Polygon Moves Above $0.80 On Rising Selling Pressure

Polygon (MATIC) price has reached bullish exhaustion with a high of $0.98. MATIC price falls back to its previous lows.

Polygon Price Long Term Prediction: Bullish

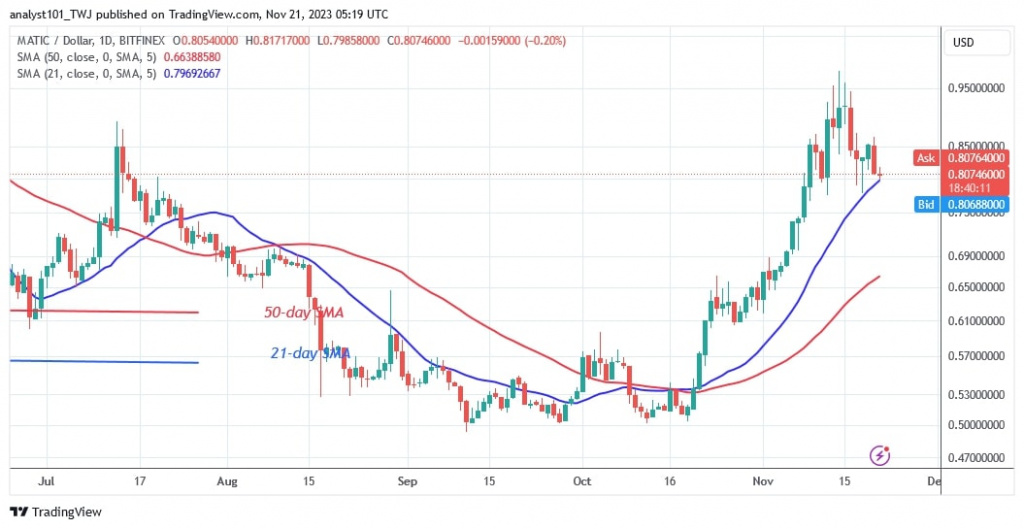

The altcoin dropped first and found support above the moving average lines. The bearish momentum is now repeating itself as the bears retest the 21-day moving average line. At the time this article was written, the market price of MATIC was $0.80.

On the downside, selling pressure will pick up again if the bears drop below the 21-day SMA. MATIC will then fall even lower to $0.66.

However, if Polygon retraces and finds support above the low of $0.66, the crypto could return to a sideways trend.

Polygon indicator analysis

The price bars on the 4-hour chart have fallen below the moving average lines, indicating that the cryptocurrency will continue to fall. The altcoin is expected to fall due to an overbought scenario. On the 4-hour chart, the 21-day SMA is lower than the 50-day SMA. This indicates a bearish crossover, which means that the cryptocurrency could fall.

Technical indicators

Resistance levels: $1.20, $1.30, $1.40

Support levels: $0.60, $0.40, $0.30

What is the next step for Polygon?

MATIC has been trading between $0.78 and $0.95 since the cryptocurrency collapse. The price indication has shown that the cryptocurrency will continue to fall. The altcoin reversed to the upside and retested the candlestick body of the 61.8% Fibonacci retracement level on November 18. The correction suggests that MATIC will fall to the 1.618 Fibonacci extension or $0.66.

Coinidol.com wrote previously that Polygon retested the $0.95 price level on November 14.

Disclaimer. This analysis and forecast are the personal opinions of the author and are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol.com. Readers should do their research before investing in funds.

Price

News

Coin expert

Price

Price

(0 comments)