement has gone quiet and isn’t moving neither up nor down. But today, the situation may change. Macroeconomic news from the US and Europe could cause fluctuations on the currency market and will give an impetus to Bitcoin price growth.

Let's start with the fact that today the European Central Bank will announce the results of its meeting on monetary policy and interest rates. Many traders think that because of Brexit, the ECB may have new incentives for monetary policy in the coming days.

Today we also expect to hear a speech from Mario Draghi, President of the European Central Bank. It is expected that there will be new incentives announced by the ECB. In this case, the Euro will come under pressure.

The US is expected to publish a positive report on Existing Home Sales in the secondary market, as well as the Manufacturing Index Flash. At the same time, employment and incomes of the population increased, and consequently, consumer spending is rising. Moreover,a positive report on the construction sector was published this week.

Exchange rates of EUR/USD today face a decrease that can positively affect the price of BTC, which traditionally grows when EUR/USD is falling.

However, these reasons are not enough for a proper growth of the Bitcoin price. Long-term lack of growth can enhance sales of Bitcoin. The activity on the stock markets is high and the Bitcoin price can change the dynamics in one direction or another any day.

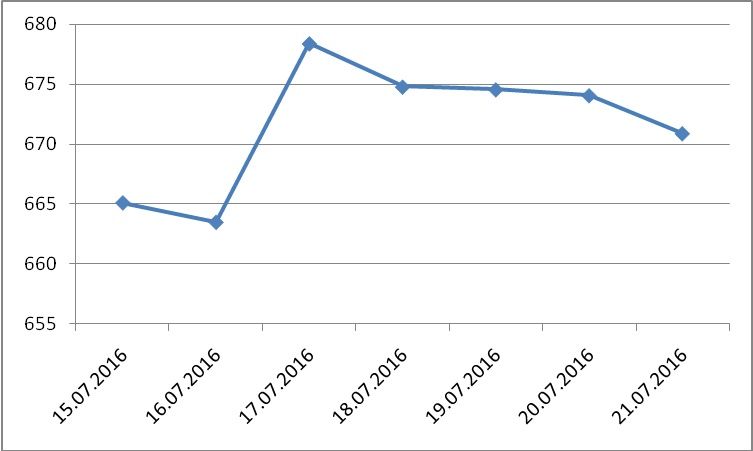

Today, we expect a slight strengthening of Bitcoin to $675. The level of support is $660. Resistance level is $675.

BTC/USD exchange rates for last 7 days:

One important factor that can push down the price of Bitcoin is an overbought condition. But after a halving of the reward for Block mining we can hardly speak about the overbuying of Bitcoin. Rather, we can speak about the limited quantity of Bitcoin. But on the other hand, we know that when the government prints fiat money in excess, that spurs inflation. In this case, Bitcoin expects growth and only growth. Do you agree?

This analysis and forecast are the personal opinions of the author and are not a recommendation to buy or sell cryptocurrency.

Price

Price

Price

Price

News

(0 comments)