Coinidol.com: XRP Slumps and Recovers Above $1.85

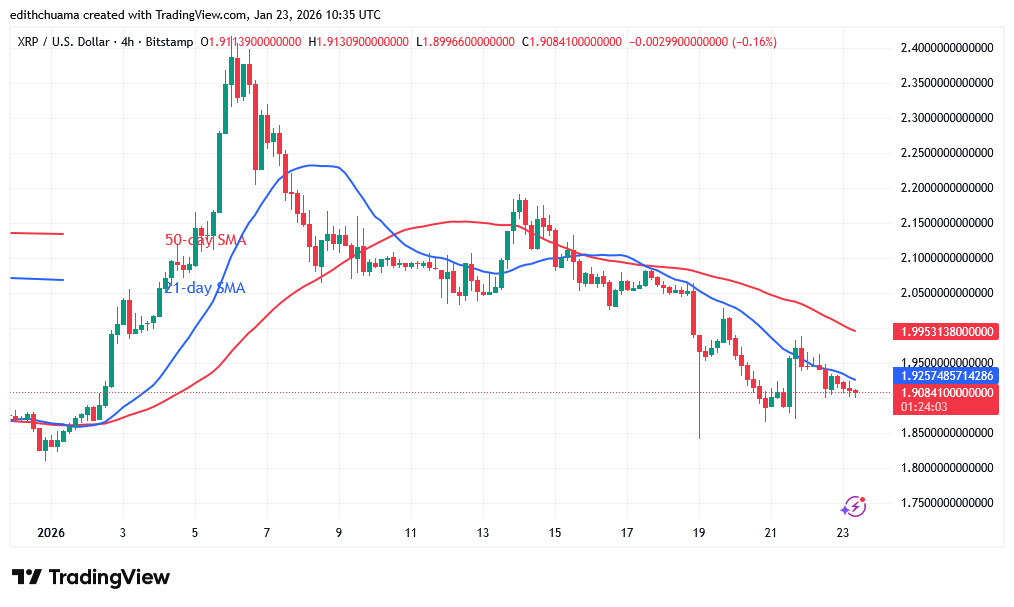

The XRP price has fallen below the moving average lines but found support above the key level of $1.80.

XRP long-term analysis: bearish

Since January 6, XRP has faced rejection at the $2.41 high, dropping to a low of $1.85. For the past five days, selling pressure has paused above the $1.80 support, allowing the altcoin to continue fluctuating below the moving average lines.

Yesterday, price movement has remained static below the moving average lines. On the downside, if the cryptocurrency retraces, it is expected to stay above the $1.80 support. XRP will resume its upward trend if buyers keep the price above the moving average lines.

Technical Indicators:

-

Resistance Levels: $2.80 and $3.00

-

Support levels: $1.80 and $1.60

XRP price indicators analysis

The 21-day SMA is above the 50-day SMA, which is sloping upwards, confirming the previous trend. On the 4-hour chart, the price bars are positioned between the downward-sloping moving average lines. The cryptocurrency price is trapped between the moving average lines, indicating a likely range-bound move for the coin.

What is the next direction for XRP?

The XRP price has stopped declining after reaching a low of $1.85. On the 4-hour chart, the altcoin is trading above the $1.85 support level but below the moving average lines. The bullish momentum has broken the 21-day SMA but remains below $1.95. The upward trend will continue if buyers maintain the price above the moving average lines.

Disclaimer. This analysis and forecast are the personal opinions of the author. The data provided is collected by the author and is not sponsored by any company or token developer. This is not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by Coinidol.com. Readers should do their research before investing in funds.

News

Price

News

Price

Price

(0 comments)