Solana Reaches The Historic Price Level Of $260 Again

Updated: Nov 27, 2024 at 23:33

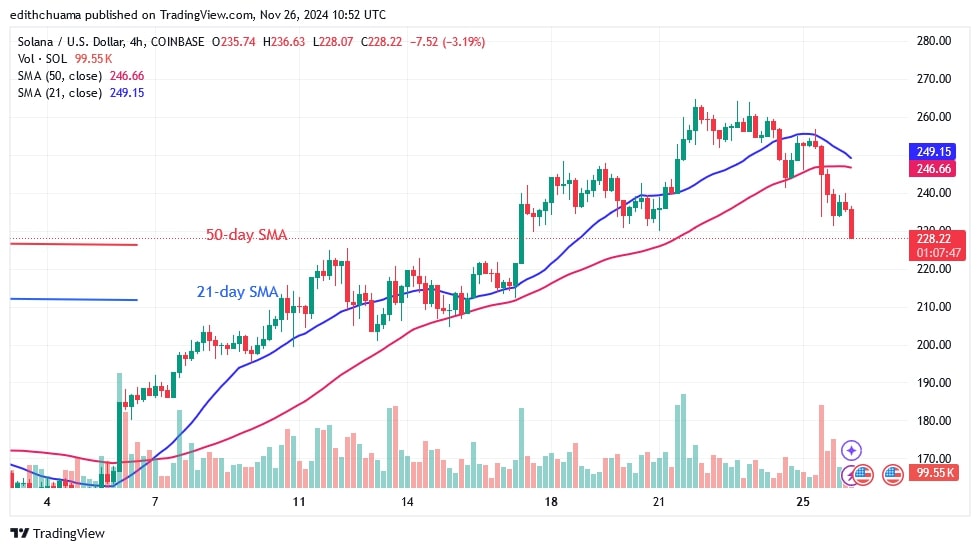

The price of Solana (SOL) is falling after reaching a historic high of $260 on November 22. Today, the altcoin has fallen above the 21-day SMA.

Solana price long term forecast: bullish

The uptrend will resume if the altcoin retraces and stays above the 21-day SMA. The cryptocurrency will rise and retest the overhead resistance at $260. The altcoin will rise to $280 if the recent high is broken. If the bears break the 21-day SMA support, the altcoin will drop further to a low above the 50-day SMA.

However, a break below the moving average lines would mean a resumption of the decline. The altcoin will fall to support levels above $160. In the meantime, the value of Solana stands at $240.

Analysis of Solana price indicators

Solana has resumed selling pressure as it pulls back above the 21-day SMA. The 21-day SMA is the support level where SOL rises. The cryptocurrency will rise and retest the overhead resistance at $260 and may rise to $280 if the most recent high is broken.

Should the bears break below the 21-day SMA support, the altcoin will fall further to a low above the 50-day SMA. However, a break below the moving average lines would mean a resumption of the decline. The altcoin will fall to support levels above $160. In the meantime, the value of Solana stands at $229.

Analysis of SOL price indicators

Solana has resumed selling pressure as it retraces above the 21-day SMA. The 21-day SMA is the support level where the crypto is rising. The current rise will end if the support level is broken. On the 4-hour chart, the price of the cryptocurrency is below the moving average lines, indicating a downtrend.

Technical indicators

Key supply zones: $200, $220, $240

Key demand zones: $120, $100, $80

What is the next move for Solana?

Solana has fallen below the moving average lines on the 4-hour chart. On the downside, selling pressure will continue until it reaches a low above $220. The price of the cryptocurrency is currently above the $228 supply. Today, a long candlestick tail indicates existing support. This shows strong buying pressure at the current support.

Disclaimer. This analysis and forecast are the personal opinions of the author. They are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol.com. Readers should do their research before investing in funds.

Price

Coin expert

Price

News

Price

(0 comments)