ValPromise, A Possible Game-Changer in Financial Market

Risk hedging tools are important in investment to stabilize the market from irrational fluctuations in the current turbulent world of finance. Financial derivatives like insurance, futures, options and forecast services, with an annual size of $50 trillion, have become quite significant in global risk management.

The current risk management system, however, being dependent on centralized information structure, is flawed in many ways. First, there is a lack of trading varieties and especially creative ones while the introduction of new varieties requires a myriad of approvals, raising the overall cost and undermining its capability to adapt to the fast-changing market. Second, the contracts are executed inefficiently as business clearing and futures contracts delivery involve much manual operation and thus operational risks. Third, OTC financial derivatives market is not transparent and credible in its valuation method as it calculates its risks with the internal models of financial institutions.

For Risk Management, You Need ValPromise

The good news is that blockchain technology, constantly evolving and ever more mature in recent years, is about to revolutionize risk management.

Blockchain is technically sharing ledger. Distributed with whole network records, efficient with low costs, safe and reliable, it is a perfect fit for risk management as it lowers regulation costs, reduces transaction risks and complexities, improves information credulity and supervision transparency, and executes the procedures jointly.

ValPromise, for example, is creative application of blockchain in risk management. ValPromise is designed as a blockchain-based release and trading system for distributed value promise protocol, in an effort to manage global risks variety-wise and region-wise. Its investors include Shen Bo from Fenbushi Capital, Wang Lijie from PreAngel Fund, Zhou Chaohui, VP of Dogecoin Foundation China (DFC), Gravity Venture Capital, Wenzhou Capital, the Crypto Venture, MDT Foundation and Alpha Connect Investments, among others.

ValPromise, derived from the deep integration of blockchain and finance, is likely to create a free and transparent financial products market, or a finance protocol-like exchange where all financial contracts related with public indicators (weather, commodity price, foreign exchange, stock index) can be released and traded with no conditions attached.

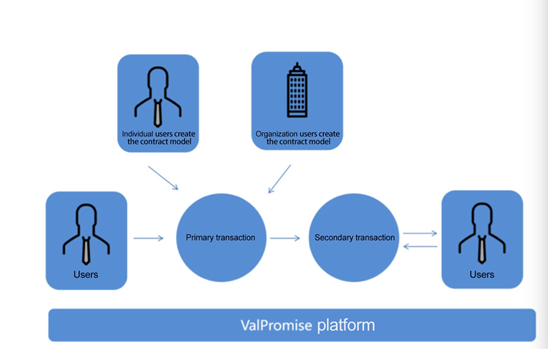

When materialized, ValPromise will cater to a huge user group with such needs. Users normally consist of issuers (financial professionals or research institutes experiment on innovative financial products) and traders (individuals or companies with investment needs) in a financial contract. The decentralization, transparency and traceability of blockchain allows ValPromise to build a trustworthy bridge between the two parties, and to have the contracts executed in such conditions. The process is supported by encryption, Hash algorithm and consensus mechanism with details of each contract searchable and traceable in the specialized blockchain browser.

ValPromise stores all shareholders’ data (identity, contract and transaction information) in a decentralized structure of block and chain, clearing the way for point-to-point issuing of financial products and saving the need for reviewing. As a result, issuers and traders can interact directly, improving efficiency greatly, reducing unnecessary costs from agencies as well as lowering operational risks, intentional or not.

ValPromise will also provide a better solution to defaults and overdue execution that haunt traders with regard to conventional centralized financial products. When establishing a contract, ValPromise locks down enough VPP tokens. At due time, smart contract technology, which is programmable, will make the decisions automatically in accordance with the stated indicators and date, thus eliminating the risk of default from both sides without endorsement of any third party.

Moreover, ValPromise will make asset contract allocation available to lower the threshold by designing popular contracts into templates of fixed formats. Issuers can select the template they need and enter the parameters to complete the contract.

Tianqibao - First Application in ValPromise Ecology

Most blockchain DApp projects are just conceptual at the moment, whereas ValPromise has already successfully launched its first business project.

Tianqibao, a mature application providing weather risk hedging and insurance services through contracts, covers areas like weather forecast, agricultural insurance, heat insurance and insurance for tourism and transportation. Over the past 6 months, it has issued around 200,000 weather insurance contracts to users, including Internet giants like Didi, Qunar and Moji Weather, among which, Didi has 450 million users of its own and radiates to about 200,000 people in communities.

Tianqibao in the App Named Moji Weather

ValPromise is inherently suitable for weather index insurance as it marks a departure from existing contract designs in terms of low efficiency, high cost of manual loss assessment as well as difficulty in data authentication. The Android Dapp based on Tianqibao application scenarios is released and can be downloaded on the website.

With Tianqibao as a successful case and the community value it brings, ValPromise can pursue in-depth market segmentation for demonstration. When users have developed the habit, more application scenarios can be designed for all-around coverage and reachability.

A Free-Trading Financial Market

Tianqibao is just the first application in the ValPromise ecology, which is essentially a public link for financial assets. Here, it can run Dapp for thousands or tens of thousands of contract scenarios which range from weather insurance, forecast contract, OTC-linked stocks, futures, FX index options, to OTC Forex futures & options as well as precious metal (gold, diamond) futures & options. Recently, ValPromise's new currency options product went live. The number of new users on the first day reached 2,423, and the total order quantity reached 7,101, with a total purchase amount of 2217110 VPP.

The project team of ValPromise has over 10 years’ experience and a vision for a financial contract exchange. They are aiming at index insurance, futures and options markets with over $50 trillion worth of annual transactions. The user base formed from Tianqibao will help to attract more users to blockchain tools. The market potential is yet to be tapped.

If you are interested, please visit http://www.valp.io/ for more information.

Disclaimer. This article is paid and provided by a third-party source and should not be viewed as an endorsement by CoinIdol. Readers should do their own research before investing funds in any company. CoinIdol shall not be responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any such content, goods or services mentioned in this article.

Price

Price

Price

News

Price

(0 comments)